Tuesday January 3 2017: Five things the markets are talking about

For Capital markets, the month of December was dogged by thin holiday trading as global equity indexes marched within striking distances of new records, the dollar ending the year losing some of its shine as dealers closed their books despite global yields floating atop of their year highs.

Two unexpected major events dominated trading in 2016 – the U.K’s surprise Brexit result, and an even bigger shock, the election of Trump as U.S. president in November.

Investors can expect 2017 to be fraught with global uncertainty – either geo-political or economic – that should lead to much volatility as the world adjusts to new regimes, political ideas and a higher rate environment.

As dealers and investors ease into the New Year, there is a plethora of new economic data for investors to absorb this week – a number of purchasing managers surveys will be released globally, ending with Friday’s “granddaddy” of economic releases – non-farm payrolls (NFP)!

1. Global equities start 2017 higher

In Asian, equity markets were broadly higher overnight despite investor concerns about capital flight from China.

Note: 2017 will be a big year for the Chinese Yuan (new currency basket) – expect President elect Trump to label China as an official currency manipulator once he is in office.

Australia’s S&P/ASX 200 closed up +1.2%, Korea’s Kospi edged up +0.9% and Hong Kong’s Hang Seng Index closed up +0.7%. Japan’s Nikkei was closed for a holiday.

In China, regional bourses jumped, supported by signs of economic recovery (China’s December Caixin manufacturing PMI came in at 51.9 vs. 50.9 m/m) with the benchmark Shanghai Composite finishing up +1%.

In Europe, regional bourses are taking their cue from Asia and trading higher. Financial stocks are leading the gains in the Eurostoxx, while commodity and mining stocks are trading higher in the FTSE 100 as oil prices surge intraday (see below).

U.S Futures are set to open +0.6% higher.

Indices: Stoxx50 +0.4% at 3,316, FTSE +0.4% at 7,170, DAX flat at 11,600, CAC 40 +0.5% at 4,907, IBEX 35 +0.4% at 9,453, FTSE MIB +0.2% at 19,607, SMI +1.0% at 8,304, S&P 500 Futures +0.6%

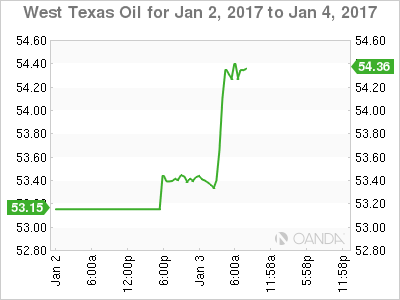

2. Oil at 18-month highs as production cuts take effect

Crude oil prices have hit an 18-month high ahead of the U.S open Tuesday, supported by hopes that a deal between OPEC and non-OPEC members to cut production, which kicked in over the weekend, will drain a global supply glut – on Nov 30th OPEC Ministers confirmed cutting output to +32.5M bpd, a six-month agreement starting on Jan 1.

Brent crude futures have jumped more than +2% to a high of +$58.37, up +$1.55 a barrel and its highest since July 2015. While U.S light crude (WTI) hit an 18-month high of +$55.24, up +$1.52 a barrel.

Expect the markets to continue to look for evidence that these production cuts are in fact occurring.

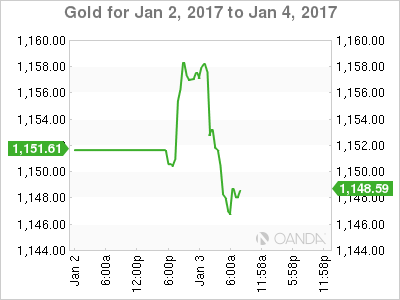

Gold has begun the New-Year on a stronger note, edging up overnight, despite pressure from a strong dollar. The precious metal has climbed +0.5% to +$1,153.13 – advancing for the fifth time in the past six-sessions.

Note: The bullion gained more than +8% in 2016, snapping three-years of declines.

3. Sovereign yields trade atop of their highs

Higher European inflation and improving data continues to back up sovereign yields.

Germany's 10-Year bund yields have climbed to +0.23%, up from +0.19% in early trade, after stronger German regional inflation lifted yields. Gilt futures prices are lower after a 29-month high reading for U.K Manufacturing PMI this morning. U.S. 10-Year Treasury yields have rallied to +2.489% from +2.448% Monday.

Earlier, the Shanghai Stock Exchange overnight halted trading of China’s 50-year government bonds due to “abnormal fluctuations,” shortly after its price tumbled more than -10%.

4. “Big” dollar gains

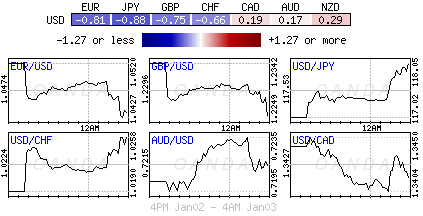

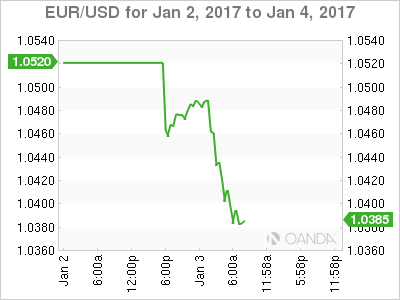

The U.S. dollar has started the New-Year on firmer footing and strengthened mostly across the board with a few exceptions. The Chinese yuan was fixed +0.2% lower outright, while the greenback gained +0.81% to ¥118.28 vs. JPY. Europe’s single unit, the EUR, is currently trading below the psychological €1.0400 at €1.0387 handle despite stronger inflation numbers this morning.

In the U.K, manufacturing data expanded at the fastest pace in two- and half- years in December (56.1 vs. 53.6), as both domestic and overseas demand grew robustly, the latter boosted by the pounds sharp drop post-Brexit vote. Sterling found some traction on the headline, grinding higher from its overnight lows to +£1.2287.

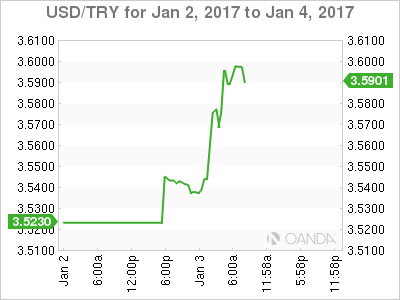

TRY has slumped to a new record low outright (up +1.2% to TRY$3.5864) after Turkey’s annual inflation rate rose to +8.53% in December from +7% in November. The higher-than-expected annual inflation rate means the central bank missed its +5% target for the sixth-consecutive year.

5. Germany still No. 1

Data this morning showed that German jobless claims dropped sharply last month, cementing Germany’s position as the regions strongest labor market.

Jobless claims fell by -17k in December vs. an expected decline of -5k. The adjusted jobless rate remains at a record low of +6.0%.

On average, +2.691m Germans were unemployed in 2016, which was the lowest number since 1991 and an increase in joblessness for this year is not expected.

However, despite Germans having found work over the past 12-months, unemployment among foreigners has risen sharply, led by exploding joblessness among migrants from war-torn countries in the Middle East and Africa.