Here are the latest developments in global markets:

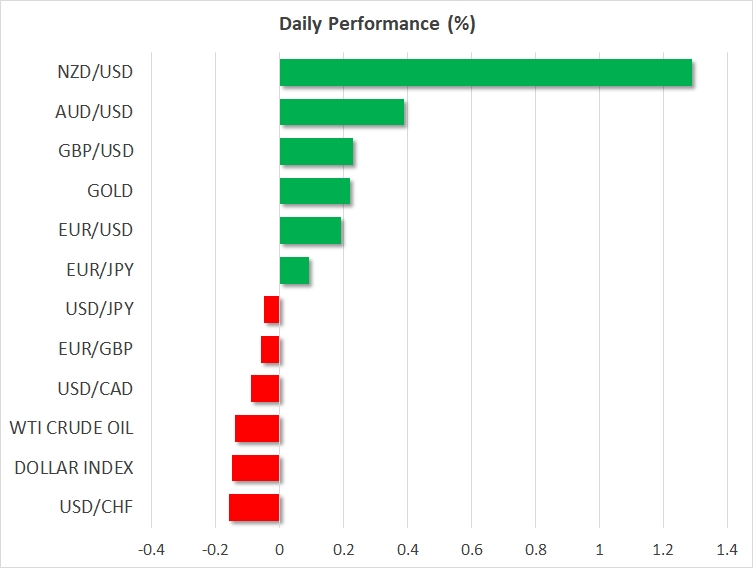

- FOREX: The dollar was trading down relative to a basket of currencies but still not far below a three-week high of 94.09 reached on Friday. The antipodean currencies – predominantly the kiwi – were advancing relative to the greenback. The New Zealand dollar’s gains came on the back of expectations of a more hawkish approach to monetary policy following the appointment of a new governor who’s seen as less of a dove by market participants.

- STOCKS: The Nikkei 225 added 0.6% to finish the day at its highest since early 1992; major Asian indices were broadly on the rise with the Hang Seng being last up by 1.1%. Euro Stoxx 50 futures traded 0.1% up at 0755 GMT. Dow, S&P 500 and Nasdaq 100 futures were up by 0.2%, 0.15% and 0.3% respectively.

- COMMODITIES: WTI and Brent crude were down but not much changed relative to Friday’s close. WTI was last at $57.30 per barrel and Brent at $63.38. Gold was 0.2% up, trading around $1,250.00 per ounce.

Major movers: Dollar’s index not much changed; kiwi jumps on appointment of new governor

The dollar’s index against a basket of six currencies traded at 93.8, being 0.1% down on the day, while USD/JPY was little changed, trading close to the four-week high of 113.68 reached earlier in the day. The Fed is widely expected to raise interest rates as it completes it two-day meeting on monetary policy on December 13. Further monetary policy divergence between the Federal Reserve and the Bank of Japan is supportive of a stronger dollar.

EUR/USD was 0.2% up and not far below the 1.18 handle after losing ground the preceding week. Pound/dollar was up by a similar proportion, trading slightly above the 1.34 level. Optimism on Brexit saw the pair exceed 1.35 during the previous week.

Adrian Orr being appointed as the Reserve Bank of New Zealand’s new governor spurred a rally in the local dollar. Kiwi/dollar was up by 1.2%, trading little below 0.6930, a two-week high touched earlier in the day. Markets apparently view Orr as being more on the hawkish rather than the dovish side.

AUD/USDwas also up, specifically by 0.4% and above the 0.75 handle.

In other news, the first bitcoin futures contracts started trading at 2300 GMT on the CBOE Futures Exchange.

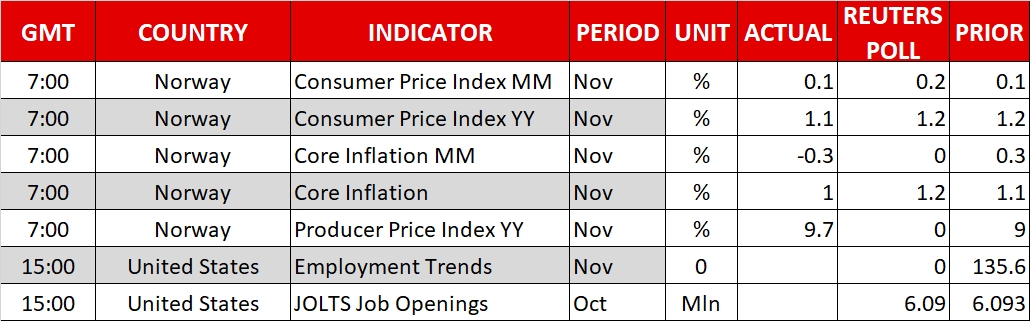

Day ahead: JOLTs job openings attract attention; eyes on Fed & tax deliberations

Economic releases during the day would be light, with the US JOLTs job openings being the figures attracting the most interest. Particularly, the report published by the Bureau of Labor Statistics is likely to show that 6,030 million positions opened in November compared to 6,093 million seen in the previous month.

However, news on monetary policy and tax legislation would also be of significance as the Fed is heading for its last policy meeting of the year on Tuesday-Wednesday – markets are widely anticipating policymakers to raise interest rates by 25 basis points to 1.50%. On the fiscal front, investors remain optimistic on the passage of tax cuts which Republicans hope to turn into law before the year-end, rendering this President Trump’s first major legislative achievement.

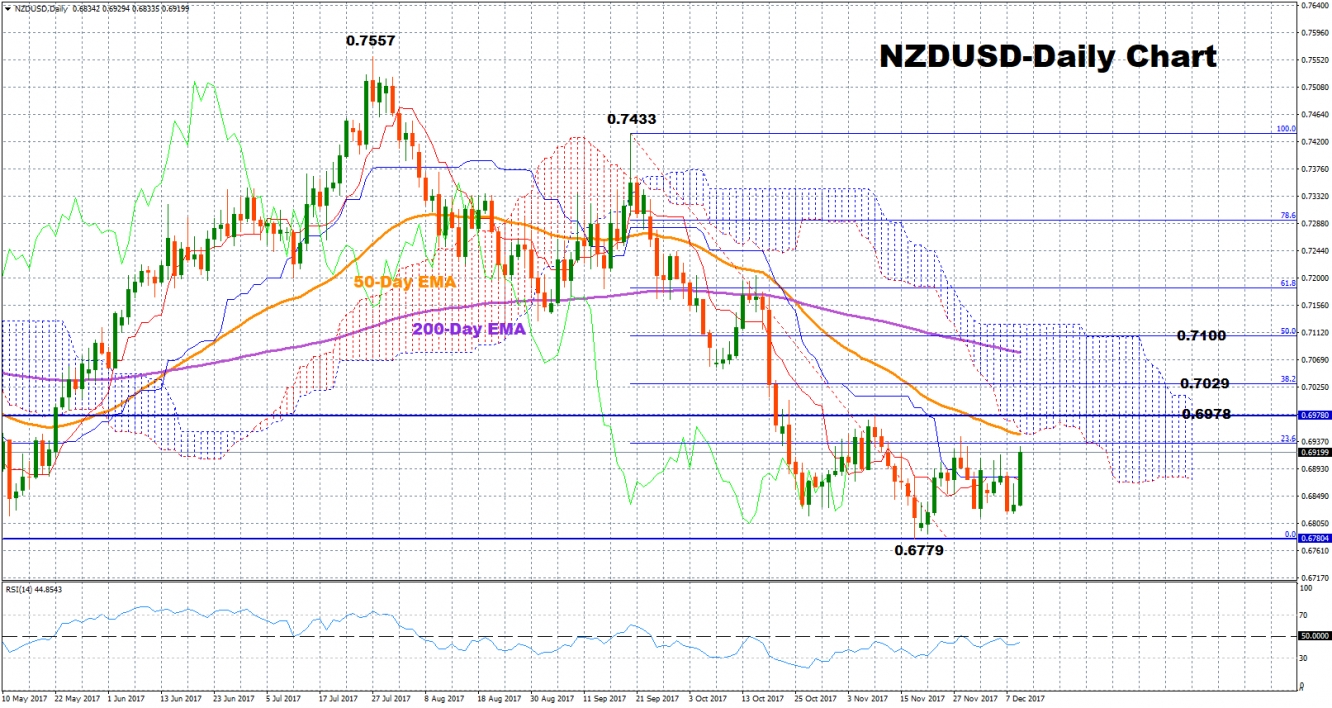

Technical Analysis: NZD/USD back to 0.6900 but neutral bias still intact

NZD/USD is trading at two-week high levels above 0.6900, as the outlook for monetary policy was altered after the appointment of a new hawkish RBNZ governor. However, in the short-term, the bias remains neutral given that the pair continues to trade between 0.6779 and 0.6978 since the end of October.

On the upside, immediate resistance could be found at the 50-day exponential moving average of 0.6948 before the upper bound of the range comes into view (0.6978). Breaking this point would turn the bias from neutral to bullish, opening the scope for a re-test of the 38.2% Fibonacci at 0.7029 of the downleg from 0.7433 to 0.6779. Additional resistance could emerge around the 0.7100 area (50% Fibonacci).

On the downside, the lower bound of the range (0.6779) could act as potential support. But any close below this could stretch the longer-term downleg started from 0.7557 to 0.6779 towards the 0.6600 area which has been repeatedly tested in the past. In case of sharp decreases, the focus would shift towards the two-year low of 0.6347.