Market Brief

It’s done. The IMF has decided to include the yuan in its Special Drawing Rights basket. The Chinese currency would occupy a 10.92% weighting, more than the Japanese yen and the pound sterling. The People’s Bank of China set the reference rate higher to USD/CNY 6.3973, while the offshore rate (USD/CNY), which is not subject to trading bands, recovered in the Asian session after falling 0.65% the previous day. On the data front, the manufacturing PMI came in on the soft side earlier tonight, proving once again that the sector is going through difficult times as the usual growth drivers are having trouble keeping up. The official purchasing managers index slipped to 49.6 in November from 49.8 in the previous month. On a more positive note, the non-manufacturing PMI printed higher to 53.6 from 53.1 in October, confirming that the two sectors are moving in opposite direction as the first one needs to reduce overcapacity, while non-manufacturing industry is expanding at steady pace. The Shanghai Composite was up 0.32% and the Shenzhen Composite fell -0.24%. Hong Kong’s Hang Seng surged 1.78%

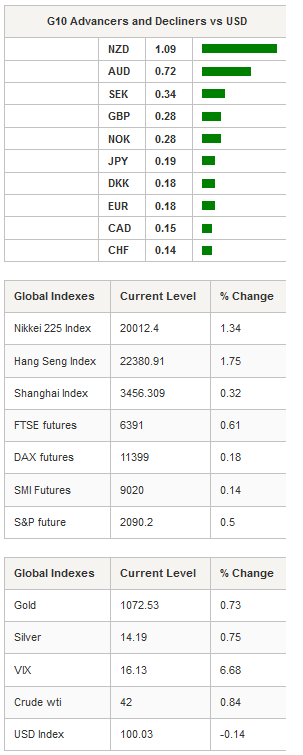

On the equity front, stocks are trading in positive territory across Asian regional markets. South Korea’s KOSPI is recovering from yesterday’s losses as exports contracted less than expected in November, printing at -4.7%y/y compared to -9% consensus. The index is up 1.60%. In Japan, the Nikkei 225 gained 1.34%, while the broader TOPIX index surged 1.37%. USD/JPY dropped as much as -0.50% to 122.64 before recovering to 122.90 in late session. However, looking at the big picture, the pair remains within its 2-week range as investors await the Fed to raise rate.

AUD/USD’s positive trend is gaining momentum and is testing the hourly resistance standing at 0.7283 (high from November 25th) as the RBA left its cash rate unchanged at 2%. On the downside, the closest support can be found at 0.7159 (low from November 23rd). We remain bullish on the Australian dollar and expect further appreciation of the Aussie against the USD as the economy stabilises. Australian shares were up 1.93%.

In Europe, equity futures are blinking green across the screen, following Asia’s lead. The Footsie was up 0.61%, the German DAX gained 0.18%, the CAC 40 0.27%, while the SMI rose 0.14%. The broader Euro STOXX 600 jumped 0.42%. On the FX market, EUR/USD is going nowhere, trading around 1.0580, while the cable continues to rally as it added 0.75% from yesterday’s low. GBP/USD will find a first resistance at 1.5136 (high from November 25th). Overall, we have the feeling that there is further room on the downside as the monetary policy divergence between the BoE and the Fed will add pressure on the pair. The pair already tested the support standing at around 1.5027-1.50 and will likely try to break it to the downside again.

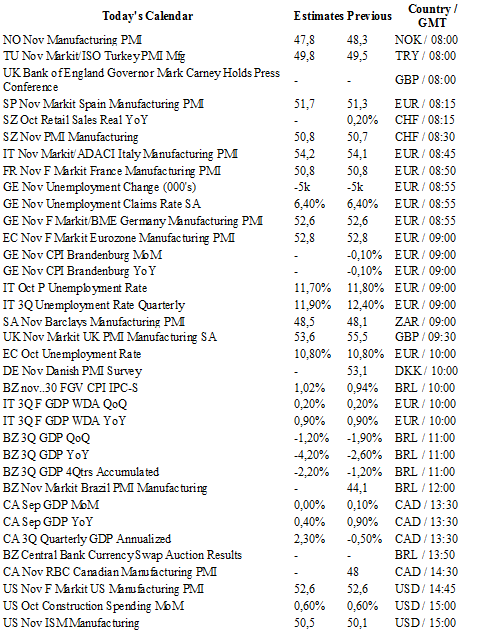

Today traders will be watching manufacturing PMI from Sweden, Norway, Turkey, Spain, Switzerland, Italy, South Africa, France, Germany, the euro zone, the UK, Denmark, Brazil and the US; unemployment rate from Germany, Italy and the euro zone; Q3 GDP from Brazil, Italy and Canada; trade balance from Brazil; ISM manufacturing from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0586

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5659

R 1: 1.5529

CURRENT: 1.5097

S 1: 1.4857

S 2: 1.4566

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 122.89

S 1: 120.07

S 2: 118.07

USD/CHF

R 2: 1.1138

R 1: 1.0676

CURRENT: 1.0279

S 1: 0.9739

S 2: 0.9476