The bulls of the Dollar took chance to fight back as yesterday’s UK inflation data and German ZEW Economic Sentiment was weaker than expected. The Dollar index rose to day-highs of 85.80. The fundamental difference between Europe and the US makes investors continue betting on a stronger Dollar.

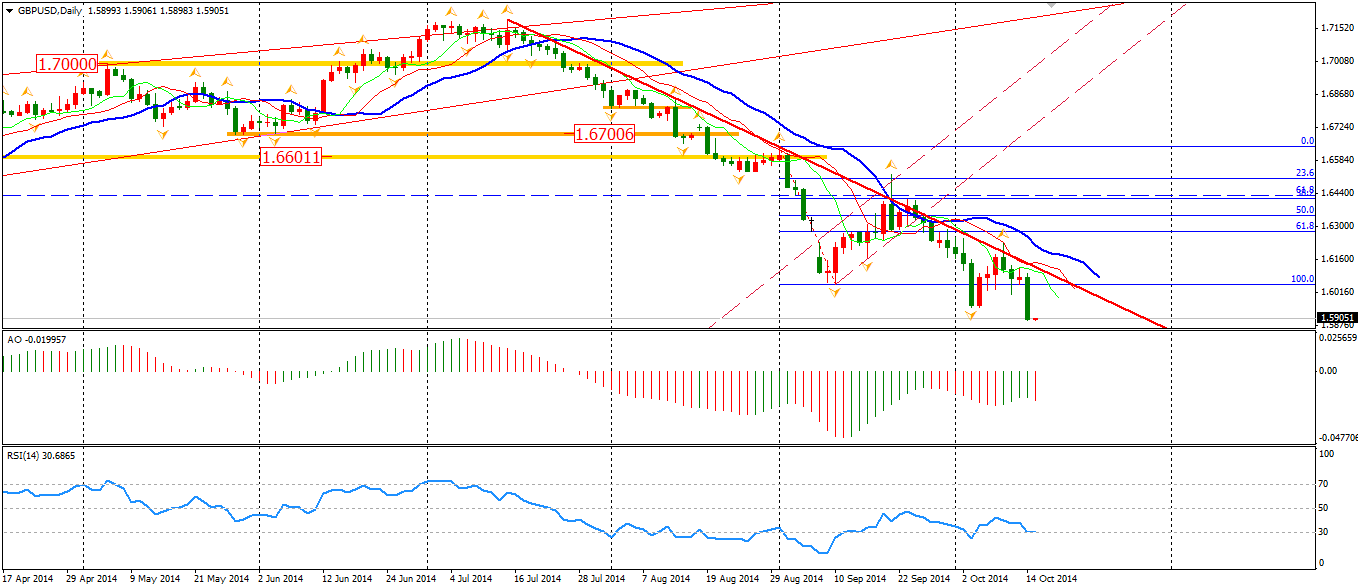

UK CPI fell to 1.2%, the lowest level since September 2009 further closing the possibility of the BOE’s interest rate hike. The inflation level, along with unemployment rate, will be the data that the BOE is closely monitoring. The Pound plummeted below 1.60 integer level after the data release and finally stopping around 1.5920 mark.

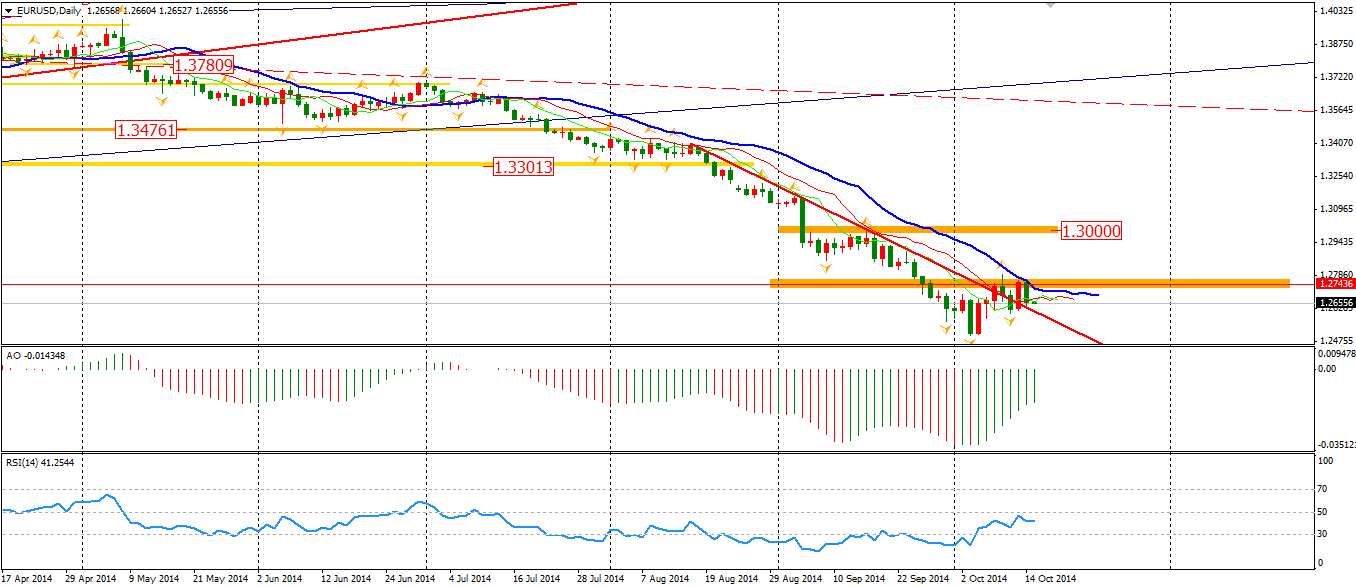

The Euro was pared by the news that the largest economic growth engine of the Eurozone may not be as strong as it once was. The German ZEW Economic Sentiment was -3.6 – the first negative reading since November 2012. The German government also cut the 2014 growth rate from 1.8% to 1.2% and cut the 2015 forecast to 1.3% in response to mild global expansion and geopolitical fears. The slowdown of Germany may be confronting the Eurozone with a three-bottom recession, rounding out the GFC and Euro crisis.

The Dow edged down 1.35% to 16321, while the NASDAQ Composite Index slumped 1.46% to 4213. The S&P 500 declined by 1.65% to 1874. We can see the index has broken the trend line and the August low near 1900. The next target may be the 1800 integer level.

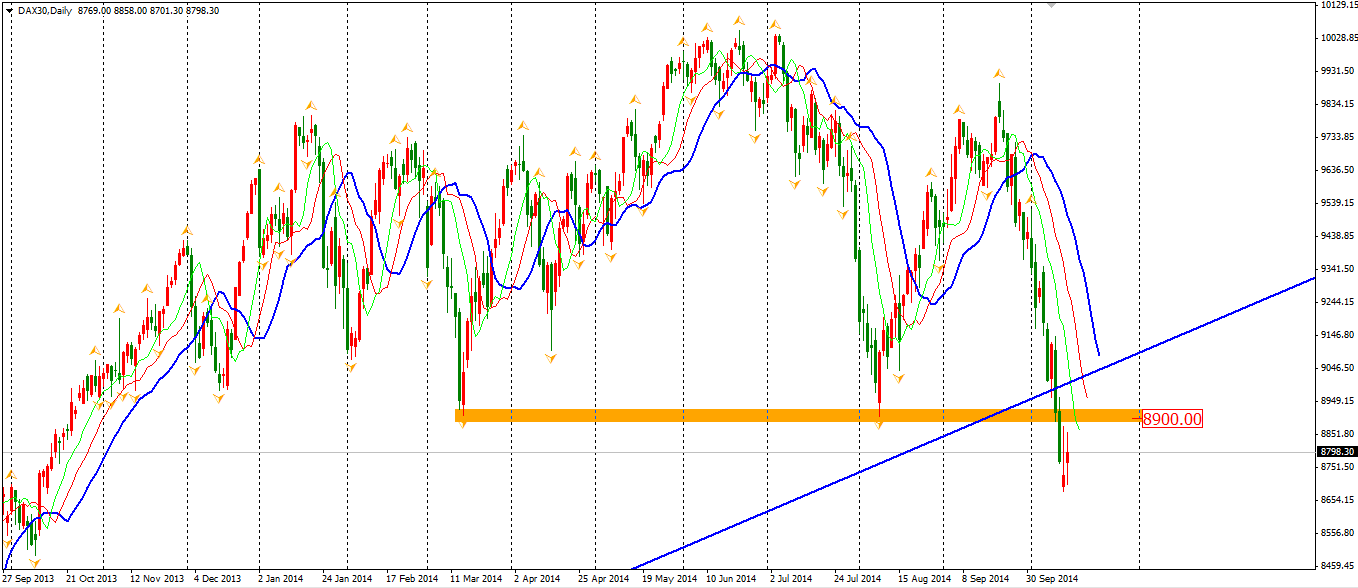

Asian stock markets remained weak yesterday. The Nikkei Stock Average slumped by 2.38%. The ASX 200 rebounded 1.03% to 5207. The Shanghai Composite also fell by 0.28% to 2359. In European stock markets, the UK FTSE was up 0.42%, the German DAX gained 0.15% and the French CAC Index rose by 0.23%. The DAX index has erased all the gain of this year and has broken the bullish trendline since 2011 and 8900 integer level. Traders may short the index again if it bounces back to this area.

The US market closed with a mild rebounding day. The Dow edged down 0.04% to 16315, while the Nasdaq Composite Index gained 0.32% to 4227. The S&P 500 recovered 0.16% to 1877.

On the data front, Chinese inflation data will be released at 12:30 AEST. ECB President Draghi’s Speech will begin at 18:00 AEST. UK job market data will be out at 19:30 AEST and US Retail Sales and PPI will be at 23:30 AEST.

Have a great trading day!

Anthony

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Confronting The Eurozone With A 3-Bottom Recession

Published 10/14/2014, 07:38 PM

Confronting The Eurozone With A 3-Bottom Recession

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.