The market calmed down and majors started to recoup their losses against the Dollar. The labour market condition index (LMCI), which the Fed watches closely, slid again to 4. The Fed has a preference for the data as it includes the 19 relevant indicators in providing a comprehensive view of the job market. The reading’s trend differs on the great success of the non-farm payroll. Yet, the market has chosen to ignore the indicator and so, the bull trend of Dollar continues.

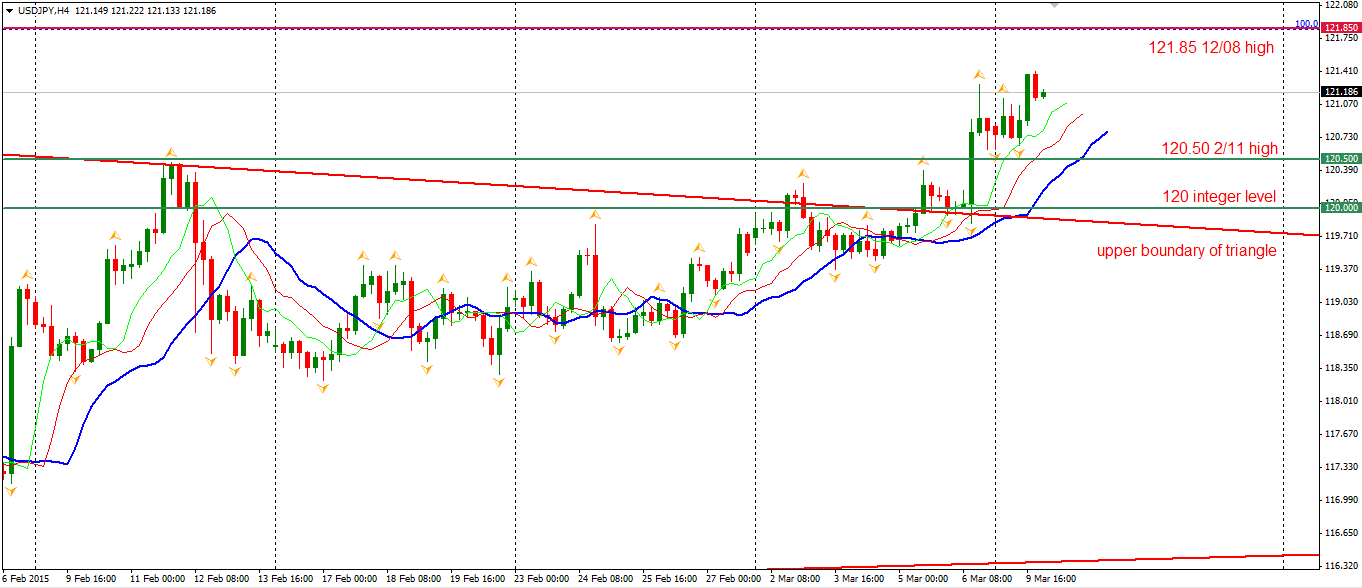

The Yen was the weakest major currency yesterday as the Dollar Yen refreshed month highs to 121.40 and closed around 121.20 at this morning. USD/JPY has now confirmed the breakout of the previous 3-month triangle/wedge pattern. Last December’s high of 121.85 will soon be tested.

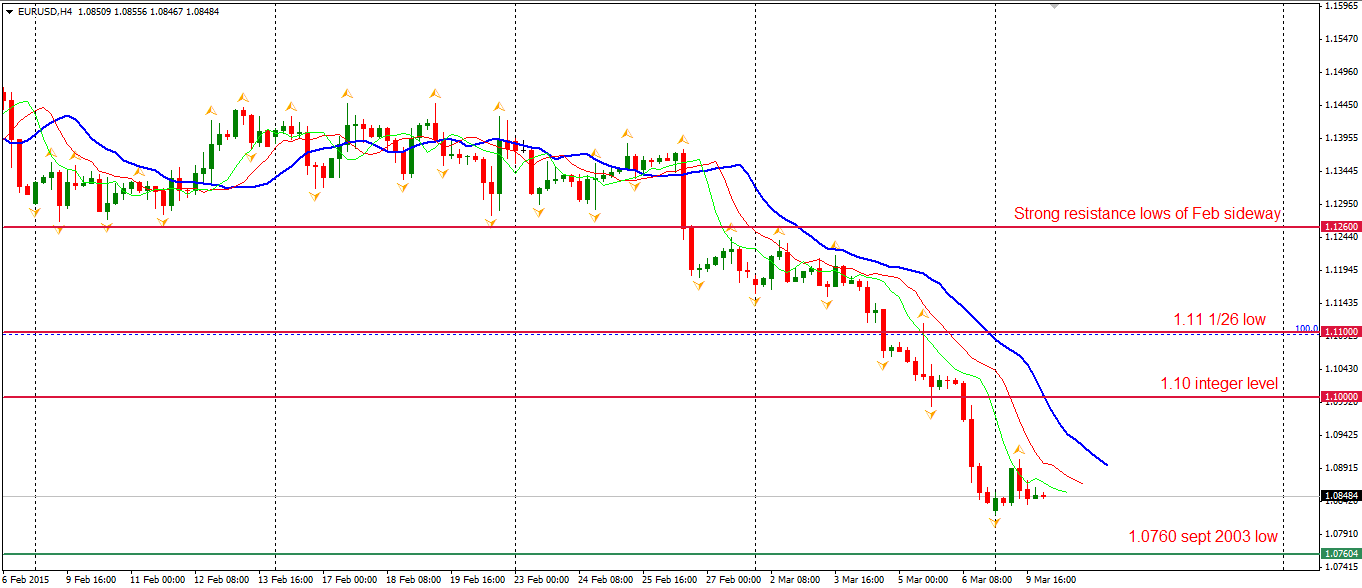

The ECB officially started its bond purchasing program yesterday. The Germany 10-Year bond yield fell to 0.36% and the Italian one fell to 1.28%. The EUR/USD remains at an 11-year low. It rebounded to 1.09 in the morning European session but erased all the gains later on. The mid-run of this currency is still bearish even after the endless fall. The ECB’s program is squeezing out funds from the bond markets to markets outside of the Eurozone instead of providing financial support to the local business activities. The outflow may continue and drag the Euro to parity level against Dollar.

Switching to the stock markets, the Shanghai Composite surged by 1.89% to 3302 as the authority agreed that banks can offer stock brokage business. The Nikkei 225 Stock Average lost 0.95%. Australia 200 slumped by 1.31%. In European markets, the UK FTSE 100 was down 0.51%, the German DAX gained 0.27% and the French CAC 40 Index lost 0.51%. The US stocks rebounded from the loss of last Friday. The S&P 500 closed 0.39% higher at 2079. The Dow gained 0.78% to 17996, and the Nasdaq Composite Index rose 0.31% to 4942.

On the data front, Australia NAB Business Confidence will be released at 11:30 AEDST. China CPI and PPI data will be out an hour after.