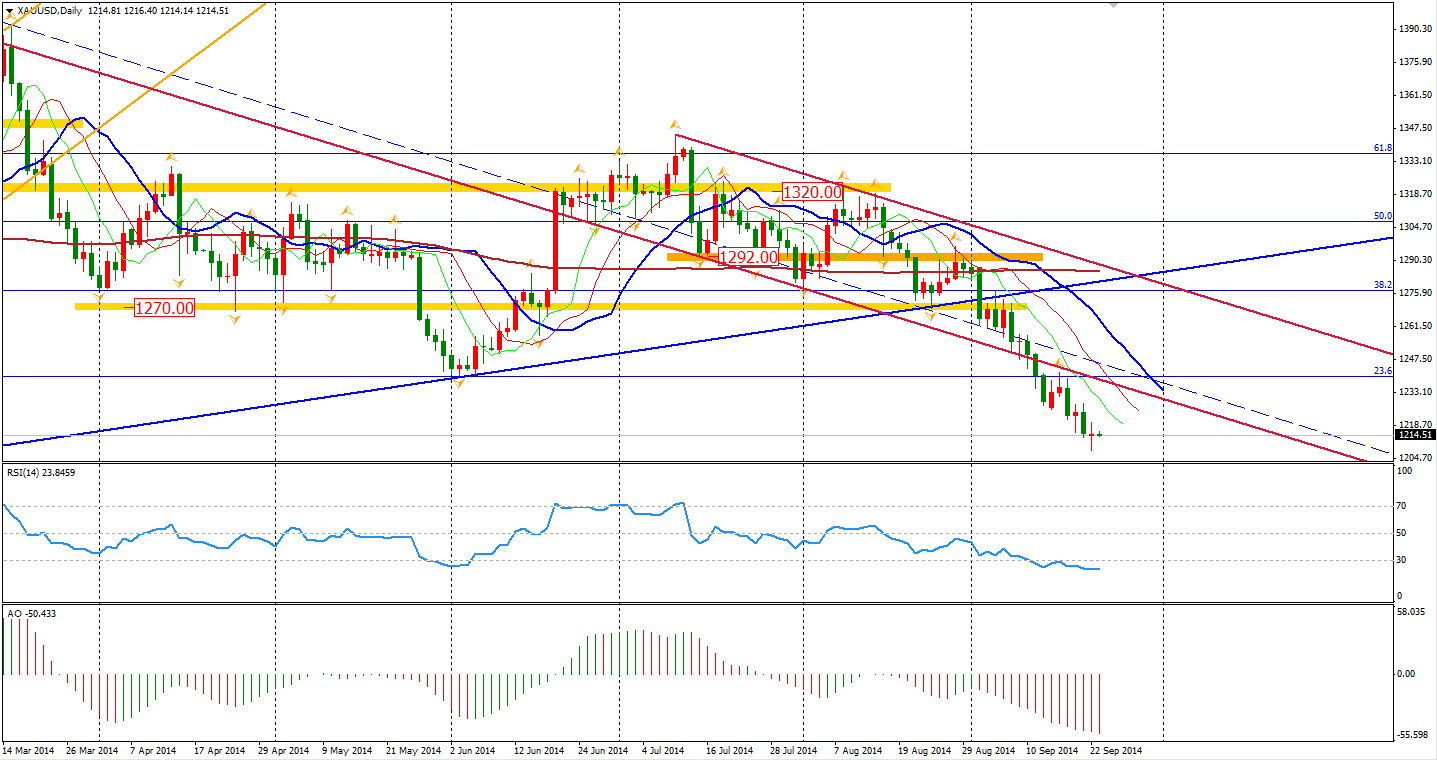

Gold slumped $10 in the Asian Monday morning session to below $1210 as the dollar’s rally dampened demand for the precious metals as alternate investments. It fell to its lowest in eight months and silver extended a slump to the cheapest in four years.

Last week, the Federal Reserve raised U.S. interest-rate projections for 2015 while affirming a pledge to keep borrowing costs low for a considerable time. However, hedge funds lowered bullish holdings in gold for the fifth straight week, the longest run this year, as equities surged and inflation remained muted. This though, left a doji in the daily chart increasing the possibility of a rebound.

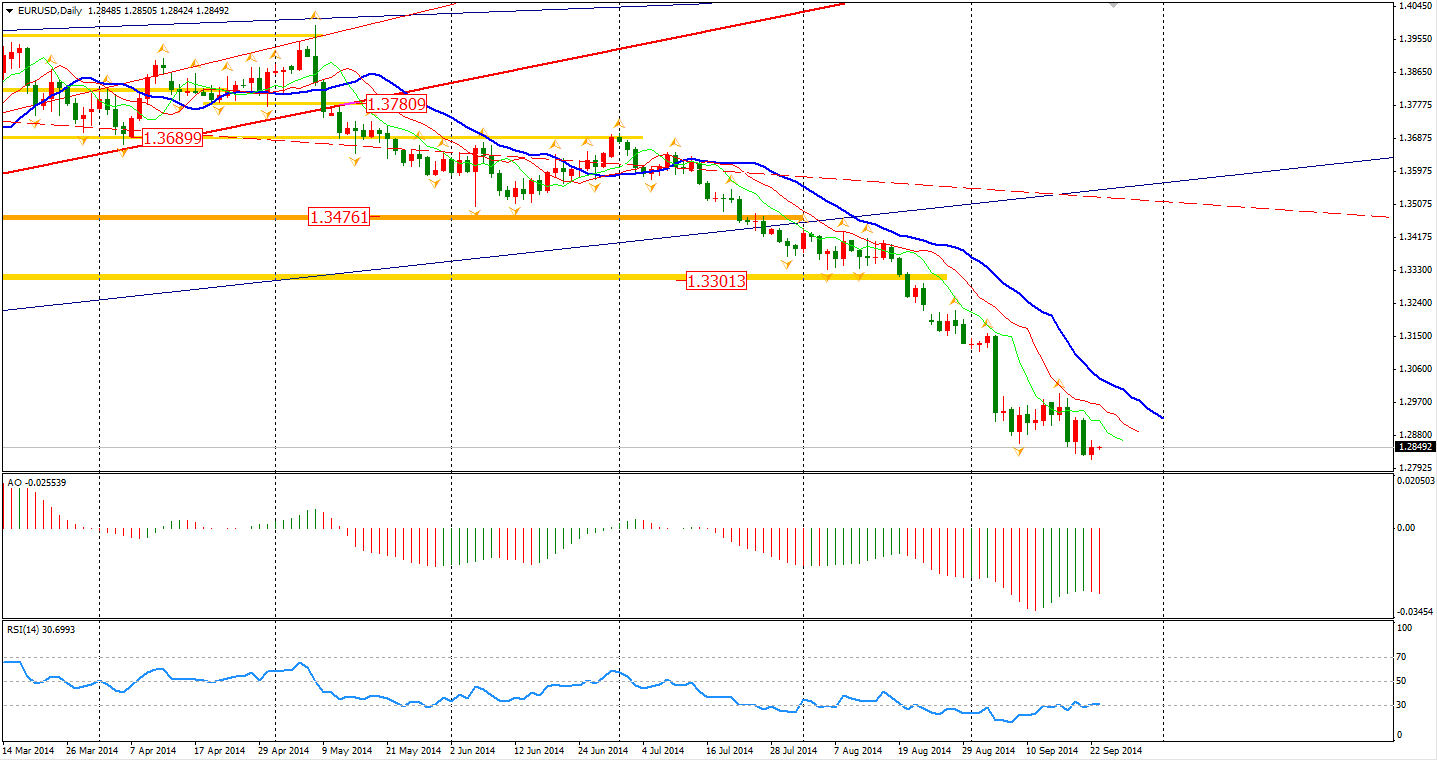

ECB president Mario Draghi inferred to the economic recovery in the Eurozone as “losing momentum” in his speech yesterday. The speech raised expectations of heightened stimulus measures. The euro again refreshed recent lows against the dollar. Relatively though, the euro performed stronger than the commodity currencies.

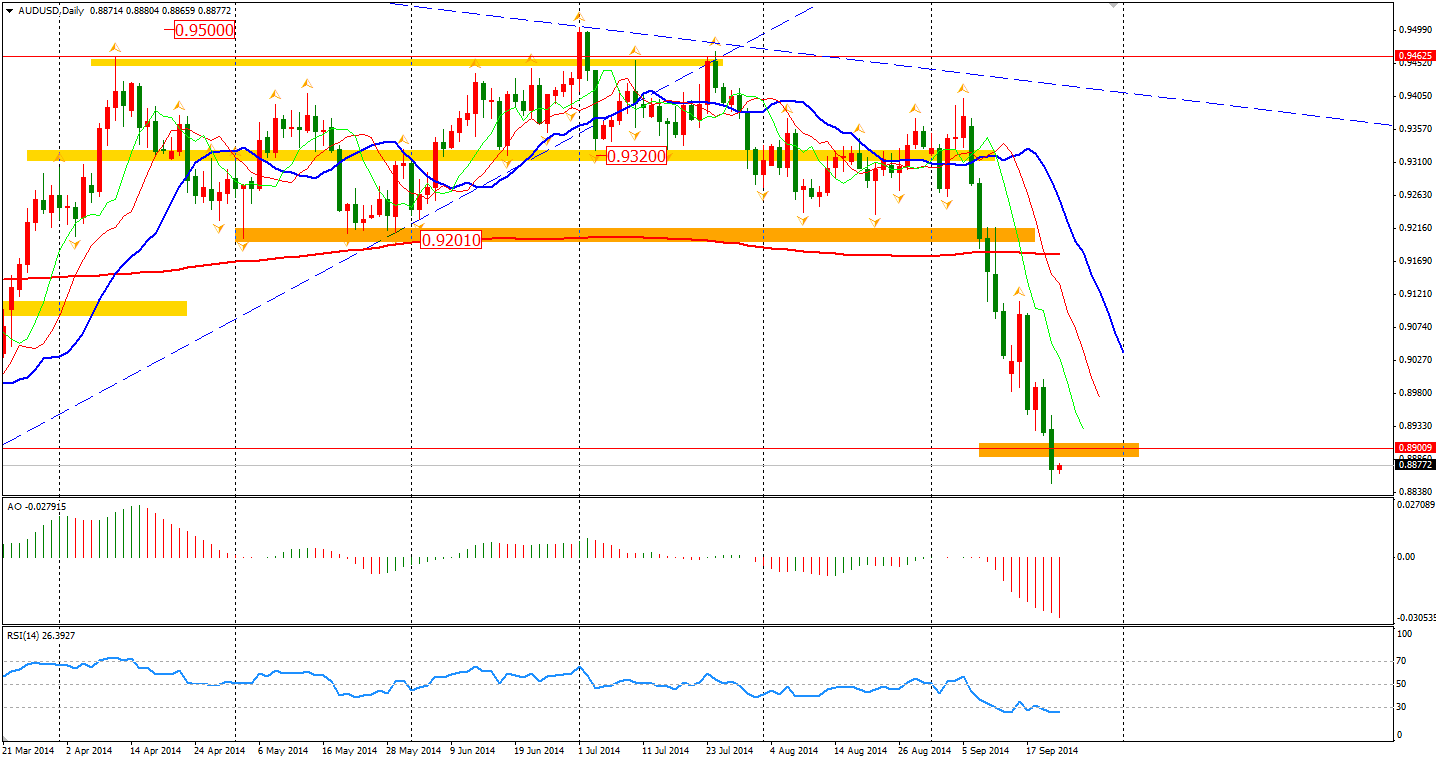

Australian dollar has dropped to a seven-month low as a slump in prices for raw materials has curbed demand for the currencies of commodity-producing nations. Yesterday, it broke the 0.89 level against the dollar, where we mentioned before was our first target of bears. The next target will be the year’s low of 0.8650.

The Asian stock markets were a sea of red on Monday. The Shanghai Composite plummeted 1.70% to 2290. The Nikkei Stock Average fell 0.71% being dragged down by Softbank (TOKYO:9984), as Alibaba's (NYSE:BABA) largest shareholder, slumping 2%. The S&P/ASX All Australian 200 lost 1.29% to 5363. In the European stock markets, the UK FTSE 100 was down 0.94%, the German DAX lost 0.51% and the French CAC 40 Index fell 0.42%. U.S. stocks retreated after last week’s rally. The S&P 500 fell 0.8% to 1994. The Dow 30 edged down 0.62% to 17173, while the NASDAQ Composite Index slumped 1.14 % to 4528.

On the data front, China HSBC Flash Manufacturing PMI will be at 11:45 am AEST. Eurozone Flash PMIs will also be released successively at the beginning of the European session. Canada Retail Sales is at 22:30 AEST.

Have a great trading day!

Anthony

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commodity Currencies Falling On China’s Weakened Demands

Published 09/22/2014, 08:44 PM

Commodity Currencies Falling On China’s Weakened Demands

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.