A fairly uneventful session in Asia, with S&P 500 futures starting to roll over somewhat, although the market still feels like it can push to the February high of 1940 (1947.2 in the cash market). This seems like a pivotal level now for the world institutional benchmark. How it acts around this prior high could really dictate play in so many other assets. Importantly, 1940 is also the exact 50% retracement of the 13% sell-off seen between December and February, so a break here would be very bullish and open up 2000.

Clearly defined trading levels can be found in so many asset classes and it is thematic of a market that has paused for thought and is assessing the landscape after thinking, ‘perhaps things aren’t so bad’. One such market is US crude where price action look remarkably like that of the S&P 500, minus the 9% correction seen yesterday. On the daily chart, a clearly defined double bottom pattern is in play and it may take some real meat on the bone for the neckline (or 28 January high) of the pattern to be broken. The preference is to trade a range in the April contract (now front month) of $36.27 to $28.74, but a break of this range would be a huge development. Yesterday’s news of an ‘agreement’ between Russia, Saudi Arabia, Qatar and Venezuela is certainly positive and a small step in the right direction, but it’s not going to cut the mustard for those who have increased long positions in the hopes of more concrete measures. Still, while it highlights the strains on the producing nations’ economies, it does show intent which breeds hope.

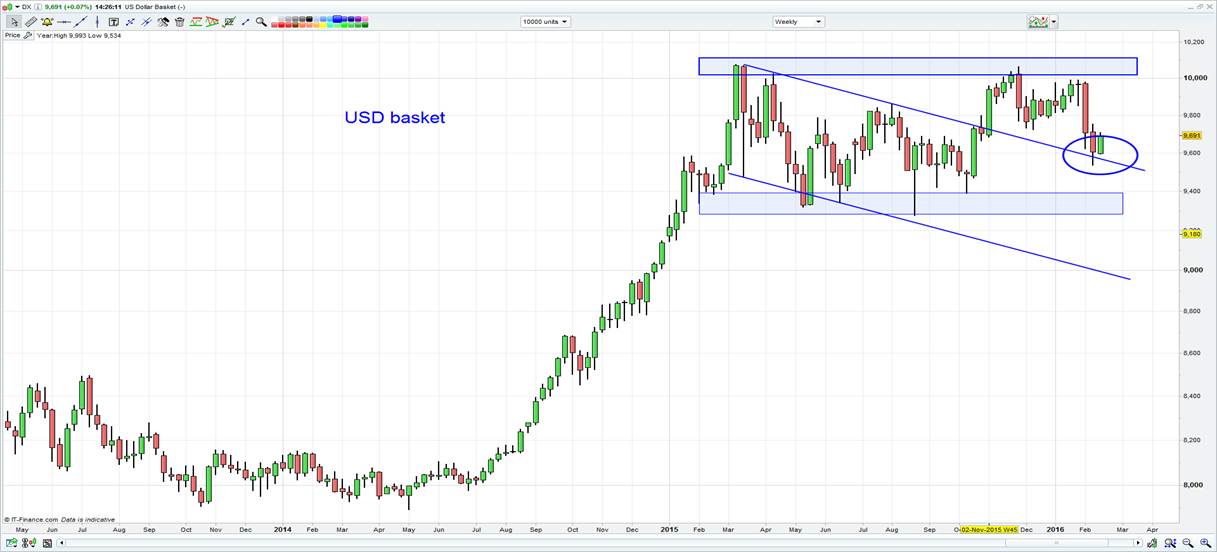

Taking a view on oil (and any other commodity with the exception of iron ore) still means taking a view on the USD. Importantly, US Dollar Index has pulled back to former trend support (on the weekly chart). A break of 96.00 leads to 94.00 which has effectively been the floor in the USD since early 2015. In saying that, a platform has been set for the USD to move higher again, but this fully hinges on risk appetite in the market. If this feel good factor continues and volatility subsides then financial conditions will improve, the US yield curve will steepen more aggressively and the USD will push back into the 100 area, taking EUR/USD back into $1.0500. Of course, we’ll then worry about the strong USD and the impact it will no doubt have on commodities.

Asian markets have seen modest upside for the most part of the day, but sellers are certainly more prevalent. With no real conviction from China or Japan, the ASX 200 has been lost, despite a raft of earnings and strong volatility in certain names. S&P futures are flat, but our European opening calls are still in positive territory, but this may change with European Central Bank (ECB) member Ewald Nowotny saying he is ‘concerned over expectations for March ECB meeting’. Looking at the front end of the German yield curve, it’s been the case for a while that impending disappointment is likely, but could equity markets still rally if we don’t see deeper negative rates?

The FTSE is back testing the 5900 area and is edging back into the top of the channel it has been trading in since November, where a break here would be duly noted. The DAX is also at a key juncture and is testing a range of lows starting in 2014 again. Like the USD, S&P 500, oil and many other markets, price has corrected somewhat, but it seems to have moved back to levels where ‘the world is about to see a protracted recessions and central banks are powerless to stop it’. We live in interesting times.