Tuesday July 19: Five things the markets are talking about

Potential monetary policy decisions are currently dictating market moves, whether it's bond yields, currency values or equity prices.

The European Central Bank (ECB) meets this Thursday and is expected to leave its policy unchanged. That goes for the Fed too, they meet on July 27. In contrast, the Bank of Japan (BoJ), who meets at the end of the month (July 28/29), is anticipated to provide more monetary stimulus. Will authorities disappoint if the yen continues to underperform?

In the U.K, Bank of England’s (BoE) Carney has hinted that August 4 will keep money market dealers busy. Down under, both the Reserve Bank of Australia (RBA) and Reserve Bank of New Zealand (RBNZ) are preparing the markets for potential rate changes (August 2 and 11 respectively).

With the outcomes being a coin-toss for a few, expect all the central bankers to be asked a question about Brexit in their post-meeting press conference. It’s that unknown that is expected to shape future interest rate policies.

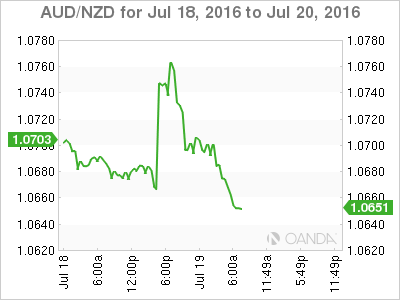

1. RBA and Reserve Bank of New Zealand (RBNZ)

Both the AUD (A$0.7496) and NZD (NZ$0.7028) have come under pressure in overnight trading. The RBNZ announced some property ‘cooling measures,’ stating that it intends to enact new macro-prudential measures nationwide to mitigate systematic risks to bank from mortgage lending.

To date, the kiwi property market inflation risks are the primary impediment to further easing by RBNZ in response to persistently low inflation. New Zealand’s Q2 CPI data only reinforces the need for more easing, and the fixed income markets have already priced in an over +70% chance of another cut next month.

The RBA released its July minutes. Aussie policymakers indicated that Brexit has had a small impact on Australia's economy thus far and that the transition to the non-resources sector is well advanced.

It was no surprise to see the RBA indicate that Aussie inflation would remain low for some time. Governor Stevens reiterated that upcoming data would allow refinement of the assessment of outlook, and that they would adjust policy as appropriate based on GDP and inflation views.

2. Global bourses see mixed results

Euro equity indices are trading mostly lower ahead of the open stateside, pressured by a downturn in recent oil prices (WTI $45.14, Brent $46.81).

Weaker energy is encouraging investors to take some profits from the recent risk-on rallies. Commodity and mining stocks are leading the losses in the FTSE 100, while financial stocks are leading the losses in the Euro Stoxx.

In contrast, equities in Japan rose for the sixth straight session on Tuesday, on growing expectations that the BoJ will soon roll out stimulus for the economy. The Nikkei stock average closed up +1.4% after being shut for a holiday on Monday. The benchmark has rallied +10.6% over the last week.

Elsewhere in the region, investors seemed to also be in profit-taking mode – Chinese stocks in Hong Kong fell -1.2%, the Hang Seng Index down -0.6%, while South Korea’s KOSPI and the Shanghai Composite Index each lost -0.2%. Australia’s ASX 200 slipped -0.1%.

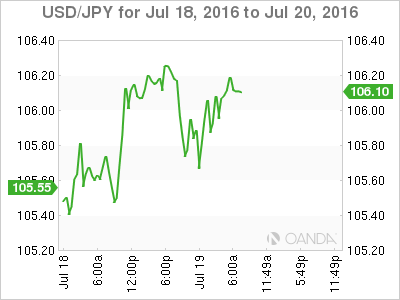

3. Yen and Yuan slip again

Asian currencies have slipped in overnight trading despite the mild rally in smaller Asian bourses. With the yen and the yuan having printed new fresh lows, they have managed to drag other currencies in the region down with them (MYR -1.1%, INR and PHP -0.2%).

The yen fell to ¥106.32, its lowest print in nearly a month, and back to the level it was trading before the Brexit vote. The surprise June 23 outcome triggered heavy buying of the yen as a safe-haven (USD/JPY low ¥98.98).

However, PM Abe’s victory in parliamentary elections earlier this month has spurred hope that the PM could introduce a fresh round of government spending to stimulate growth, alongside further policy easing by the BoJ. This has managed to weaken the JPY to current levels.

Elsewhere, the People’s Bank of China (PBoC) set the yuan benchmark at its weakest level in nearly six years (¥6.7030). Is China steering the yuan into a slow descent to help the country’s weakening economy?

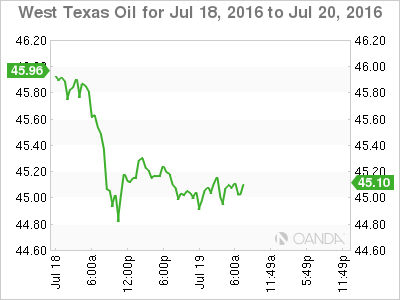

4. Commodities

Crude is finding it difficult to find any traction of late. Oil prices are again on the retreat on fears that the global glut of gasoline will continue to weigh on crude markets.

The September contract for Brent is down -0.38% at $46.78 a barrel, while its counterpart stateside WTI trades -0.35% lower at $45.10 a barrel for August deliveries.

Market oversupply has crude bears eyeing sub $40 a barrel once again, especially with Iran’s return as a major oil exporter cranking up the pressure on global markets.

Despite the fact that the Saudis holding back -540k barrels a day (announced in June) has managed to alleviate some of the impact, fears remain that any further growth in crude output will only increase pressure on future prices.

Investors will be looking to API’s release this morning and tomorrow's EIA data for direction.

5. Bonds prices advance

Sovereign bond prices and their respective yields continue to be volatile.

U.S. 10-year treasury prices have rallied in the overnight session, the first time in four days, pushing their yield down by three basis points to +1.56%. Yesterday’s intraday high print was +1.60%, a long way from its record-low close 10 days ago of +1.366%.

With central banks continuing to have problems with ‘deflation,’ investors should not expect elevated sovereign yields to be sustainable.

With the RBA and RBNZ signaling “lower for longer” at a minimum, similar maturity bonds in Australia and New Zealand are also advancing, cutting their respective yields by 7bps to +1.92% and +2.26%.