Despite some TV and media pundit and investor rhetoric about the imminent implosion of the U.S. markets under President Trump's economic agenda (in the months leading up to the November 8, 2016 Presidential election and, still, to date), we continue to see new market all-time highs being made, along with stabilization and advancement of world markets, in general, since the election.

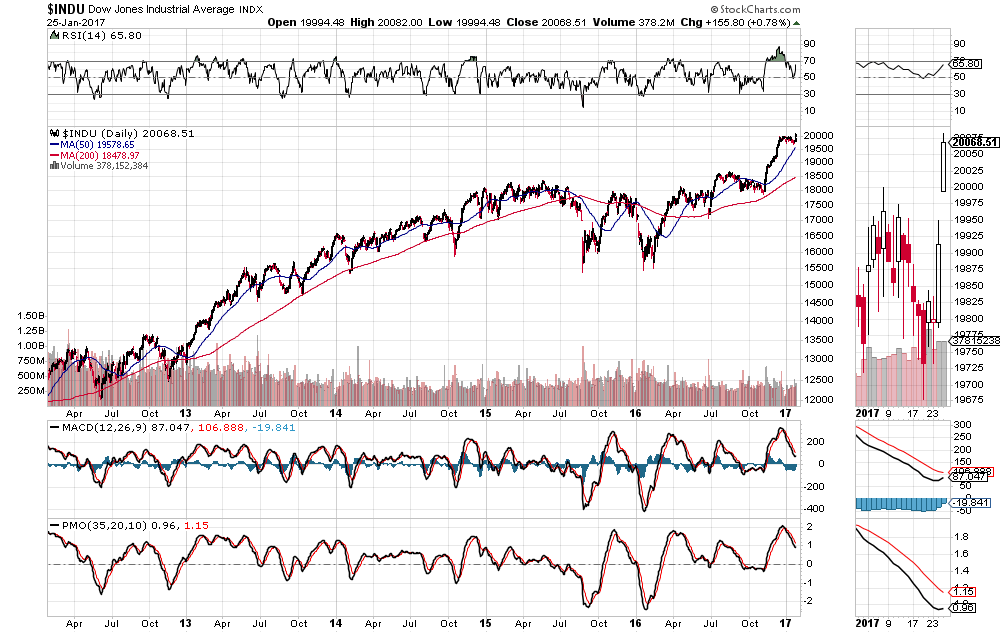

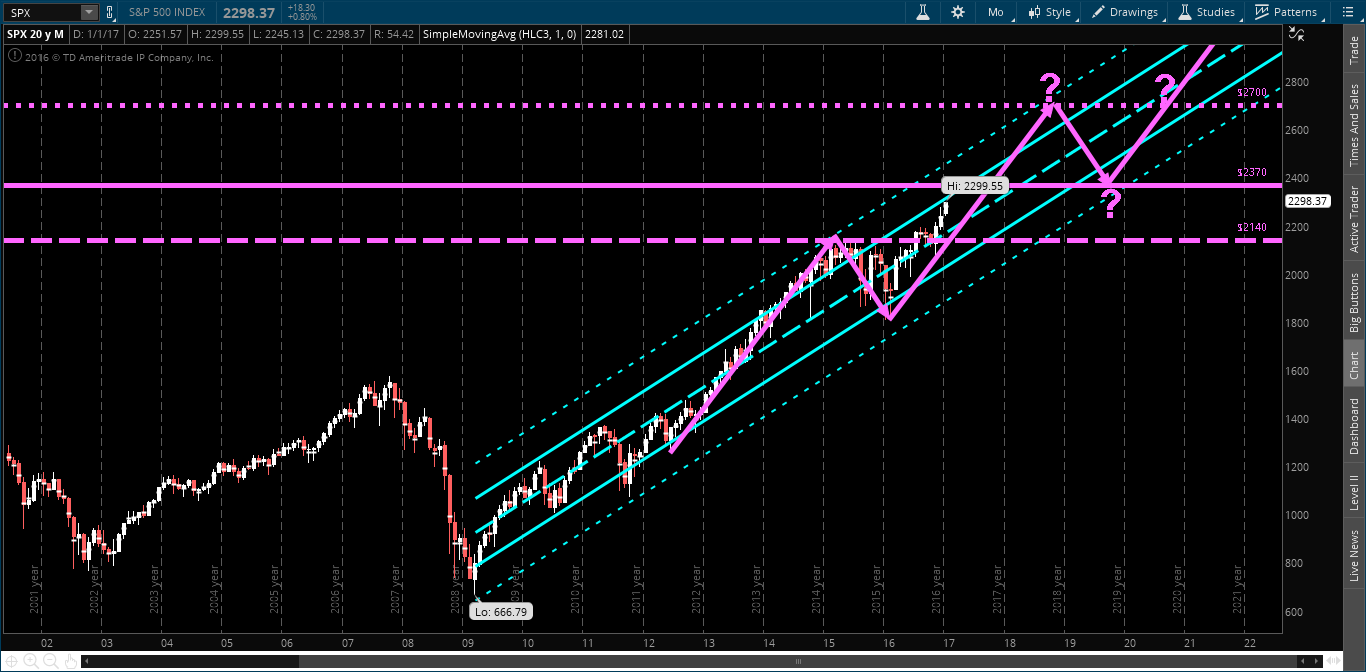

The following charts illustrate that point. For example, the Dow 30 Index finally broke and closed above 20,000 on Wednesday, while the S&P 500 Index remains on track to, potentially, achieve the 2400 level by the end of 2017 (as described in my post of December 1, 2016), and closed at an all-time high of 2298.37 yesterday.

As well, the SPX:VIX ratio also closed at an all-time high Wednesday, with the momentum indicator confirming longer and short-term bullish sentiment in the SPX, as shown on the monthly and weekly timeframes (which I mentioned as something to monitor in my post of December 31, 2016).

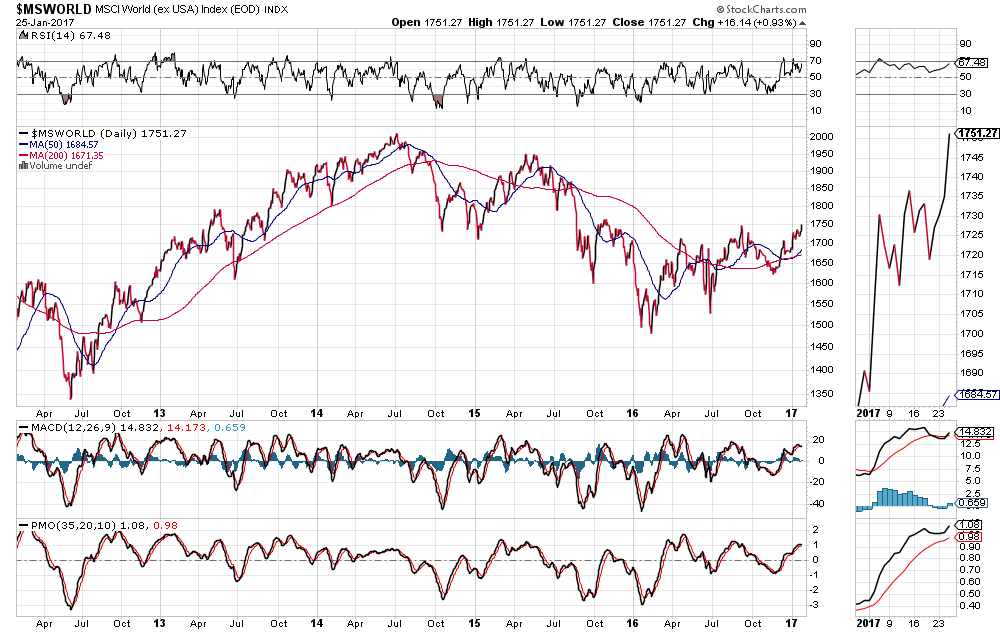

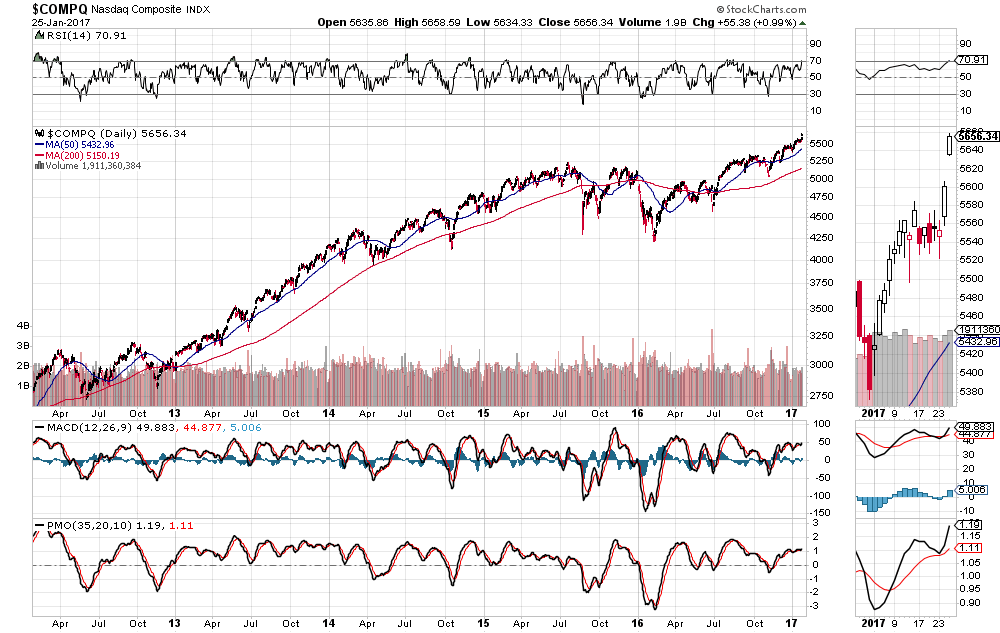

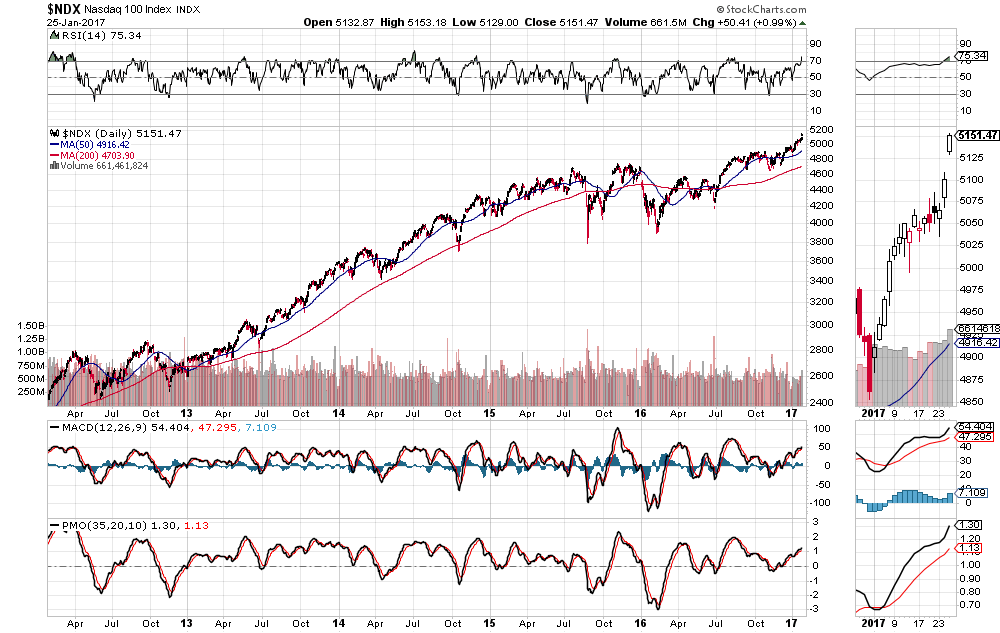

The NASDAQ Composite Index and the NASDAQ 100 Index both closed at all-time highs on Wednesday. Even the World Market Index, after its latest and current rally produced another moving average Golden Cross formation in mid-January of this year, shows that foreign markets are also under such bullish influence.

So, while a healthy divergence of pundit/investor viewpoints will, no doubt, continue, it may be wise to consider what the charts are portraying, as part of your "due diligence" trading/investing process. At the moment, momentum is favouring the bulls and will do so, until these charts prove otherwise.