Investing.com’s stocks of the week

Yesterday finished with a bit of indecision as indices closed with bearish 'black' candlesticks; there were strong opening gaps but no follow-through with afternoon buying. The risk is for a gap down today, which would leave bearish 'reversal evening stars.'

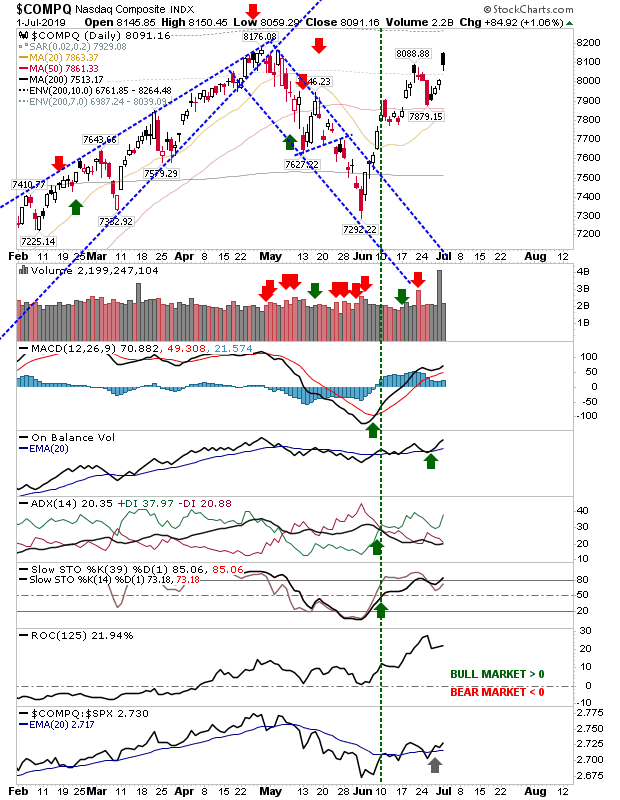

The biggest gain came from the NASDAQ. The index gapped over 1%, but this gap didn't clear the April high. Volume was reasonable if a little unspectacular. Relative performance against the S&P remained strong.

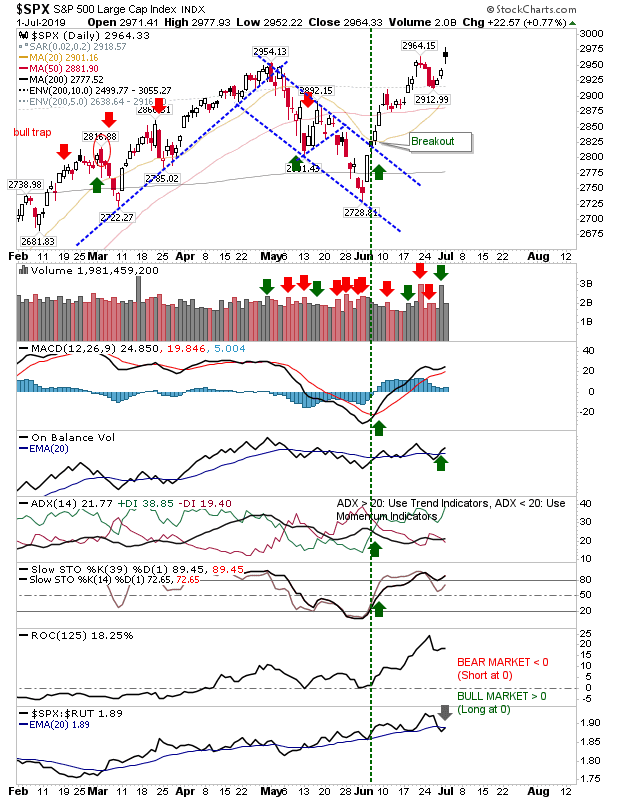

The S&P didn't quite post the same relative gain as the NASDAQ but it did manage to make a new high as part of the gap higher. Relative performance shows the index losing ground against its peers but then it has been in a leadership role since March.

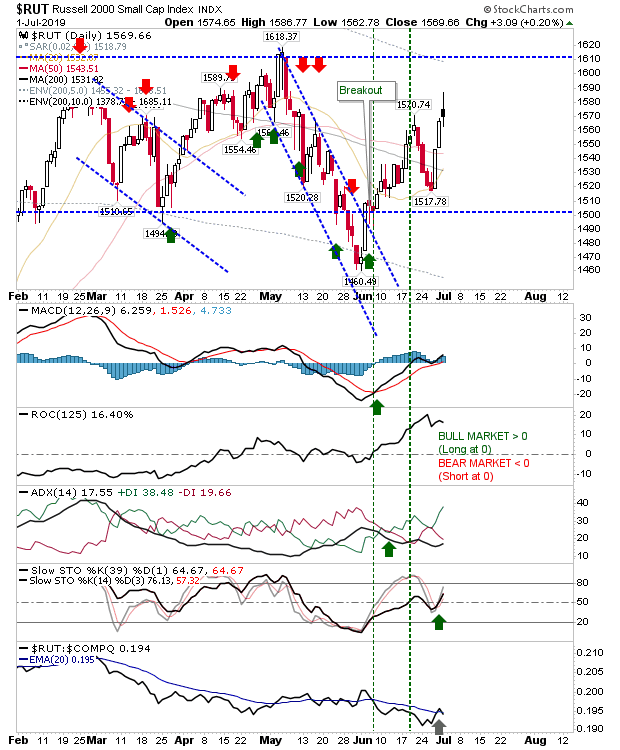

The Russell 2000 does look to be shaping a challenge of 1,610. Yesterday's 'spinning top' candlestick was the least potentially bearish candlestick of the three featured yesterday.

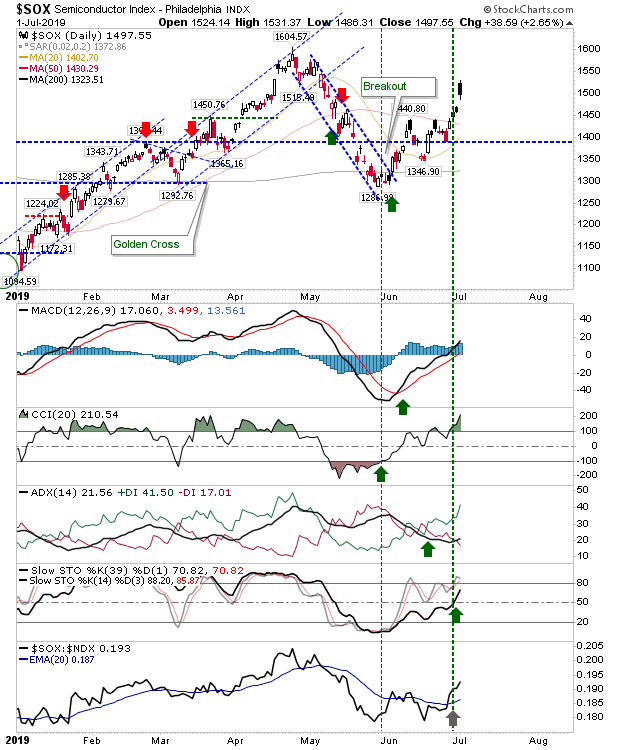

The Semiconductor Index had the biggest gain of secondary indices, although there is plenty of room left before it challenges April highs. Technicals are net positive and the index has sharply advanced in relative performance against the NASDAQ 100. I would be looking for a challenge of 1,605 before the end of the month.

For today and the next few days it will be about consolidating—and negating—the bearish implication of yesterday's 'black' candlesticks, If this is achieved, then a larger push to multi-year highs and a continuation of the rally stalled since 2018 would look assured.