Tuesday, May 28: Five things the markets are talking about

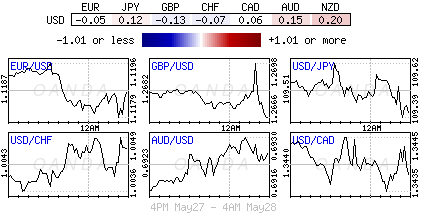

On the whole, global equities have advanced in the overnight session along with U.S equity futures as investors and traders return from a U.S and a U.K bank holiday. The ‘big’ DX has found some traction with U.S Treasuries, while crude oil trades mixed along with gold.

Tit for Tatt

There has been no progress in global trade talks – China, U.S Europe or Japan – according to President Trump the U.S is not ready to make a deal, so much so that American tariffs on Chinese goods “could go up very, very substantially, very easily.” On the other hand, China has been trying to play down the impact of the trade war on its economy, saying higher tariffs will have a “very limited” impact and would hurt the U.S about as much.

On tap: NZD financial stability report, ANZ Business confidence, RBNZ Gov. Orr speaks (May 28), BoC monetary policy announcement, AUD private capital expenditure & NZD annual budget release (May 29), CH, Fr. & DE bank holiday, US preliminary GDP & CNY manufacturing PMI (May 30), CAD GDP (May 31).

1. Stocks see the light

In Japan, the Nikkei rallied overnight as gains in European markets Monday improved sentiment, while activity in the gaming sector “shot up on hopes for a new gaming title.” The Nikkei share average ended +0.4% while the broader Topix rose +0.3%.

Down-under, Aussie equities beat a three-session losing run overnight as mining stocks rallied on firmer iron ore prices. The S&P/ASX 200 index finished the session +0.5% higher. The benchmark closed 4.1 points lower on Monday. In S. Korea, the Kospi index added +0.13%.

In China, stocks closed higher for a second consecutive session overnight, as officials downplayed the impact of the trade war with the U.S, and as foreign investors bought shares ahead of an increase in MSCI’s weighting. The blue-chip CSI300 index rose +1.0%, while the Shanghai Composite Index closed up +0.6%.

In Hong Kong, stocks ended higher after falling to a four-month low yesterday, but gains are capped as investor sentiment remains fragile over trade and economic growth. The Hang Seng index rose +0.4%, while the China Enterprises Index gained +0.1%.

In Europe, regional bourses trade mixed as investors continue to digest results from the EU elections. The FTSE is little changed having been closed yesterday.

U.S stocks are set to open small in the ‘red’ (-0.19%)

Indices: Stoxx600 -0.37% at 375.32, FTSE -0.06% at 7,273.25, DAX -0.40% at 12,023.21, CAC-40 -0.49% at 5,310.08, IBEX-35 -0.67% at 9,155.08, FTSE MIB -1.14% at 20,131.50, SMI -0.40% at 9,673.80, S&P 500 Futures -0.19%

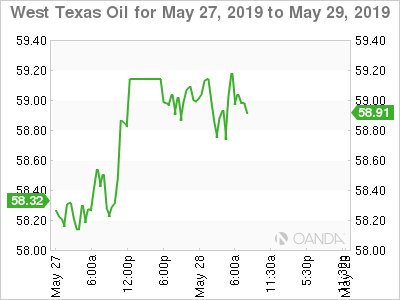

2. Oil mixed as OPEC cuts and sanctions prop up prices, but trade worries weigh

With traders back at their desks, the crude oil price story has not changed. Oil prices are mixed as supply cuts, led by OPEC+ and U.S sanctions – Iran and Venezuela – support crude, while concerns about an economic slowdown weighe on the market.

Brent crude futures are at +$69.99, down -12c, or -0.2%, from the last close, when they rose +2.1%. U.S West Texas Intermediate (WTI) crude futures are at +$59.03 per barrel, up +40c, or +0.7%, from Friday’s close.

Note: Last week, both crude contracts registered their biggest price declines this year amid concerns that the U.S-China trade dispute could accelerate into a global economic slowdown.

Price action remains a ‘push-pull’ trade with the crude ‘bear’ getting a helping hand from slowing demand growth due to the negative impact on the global economy of the Sino-U.S trade war, while the crude ‘bull’ has been relying on escalating political tensions between the U.S and Iran, as well as ongoing supply cuts led by OPEC+.

Expect investors to take their cues from this week’s API and EIA inventory reports which are a day later reporting due to the U.S Memorial Holiday.

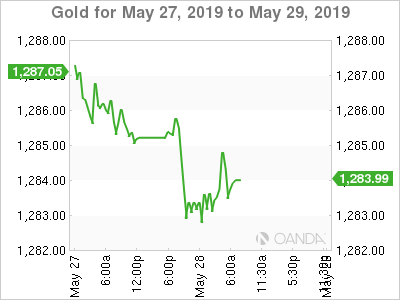

Ahead of the U.S open, gold prices have eased a tad, dropping for the first time in four sessions, as the ‘big’ dollar rebounds from multi-week lows amid simmering Sino-U.S trade tensions. Spot gold is down -0.2% at +$1,282.86 per ounce, while U.S gold futures are down -0.1% at +$1,281.80 an ounce.

3. German Bund yield falls to a 3-year low

10-Year Bund yields have hit fresh three-year lows this morning as market sentiment remains cautious in the aftermath of the European Parliament elections over the weekend even as the next parliament will remain pro-European, albeit more fragmented and with more-pronounced changes in some countries.

The yield is down -2 bps at -0.142%, encroaching on 2016’s record low of -0.20%. Expect some relief for Euro yields as the new product come to market this week – Germany will launch a two-year, €5B Schatz while Italy will sell zero-coupon notes and inflation-linked bonds. Dealers will need to make some room to take down product.

Elsewhere, the yield on 10-year Treasuries fell -3 bps to -2.29%, the lowest in more than 19-months, while in the U.K, the 10-Year Gilt yield has fallen -4 bps to +0.956%, the lowest in more than two-years.

4. Dollar rallies from multi-week lows

The greenback reached session highs overnight in Asia, supported mostly by Trump’s comment about the U.S being “not ready” to cut a trade deal with China. It put pressure on trade-linked currencies besides weighing on the yuan again.

AUD (A$0.6918) is a tad softer on Trump's comments that American tariffs on Chinese goods “could go up very, very substantially, very easily”. The AUD is expected to continue to remain in a tight range. Next week’s expected RBA rate cut (June 4) is unlikely to be a major catalyst for AUD prices unless the accompanying RBA statement provides guidance of further RBA rate cuts.

GBP/USD (£1.2670) – Brexit continues to dominate the U.K headlines and the possibility that a ‘hard’ Brexiteer taking the reins from PM May has sterling bears looking for opportunities to short the pound once again.

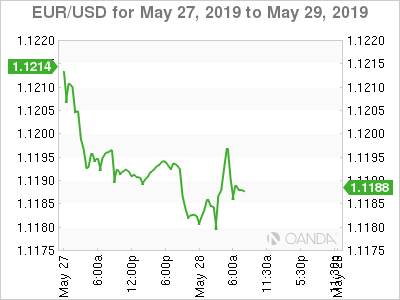

EUR/USD (€1.1192) is currently hovering just below the psychological €1.12 handle and the techies believe the single unit will trade in its recent contained trading range unless more volatility comes in from Italy or Brexit. On the data front, the week is not throwing up anything of significant interest.

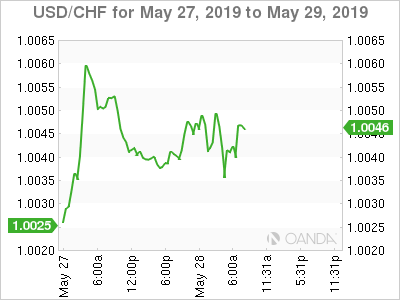

5. Solid Q1 economic growth in Switzerland

Data this morning showed that Swiss GDP growth exceeded expectations in Q1 on broad gains in consumption, investment and exports.

Swiss GDP advanced +0.6% from Q4 and +1.7% from a year earlier, well above market expectations.

Analysts expect today's figures should ease any pressure on the Swiss National Bank (SNB) to launch further policy easing, but with inflation still “super low” the SNB should be in no hurry to raise its -0.75% policy rate.