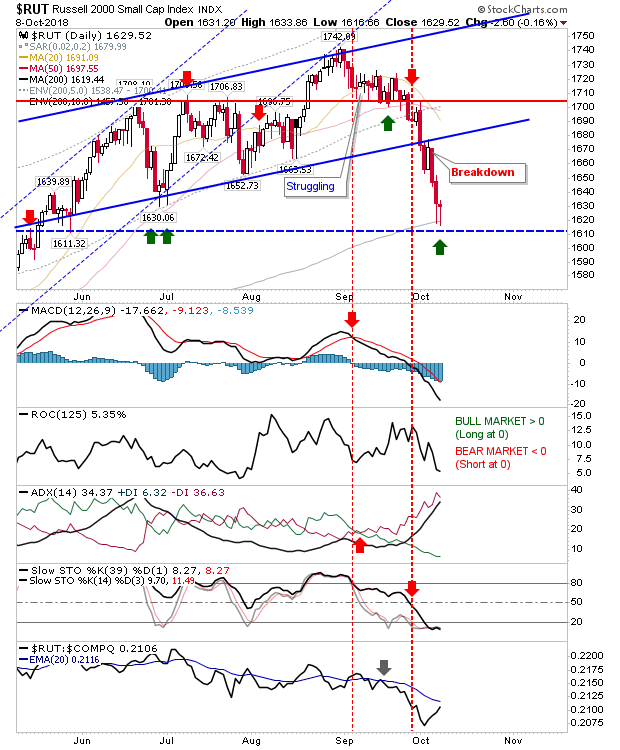

Yesterday was a simple call for action. On Friday, the Russell 2000 tagged its 200-day MA in a manner which was picture perfect for those peppering the 200-day MA with GTC 'buy' orders. Monday was the second chance for a slice of this action with another tag of the 200-day MA.

If there is a 200-day MA fail it will be a clean sell but as this is oversold on near-term and intermediate stochastics it's looking like a relatively low risk buy with stops on a loss of 1,615 and an initial target of 1,715 - a healthy risk:reward with the index closing at 1,630.

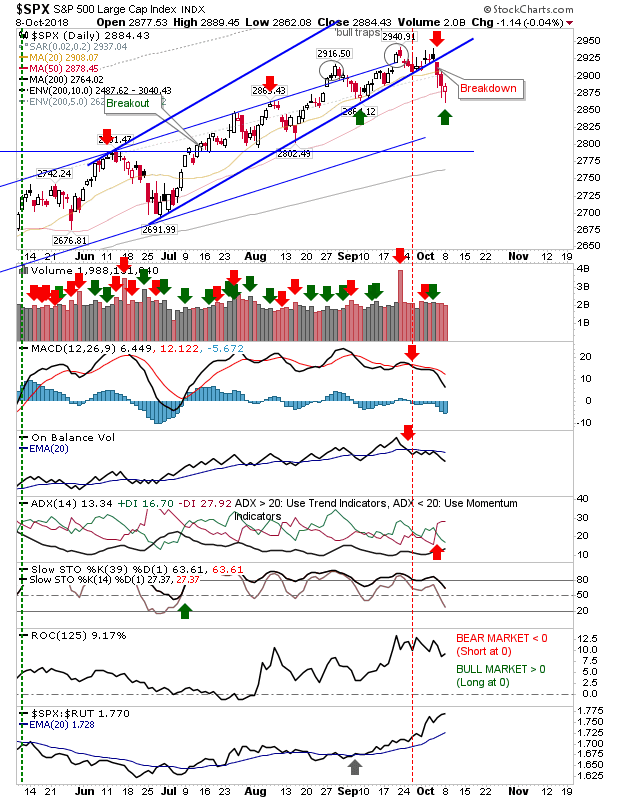

The S&P dug in at its 50-day MA which is another a buying opportunity. Monday finished with a bullish hammer on bearish technicals but price action looks key. Stops on a loss of 2,862, trail stops and see how it goes.

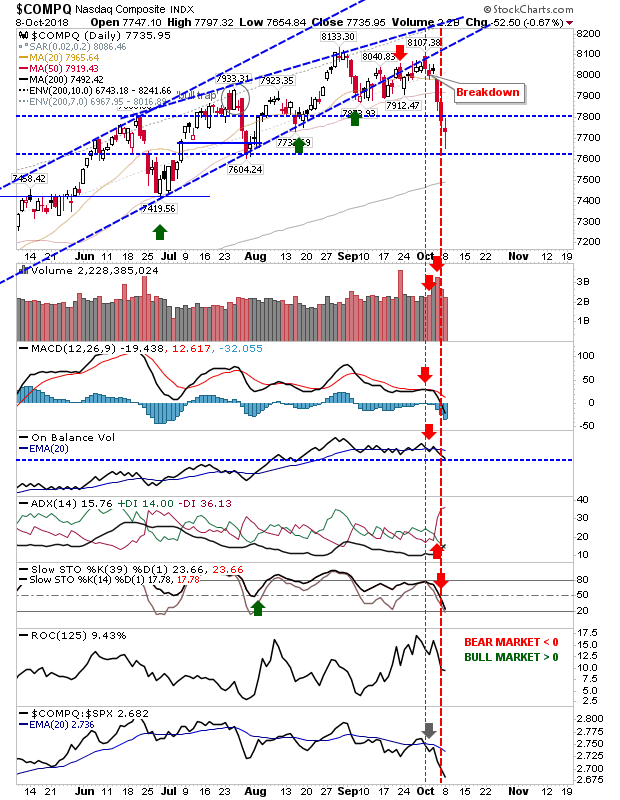

The NASDAQ took further losses as it drifts down towards its 200-day MA. Yesterday's action marked an indecisive 'spinning top' so no clear trade on offer (aggressive longs could look to buy a close above yesterday's high of 7,798 but the risk is measured on a loss of 7,655 which is still too wide to be attractive).

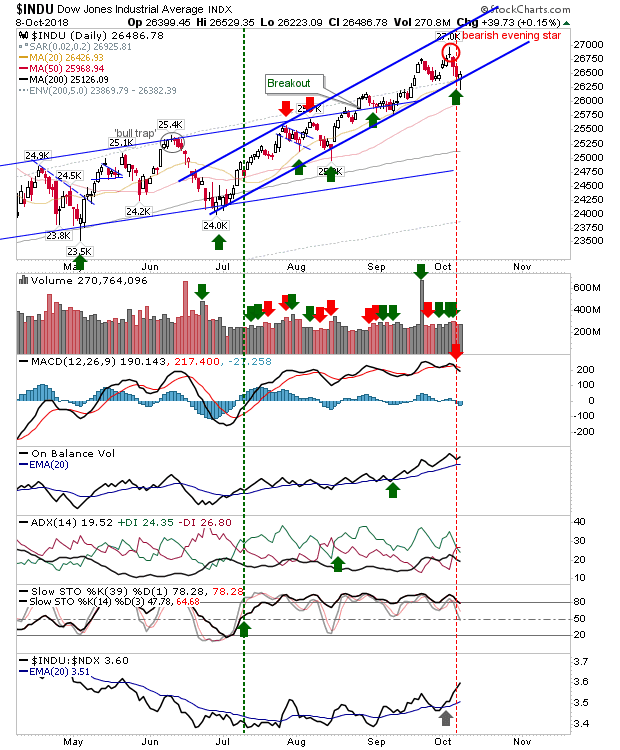

In contrast, the Dow Jones Industrials managed a bullish hammer right on channel support. While the MACD is on a 'sell' trigger, other technicals are bullish. This is an easier 'buy' trade with stops on a loss of hammer lows of 26,223 or 50-day MA.

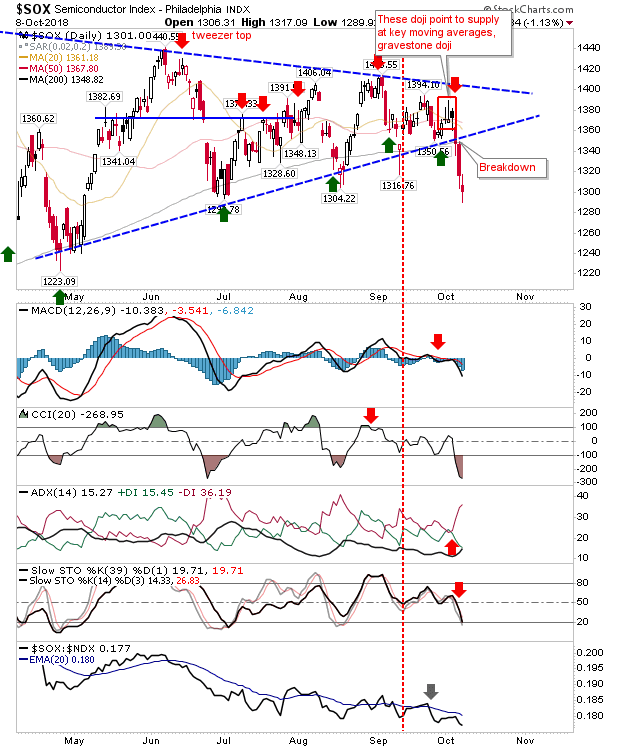

Finally, Semiconductors suffered another day of losses as it falls into a void of support. Relative performance also ticked lower after 3-months of relative calm.

For today, look to indices testing key moving averages (200-day and 50-day MA) to bounce and begin a new rally. Risk is easy to measure so if there is an undercut of these lows don't be afraid to exit the position.