Developed Asia and Emerging Asia diverged in performance today following the Presidential inauguration last Friday.

Developed and Emerging are clumsy terms to use these days in this part of the world. China, Singapore and Taiwan could hardly be described as “emerging” economies today. Although one could argue India is. Are they any more or less developed than their “developed” counterparts in Australia and Japan for example? I guess it depends on your point of view. A more accurate description might be those economies with an open capital account and a floating currency vs. those whom are not and may be in Mr Trump’s ”

A more accurate description might be those economies with an open capital account and a floating currency vs. those whom are not and may be in Mr Trump’s “currency manipulator” sights. To the 2nd group, you could well and truly add South Korea. The KOSPI is not represented here today because South Korea is so restricted even Superman couldn’t get it listed on their online trading platform. I would hazard a guess to saySouth Korea would be no.2 in Mr Trump’s manipulating list behind China.

Looking at the performance of APAC’s equity indices today it fair to say that the ones in the first group suffered and the ones in the second traded a “breath a sigh of relief premium.” The is to say that with the long USD trade unwinding post-Friday and Mr Trump saying nothing about them this weekend, no news was good news.

Looking at Australia and Japan, both the AUD and the JPY have rallied against the USD today, in JPY’s case, staunchly. Both had been early beneficiaries of the Trump reflation story, and with open capital accounts, AUD’s and JPY’s could freely be sold for USD’s. This has meant a lot of the Trump-call had already been built into them leading into last Friday, being high beta to US performance since the election.

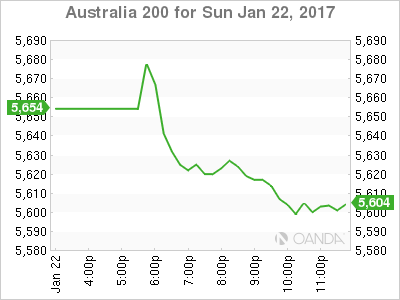

Down 0.9% as a stronger AUD and nervousness about the ramifications of a trade war between China and the USA weighed on the index. China is by far and away Australia’s largest trading partner and thus a default beta to future China performance. There was off course profit taking involved as well.

Australia 200

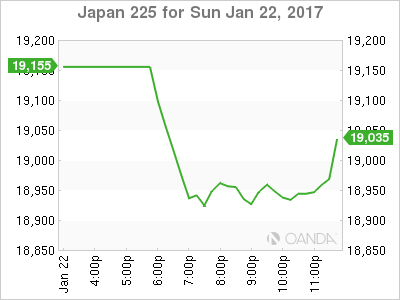

Down 1.25% as the USD/JPY fell over 100 tics to a low of 113.12 this morning. The Nikkei is intimately correlated to the USD/JPY in export-centric Japan, with long USD/JPY positioning some of the heaviest expressions of the Trump-flation trade.

Japan 225

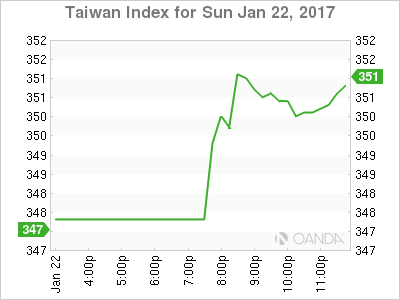

Taiwan

The emerging market where economic reality and politics collide. In this case, not the China Straits but rather Foxconn, Apple’s largest contract assembler. Otherwise known as Hon Hai Precision Machinery, it has a massive weight in the Taiwan Index. Some 25% to be exact. Where goes Foxconn goes the Taiwan Index goes. In this case, up today as Foxconn announced it is pondering a $7 billion investment with Apple (NASDAQ:AAPL) to make displays in …you guessed it, the USA.

So in addition to breathing an emerging market sigh of relief post-Trump, they are doing their part to make soothing noises about making America great again. The Taiwan Index ends the session up 0.5%.

Taiwan Index

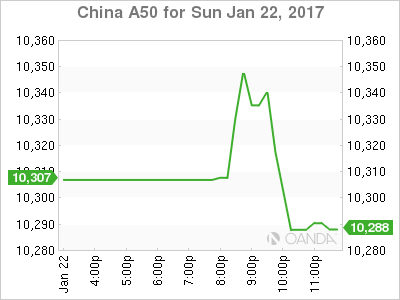

Can’t break the shackles of a potential trade war/currency manipulator label hanging over it. All in all only down-0.3% on the day but one imagines this Index will find the topside hard going until we see more Trump-clarity.

China A50

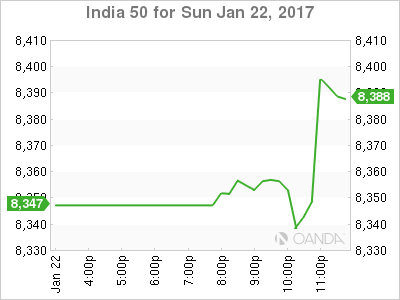

India

Another emerging market breathing that sigh of relief. No news from Washington is good news in the emerging space at the moment and the Nifty 50 obliged by rallying 0.2% on a quiet day.

India

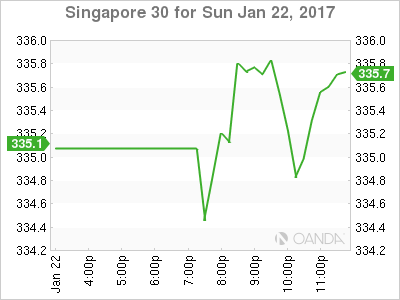

Singapore

Also crawled into the black today finishing 0.15% higher. As a high beta market to the rest of the emerging South East Asia region, no news was also good news for the Straits Times as well.

Singapore 30

Summary

Developed vs. Emerging Asia stocks had contradictory results today. Developed having been perceived as the less high risk of Trump-wrath had already priced in a lot of the reflation trade before the inauguration. Emerging were seen as being much more at risk of some Washington finger-pointing. With the passing of the weekend, no news has been good news for developing markets in the region, and lead to profit taking in the developed. Whether this situation stays this way off course, is open to debate.