While bulls shrugged off the latest Trump missive there was no reversal in markets to change their prior directions with one exception.

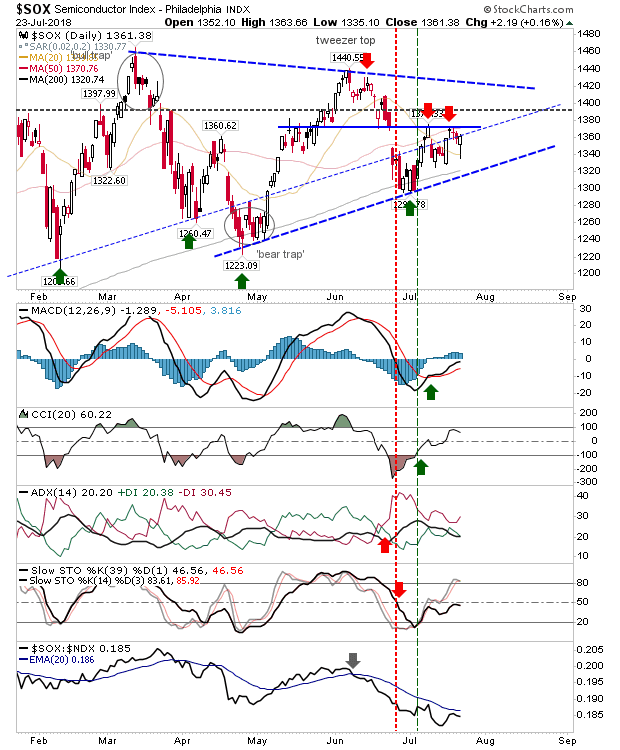

The Philadelphia Semiconductor Index is still clinging on to 1,380 resistance but today's close posted a bullish hammer with a spike low at the 50-day MA. Expectations for tomorrow would be a rally break of the latter resistance and a push to triangle resistance.

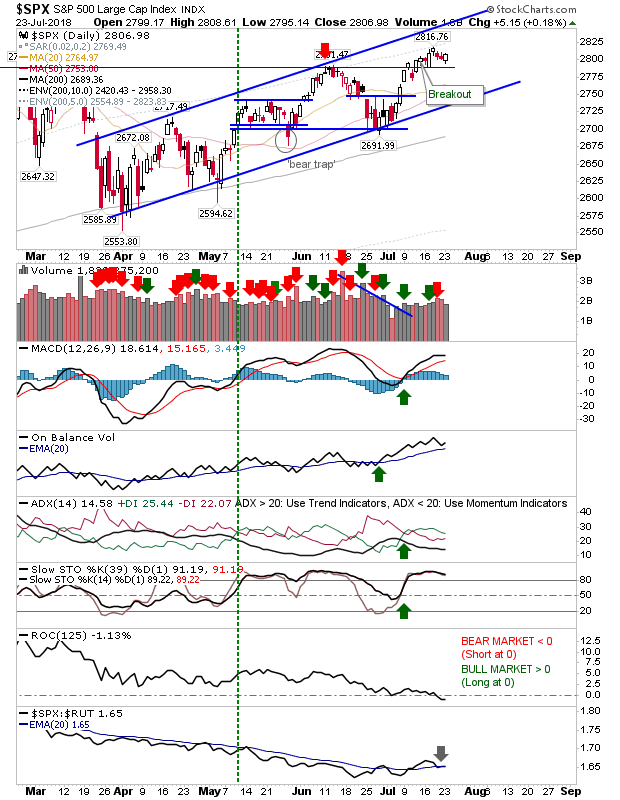

The S&P 500 enjoyed a small bullish engulfing pattern. It's not a reversal pattern as the market is not oversold but it could offer a day-trade bounce; stops go on a loss of 2,795. Upside target is channel resistance.

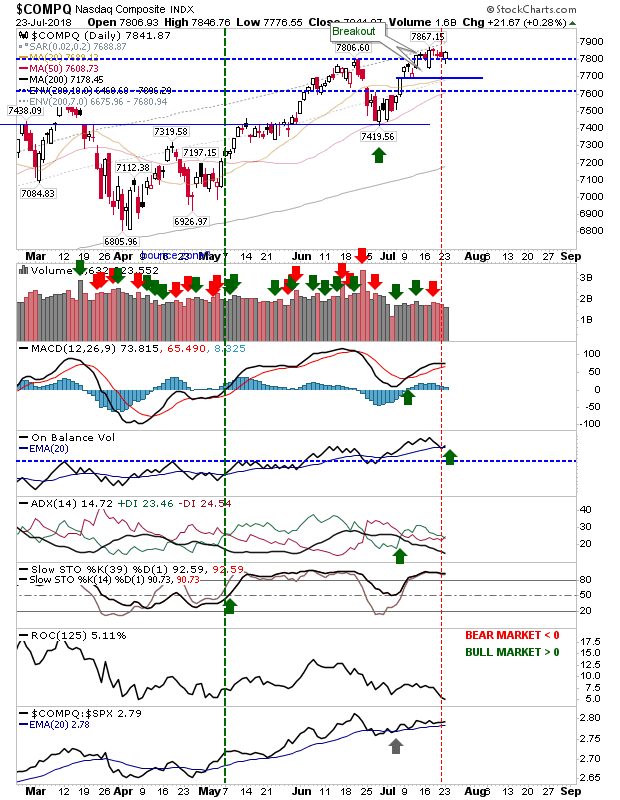

The Nasdaq dug in at support and traders who wanted to buy breakout support had yet another chance today; stops go on a loss off 7,775.

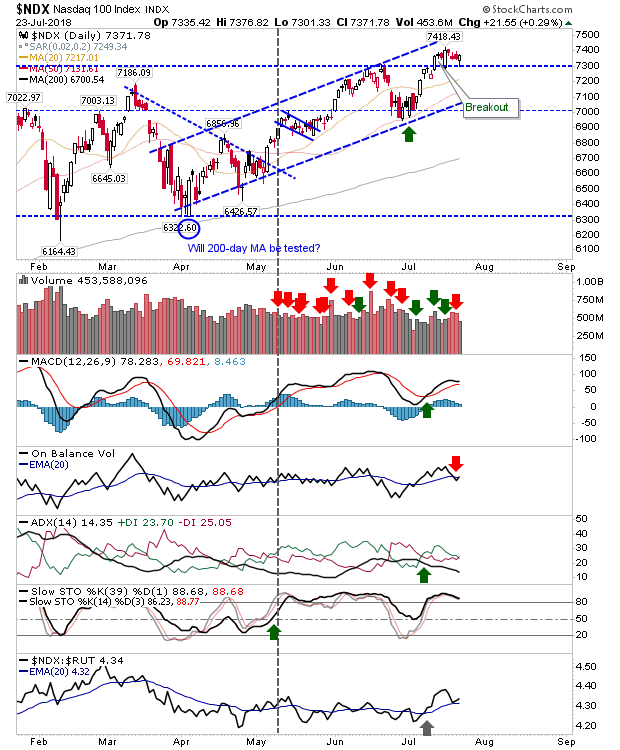

The Nasdaq 100 tagged breakout support with 7,300 the stop level. Technicals are mixed with On-Balance-Volume flipping in what has been a scrappy six months but relative performance is accelerating ahead of speculative Small Caps.

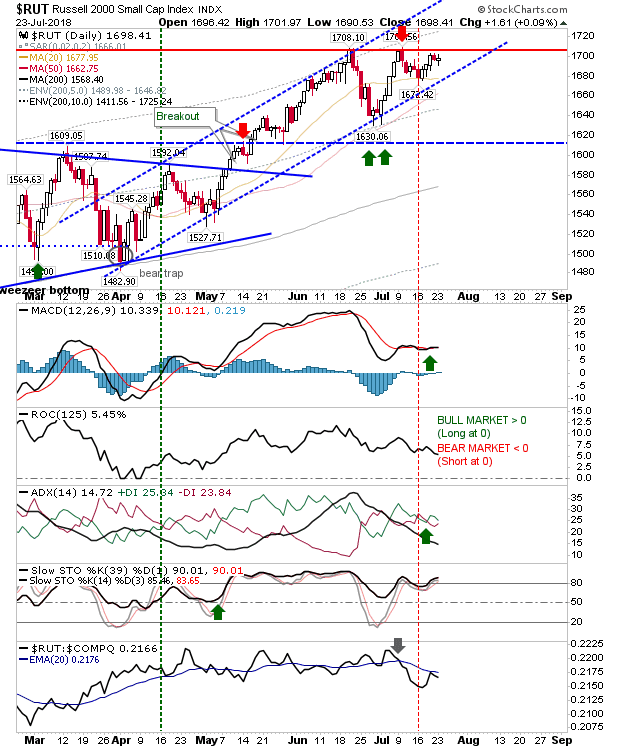

The Russell 2000 still has a double top to negate but with it simmering just below resistance there is a good chance the week could finish with a breakout. Technicals are good with a MACD trigger 'buy', positive +DI and overbought stochastics.

Overall, it looks like markets are ready to move higher in unison; this will negate whatever residual shorting opportunities are in play for the Semiconductor Index and Russell 2000. Today's lows should offer a protective area for a near term long trade.