Another day, another day of gains. Nothing significant yesterday, but enough to keep rallies and recent breakouts intact. There are few trading opportunities—except to hold on to existing positions.

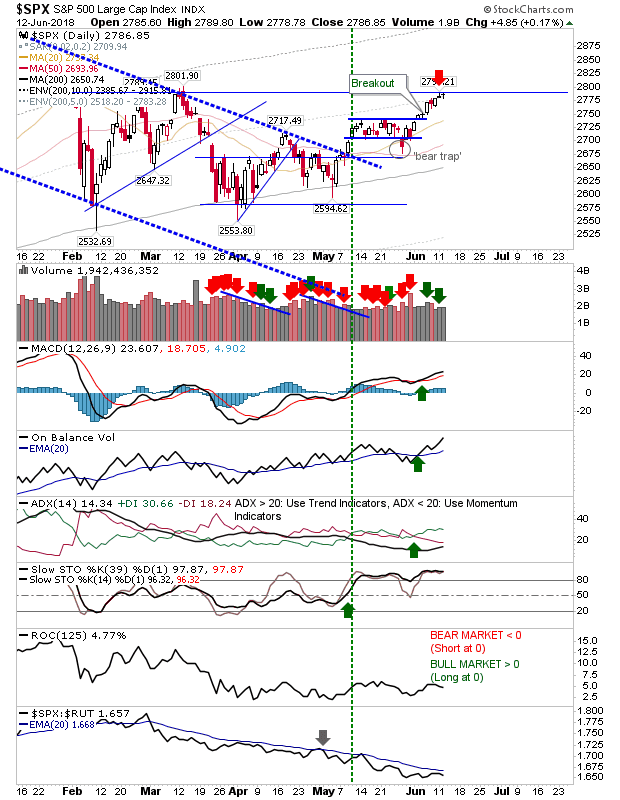

The S&P has a potential shorting opportunity at March swing high resistance but given the breakouts in Tech and Small Caps, I'm not entirely convinced by it. Technicals are net bullish except for relative performance which has been in decline since March.

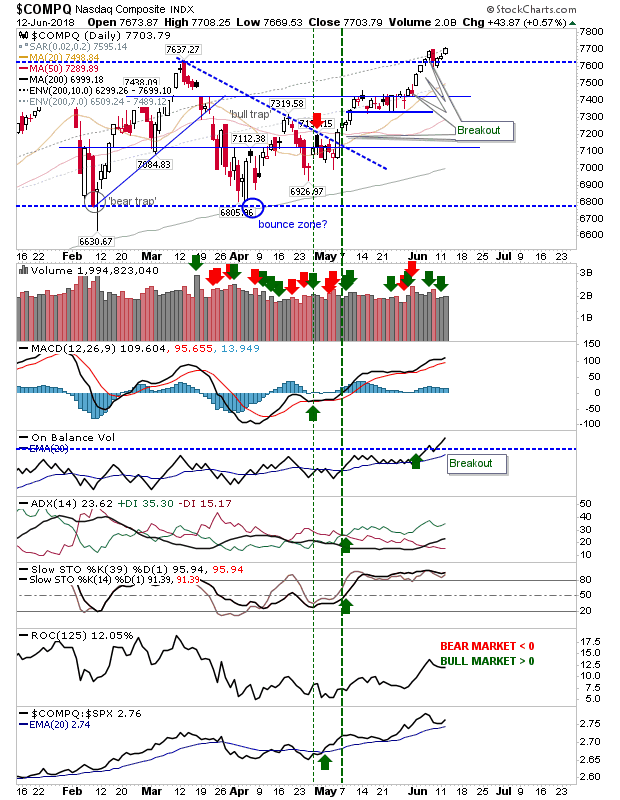

The NASDAQ closed at new highs, negating the June 'bear trap'. Relative performance is good too, which favors a continuation of the rally.

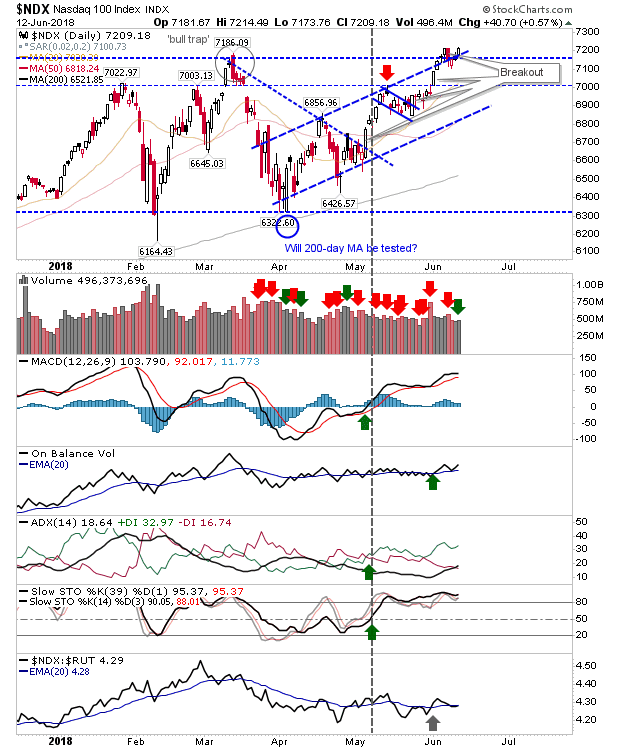

The NASDAQ 100 also returned to its breakout—following the lead of the NASDAQ. Relative performance against the Russell 2000 is also improving.

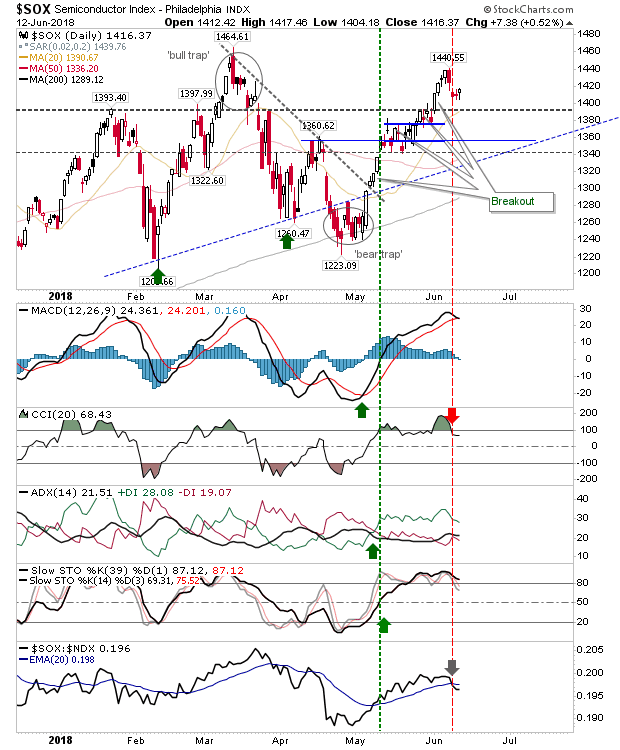

The Semiconductor Index is looking to challenge the March 'bull trap'. It's coming under a bit of pressure with a 'sell' in CCI and a drop in relative performance against the NASDAQ 100. There may be a short play here if it gets closer to 1,440.

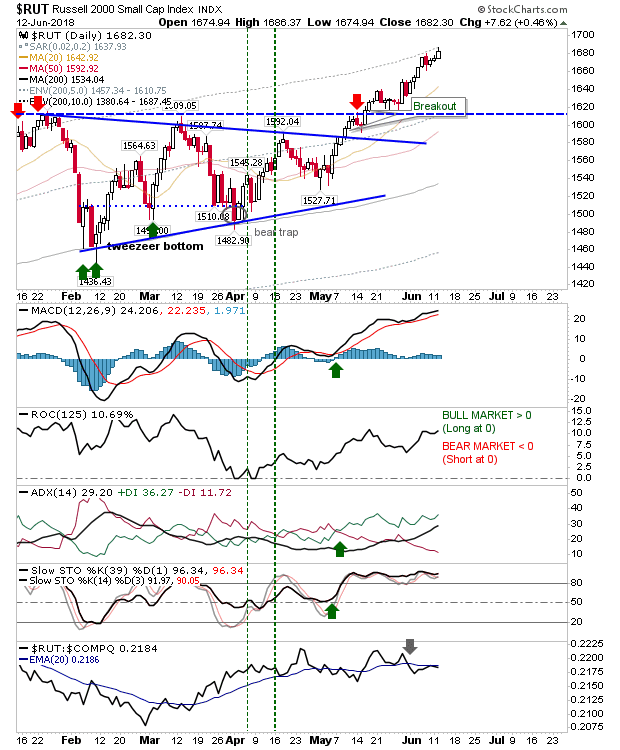

The Russell 2000 is tagging the 10% band above its 200-day MA. While this is not 'profit take' territory it does show the strength of the rally. Unlike Tech averages, Small Caps have started to slowly roll over in the relative performance stakes.

For today, consolidation/hold/do nothing is the preferred play. Shorts could look to attack the S&P and maybe the Semiconductor Index. Those longs who have no position could look to buy the NASDAQ and NASDAQ 100 breakouts but the whipsaw risk is high.