It was a better day for bulls yesterday, as markets registered an accumulation day with respectable gains. However, only one index, the Dow, made a test of resistance (200-MA on hourly) and was initially rebuffed.

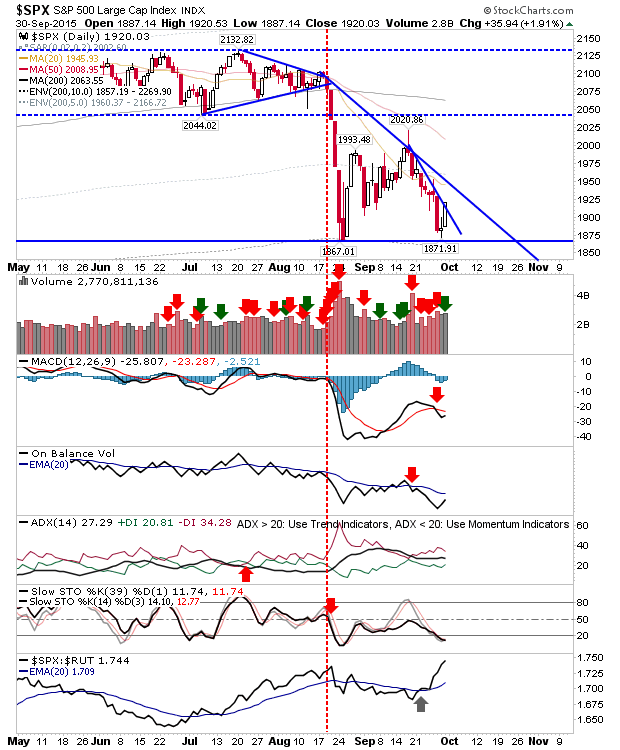

The S&P registered nearly a 2% gain. The 20-day MA looks to be the next area of resistance as yesterday marked a sharp break of declining resistance.

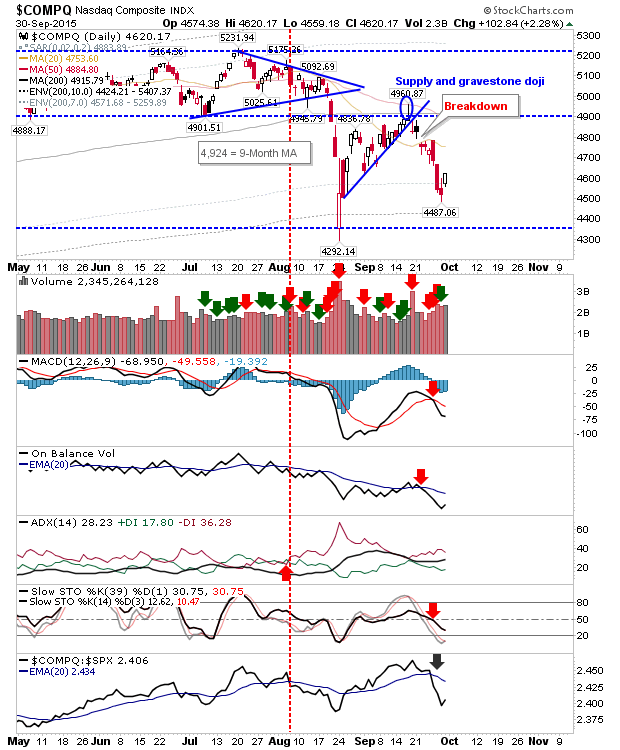

The NASDAQ kicked in a rally without having tested the August low. If this rally can mount a challenge of 4,900 (and break it), it will have the makings of a good Santa rally.

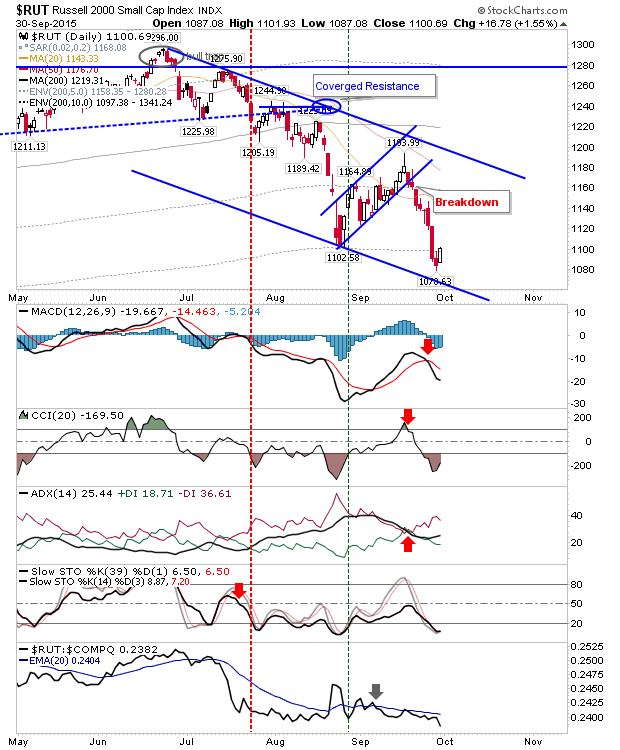

Likewise, the Russell 2000 has kicked a rally just a shade above potential channel support.

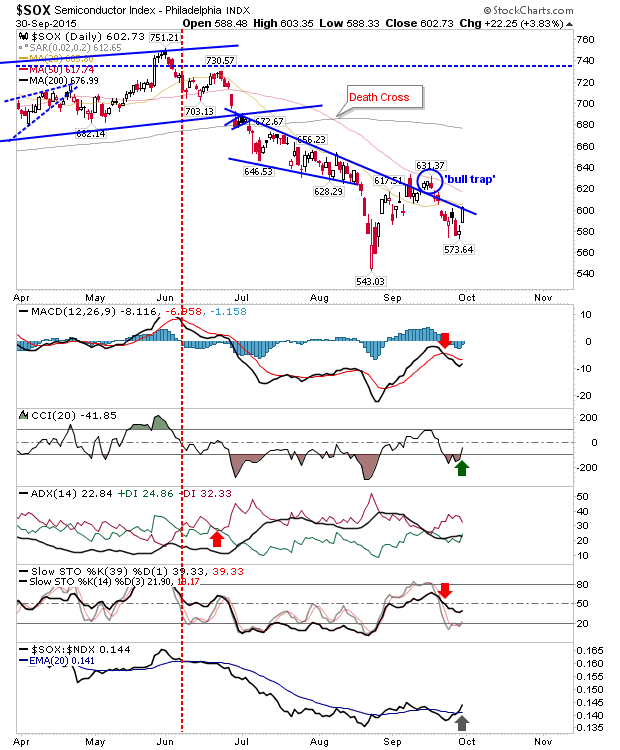

The other index to watch is the Semiconductor Index. It's shaping a good reversal with yesterday's close nestled against declining resistance. The 'bull trap' won't be negated until 631 is broken, but holding above 600 into next week would probably be enough to see a challenge and break of this level.

With ISM data later today, and jobs data on Friday. There are plenty of potential hiccups or boosts to shape action before the weekend. Long term buyers will be looking for value while shorts will be reluctant to attack until a major resistance level is challenged.