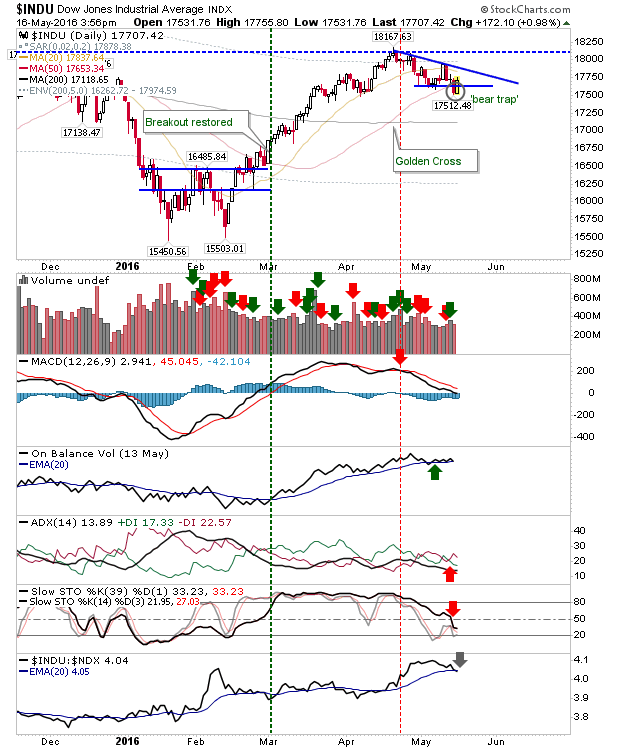

Bulls were able to press their advantage yesterday, with good relative gains. Buyers were able to recover 50-day MAs and take indices back from the brink.

In addition to a close above the 50-day MA, the Dow did enough to generate a 'bear trap' - next up will be to break declining resistance from the high. Technicals edge in favour of bears and overall volume hasn't been great either, but because of such conditions, yesterday's buying was harder to achieve.

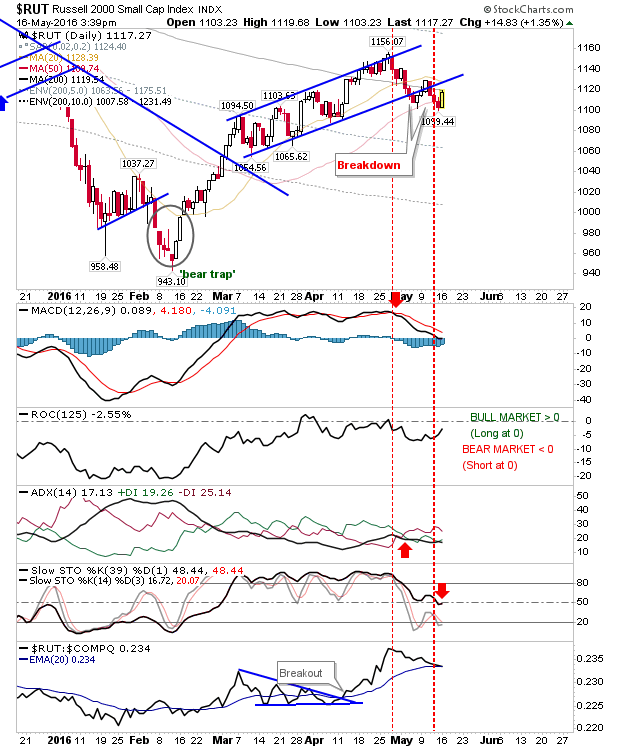

The Russell 2000 also made it back above its 50-day MA, but finished on its 200-day MA which is also below the rising channel. It's a harder sell for bulls, but I do have a short bias on this.

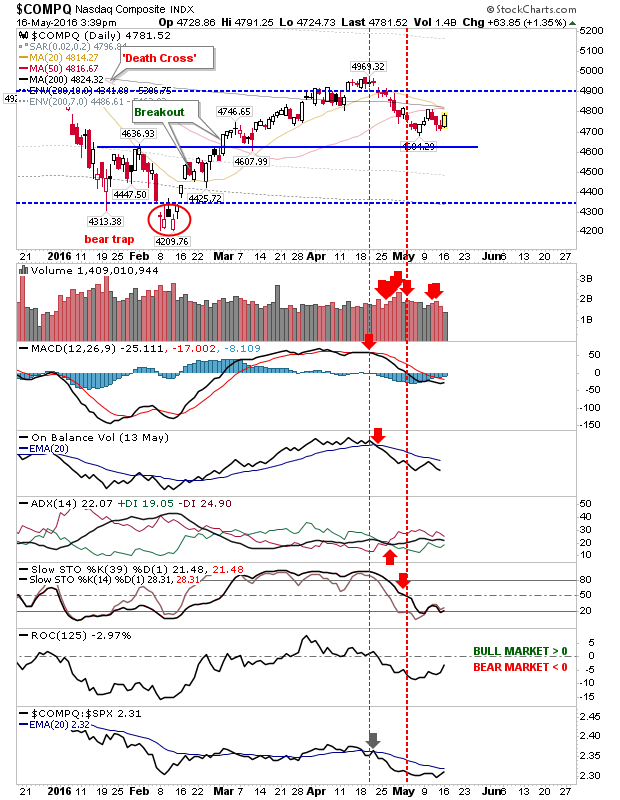

The NASDAQ is another index which will quickly find itself up against converged 20-day, 50-day, and 200-day MAs. Keep an eye on relative performance to the S&P as this may help determine whether Large Caps or Tech are going to do most of the running for the next leg of the rally.

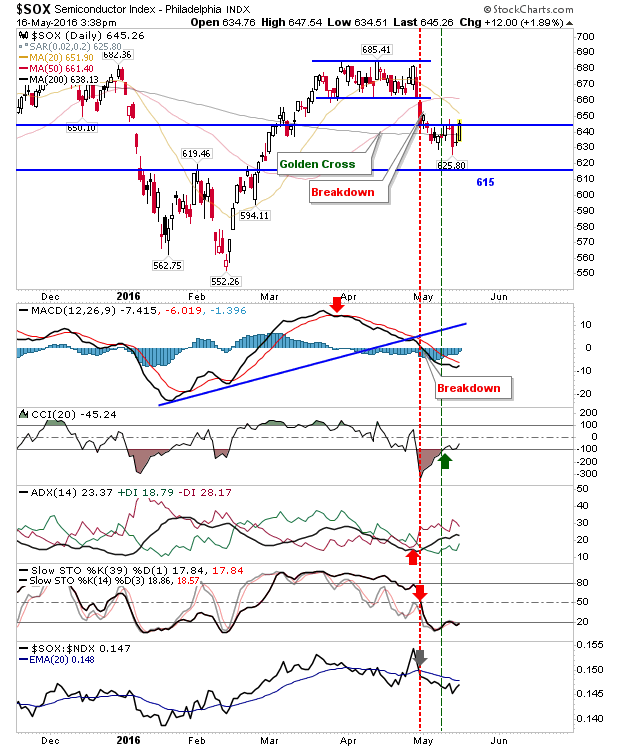

The Semiconductor Index also did well yesterday, to post a near 2% gain as it closed above its 200-day MA. This is looking like a good swing low after last week's big red candlestick undercut of the 200-day MA failed to follow through.

For today, bulls could have enough to generate a rally through the week. Pullbacks to Monday's low (with a stop below the swing low) would offer a reasonable value proposition.