Market Brief

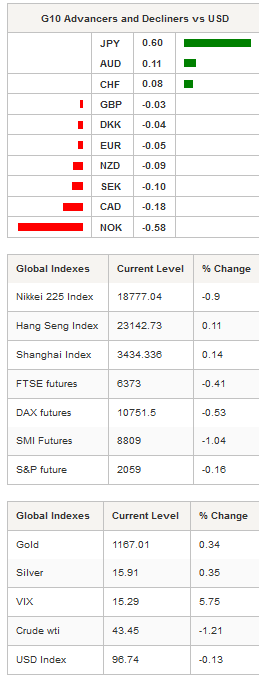

Most Asian regional markets were trading in negative territory as the boost provided on Friday by the PBoC’s decision to further ease its monetary policy, wore off quickly. The upcoming rate decision by the Federal Reserve is also weighing on global markets as participants take their profits home and consolidate their positions. Although the market does not expect the Fed to start tightening tomorrow - probabilities extracted from the overnight swap rates show a 10% chance of a lift-off on Wednesday - the market will pay close attention to the accompanying statement, as there will be no press conference this time, to get a clue about the Fed’s thinking.

Only Chinese stocks managed to end up in positive ground. The Shanghai and the Shenzhen Composite edge up 0.14% and 0.65%, respectively. In Japan, the Nikkei 225 and the TOPIX index fell 0.90% and 1.02%, respectively; in spite of the fact that the BoJ is expected to increase its stimulus at its semi-annual meeting on Friday. Elsewhere, in Hong Kong the Hang Seng edged up 0.11%, while in South Korea the KOSPI index fell 0.17%.

After breaking the resistance standing at 121.33 last Friday, USD/JPY is back below 121 as the greenback runs out of steam ahead of the FOMC meeting. On the upside, a resistance can be found at 121.75 (high from August 28th); on the downside a weak support lies at 119.62 (low from October 22nd), while a stronger one can be found at 118.07 (low from October 15th).

In New Zealand, the September trade balance was a major surprise. The trade deficit widened to NZ$1,222mn from a revised deficit of NZ$1,079mn in the previous month, well below market expectations for a smaller deficit of NZ$825mn. Exports fell to NZ$3.69bn in September, compared with a downwardly revised figure of NZ$3.71bn in August. While imports rose to NZ$4.91bn from an upward revision of NZ$4.79bn in the previous month. Exports of milk powder, butter and cheese (NZ largest export commodity group) fell 22%m/m but were party compensated by a rise in meat exports, which increased 33%m/m. Initially, NZD/USD fell sharply to 0.6757 before bouncing back and stabilising around 0.6780. The currency pair is expected to trade sideways ahead of tomorrow's RBNZ meeting. The Reserve Bank of New Zealand is expect to leave its official cash unchanged at 2.75%, waiting for further economic data and other central banks’ decision to adjust its policy.

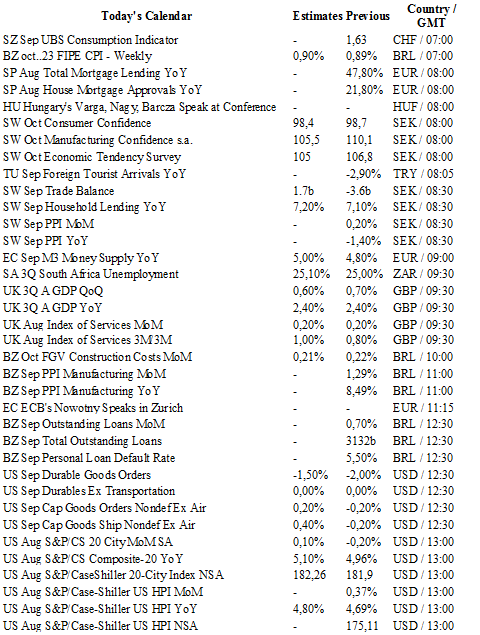

Today traders will be watching the Swedish trade balance and PPI; third quarter GDP from the UK; manufacturing PPI from Brazil; durable goods orders, Markit PMI, consumer confidence index, Richmond Fed manufacturing index and S&P/Case-Schiller index from the US.

Currency Tech

EUR/USD

R 2: 1.1495

R 1: 1.1387

CURRENT: 1.1052

S 1: 1.0809

S 2: 1.0458

GBP/USD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5347

S 1: 1.5202

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 120.41

S 1: 118.07

S 2: 116.18

USD/CHF

R 2: 0.9903

R 1: 0.9844

CURRENT: 0.9830

S 1: 0.9476

S 2: 0.9384