Australia has just concluded a mail-in referendum that has overwhelmingly affirmed the country's will to legalize same sex marriage. With a turnout of 79.5% of the population, the vote carried with 61.6% in favor.

Prime Minister Malcolm Turnbull has pledged to carry out the will of the people and sign it into law by Christmas. If he succeeds, Australia will become the 26th country take this massive step. This is up from just two countries that had such laws in 1993.

The quick pace at which the world is changing has been accelerating and we can notice a paradigm shift from conservative to liberal thinking. For example, recreational marijuana has seen a similar global change of mind over the last few decades.

So, how long do you think it will take for the world to switch out the money we're using and ditch government backed system in favor of a borderless digital solution?

Today's Highlights

Is this the Top?

Buffet's Switch

All Cryptos are Green

Please note: All data, figures & graphs are valid as of November 15th. All trading carries risk. Only risk capital you're prepared to lose.

Market Overview

The price of crude oil dropped yesterday bringing with it energy stocks, which managed to drag down global indices ever so slightly.

After a record breaking bull run and stocks hovering near their all time highest levels, it does seem that some buyers at least are starting to develop a fear of heights.

For the Dow Jones, 4 of the past 5 days have created red candles (orange circle) but so far it seems more like a lack of buyers than any serious selling. Which is ironic, since most of this recent ramp has been caused by a lack of sellers.

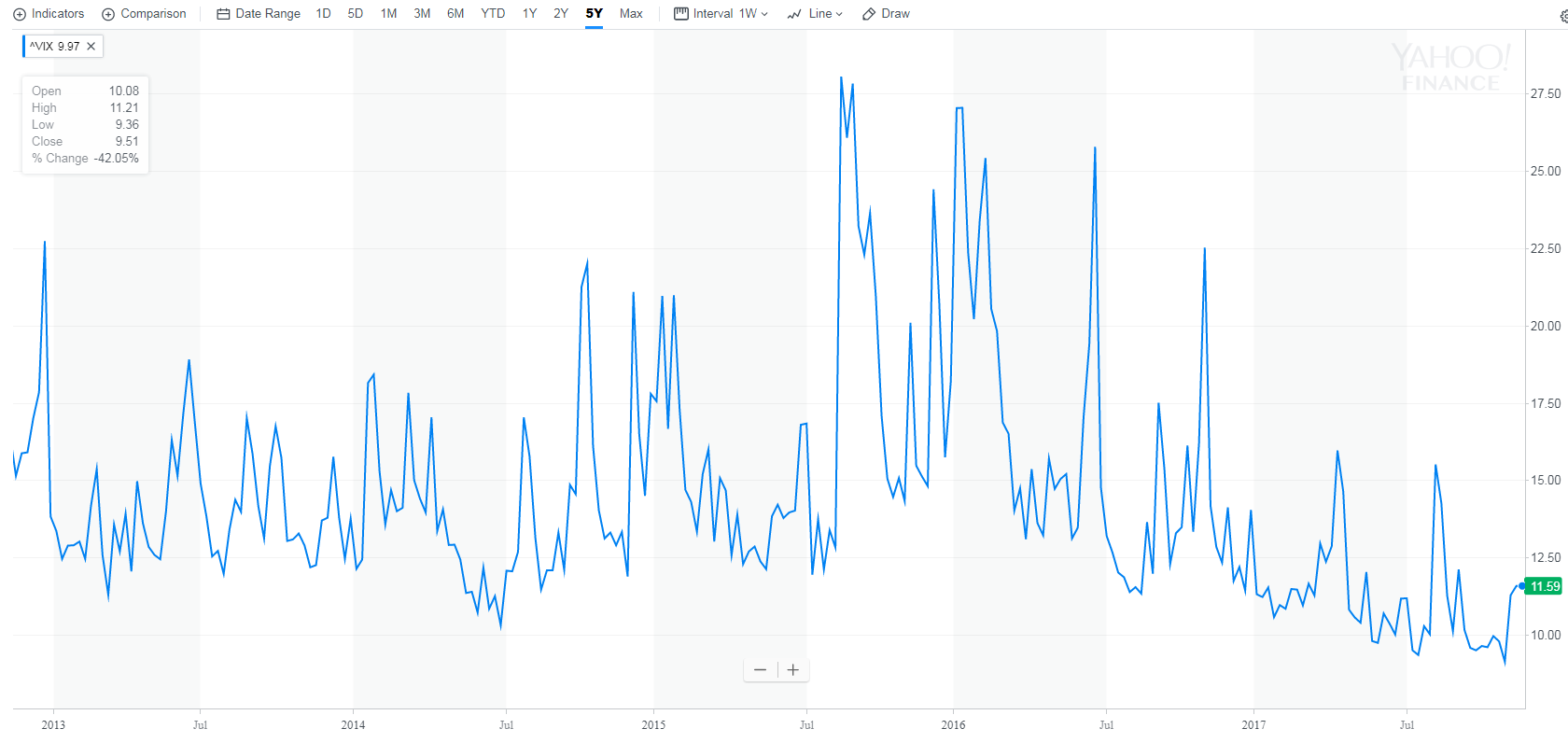

Either way, volatility has ramped up slightly with the VIX "fear index" clocking 11.59 points. A welcome change from the record low seen two weeks ago.

Asian markets have also performed poorly this morning with the Nikkei 225 dropping 1.5% and the China A50 Futures as well as the ASX 200 down about 0.5%. The European markets have just opened and the picture so far does not look pretty.

As can be expected, with risk sentiment being meek investors are turning to gold as the safe haven. The shiny metal has been quite stable throughout the recent bull run. After showing incredible support at $1260 (blue) has now created itself a mini upward channel (yellow).

Buffet's Portfolio

As the world's most famous and popular investor, it's fun to keep tabs on what he's holding and his performance. Even though this year his stats don't come close to some of the traders in eToro...

...it's really the consistency that counts. The man has delivered an average of 9.7% returns since 1965.

So what's new?

In a surprising move, Warren has made a major shift in the tech stocks that he's holding in Q3. He's dumped 30% of his holding in IBM (NYSE:IBM) and purchased an additional 4 million shares of Apple (NASDAQ:AAPL) stock.

The move seems to have been advantageous as Apple rose 6% during the quarter and IBM fell 5%.

Over to Crypto

Everything is green in crypto land today. Over the past 24 hours 87 of the top 100 cryptocurrencies are in profit. The total market value of all digital assets in circulation is now at a record high $215 Billion, up from $17 Billion at the start of the year.

The @CryptoFund that we've created at eToro back in June tracks the top traded cryptocurrencies by volume and has returned 78% profits so far.

What else?

The focus today will likely be on CPI inflation numbers coming from the USA. More importantly, the influence of these numbers on the Fed's decision to hike rates or not at their meeting on December 13th.

At this point, the market is pricing in a 92% chance of a rate hike at the next meeting. A strong number here could push that expectation to 100%. Or vice versa a surprise deflation could shake confidence in the Fed's ability to pull off a smooth hike.

Also watch the crude oil inventories. Crude has been driving the markets for the past few days so stay on top of it.

Lemme know if you have any questions. All comments and feedacks positive or negative are always appreciated.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.