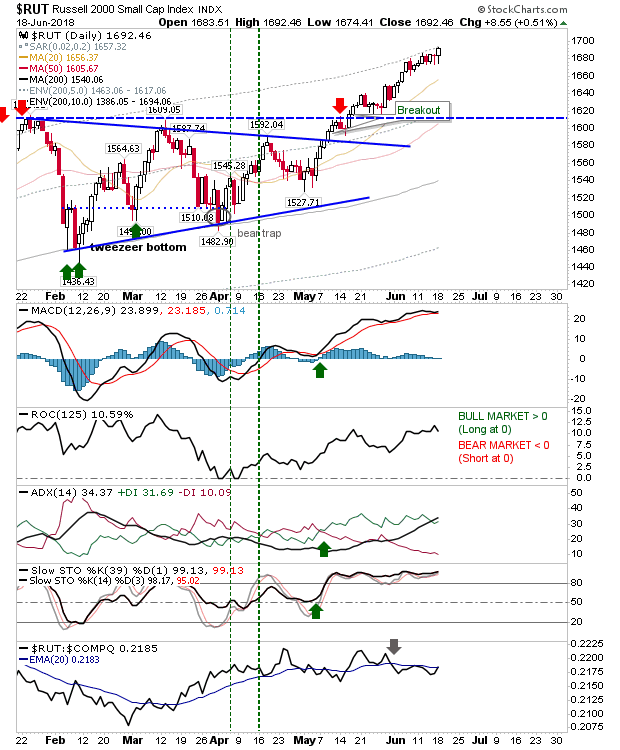

It's looking a little early for some of the nascent pullbacks seen, but buyers are stepping in here to support markets. Much of this looks to be driven by the secular bull market leader, the Russell 2000. It managed a new closing high yesterday as momentum traders continue to benefit from strength in this index.

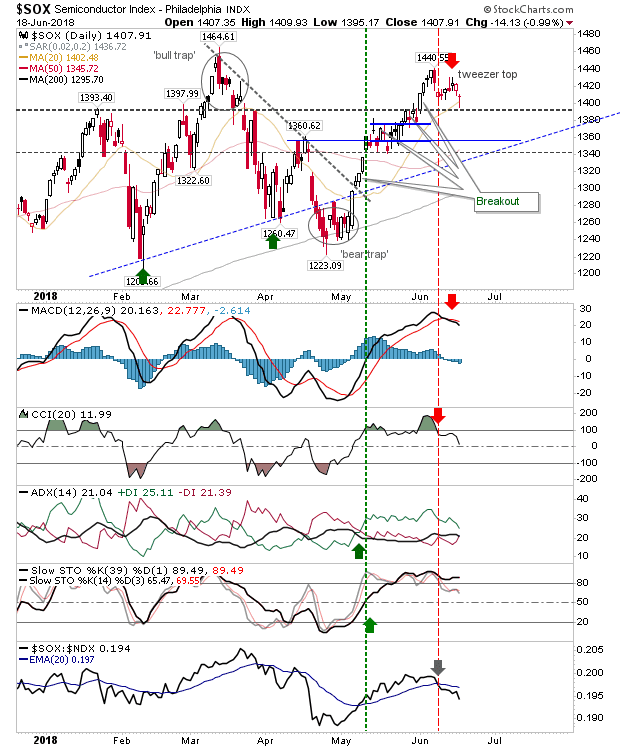

The index in the best position to offer a trade later today is the Semiconductor Index. Yesterday it offered a solid doji just above support. The 'tweezer top' is a concern as this pattern is typically a strong reversal signal so cautious buyers may instead prefer to wait until this is negated - but then the risk:reward becomes much broader. Technicals are a mix of bullish and bearish, although tie-deciding relative performance is on bears' side (vs Tech indices).

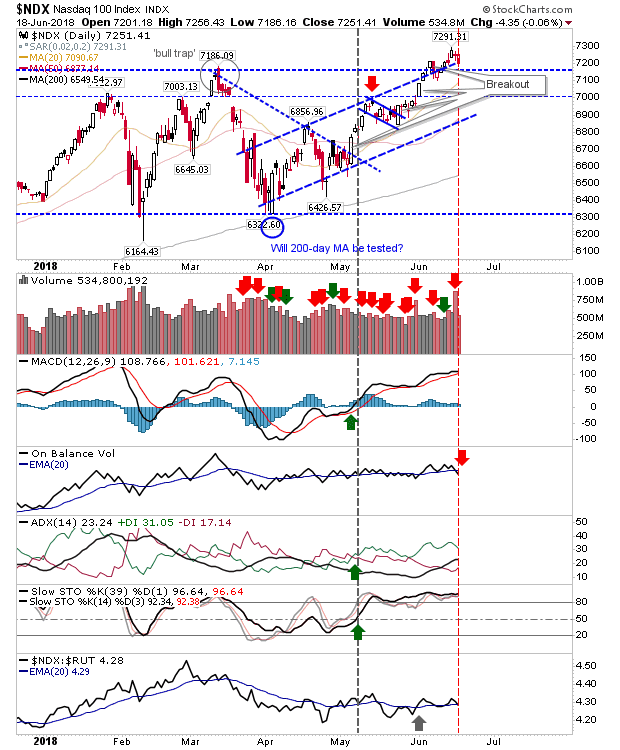

Tech indices have benefited with the NASDAQ 100 offering a breakout opportunity of its own; this a second chance for a bite of the momentum cherry. Technicals are also a little stronger than the Semiconductor Index.

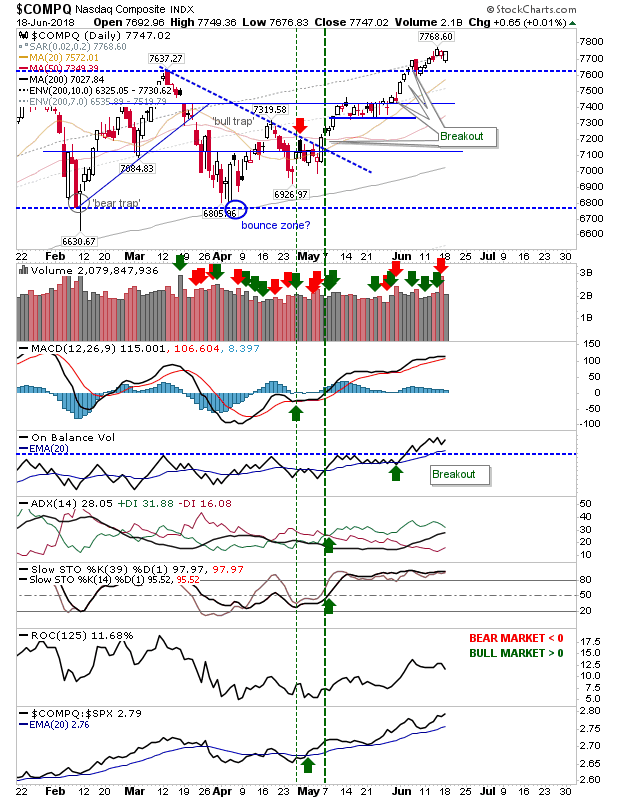

The NASDAQ is a little further along in its push to new highs but it's a momentum play alternative if you don't like the NASDAQ 100.

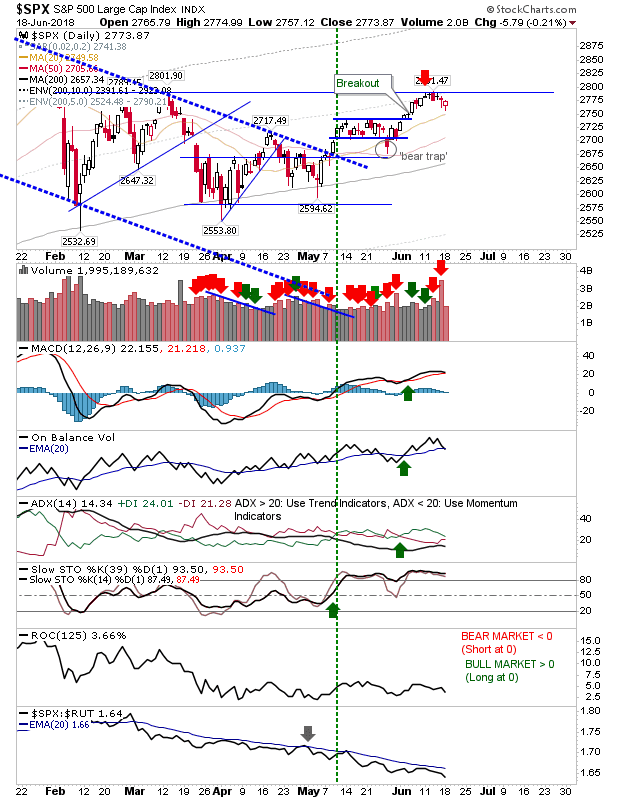

The S&P is also playing for a bounce opportunity with the 20-day MA acting as a support level. It may be not as attractive as other indices but it's a more cautious play. Technicals are okay despite relative underperformance.

For today, there are different grades of long plays: momentum plays in the NASDAQ, and NASDAQ 100, pullback plays in the Semiconductor Index and S&P and a momentum hold for the Russell 2000.