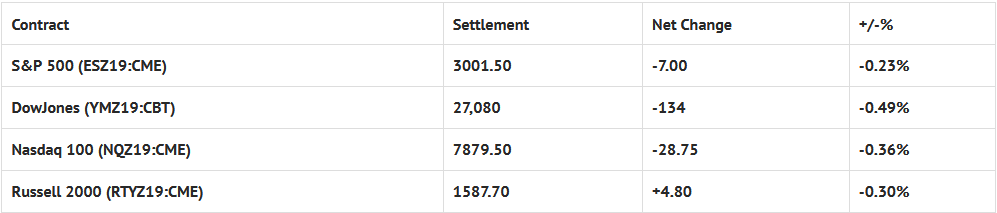

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Composite -1.74%, Hang Seng -1.23%, Nikkei +0.06%

- Fair Value: S&P 500 +2.64, NASDAQ Composite +24.47, Dow -2.24

- Total Volume: 1.69 million ESZ & 8,793 SPZ traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, FOMC Meeting Begins, Redbook 8:55 AM ET, Industrial Production 9:15 AM ET, Housing Market Index 10:00 AM ET, and Treasury International Capital 4:00 PM ET.

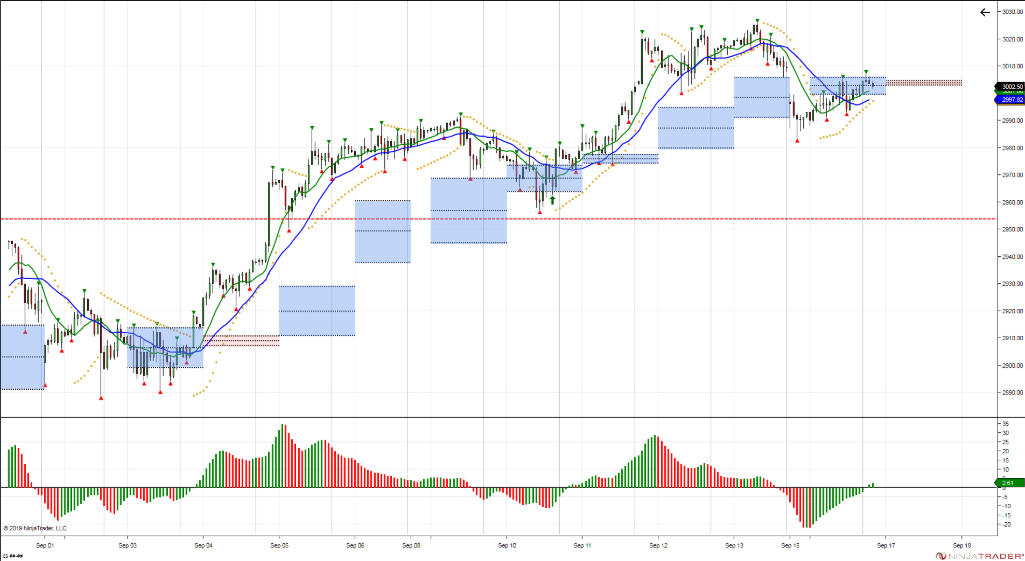

S&P 500 Futures: Uncertainty Abounds

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Defensive bounce off 2985, trouble overcoming Friday’s 3005 low, leaving longs on hook from last week. Need new buyers to recover for another shot @ highs. Failure to overcome, gives room to retest 2985, w sell stops < last Tues 2957 low to shakeout buyers. 2930 next lvl.

After Saturday’s drone attack on Saudi Arabia’s oil fields, the S&P 500 futures sold off down to 2983.50 Sunday night on Globex, and then rallied to 3000.75 at 7:35 am Monday morning.

The futures printed 2998.00 on Mondays 8:30 futures open, and initially down ticked to 2995.75, before making a series of higher lows. An early high was made at 3005.25 just after 9:00 CT, completing a MrTopStep 10 handle rule, and then sold off down to 2996.75, just 3 ticks under the vwap.

After the pullback, the ES traded back up to a lower high at 3004.50 at 10:15, and got hit by several sell programs down to 2993.25, then rallied up to 3002.50. After 2:00 the futures pulled back down to 2999.25, and then rallied up to 3003.25 as the MiM went from $435 million to buy, to $610 million to buy.

At 2:30 the ES pulled back down to the vwap 2998.25, and then popped back up to 3001.25 as the MiM buy dropped down to $369 million to buy. The futures then went on to trade 3000.00, as the final 2:45 cash imbalance showed $304 million to buy. On the 3:00 cash close the futures printed 3000.25, and settled at 3002.25 on the 3:15 futures close, down -7.25 handles, or -0.24% on the day.

In the end, despite the large overnight drop, the ES recovered nicely. It seemed like there was some type of mid-month rebalancing going on. As I have always said; the ES tends to take bad news and make good of it.

Was it bullish price action, or just short covering? I think it was a mixture of both. Is there still uncertain risk out there? I guess so, but I do not think that there is going to be a war between the U.S. and Iran. In terms of the days overall trade, 1.7 million ESZ’s traded.