Bears were again unsuccessful in pushing an early advantage with bulls coming to feed late in the day. The gains were modest, but speculative Small Caps had the best of the action.

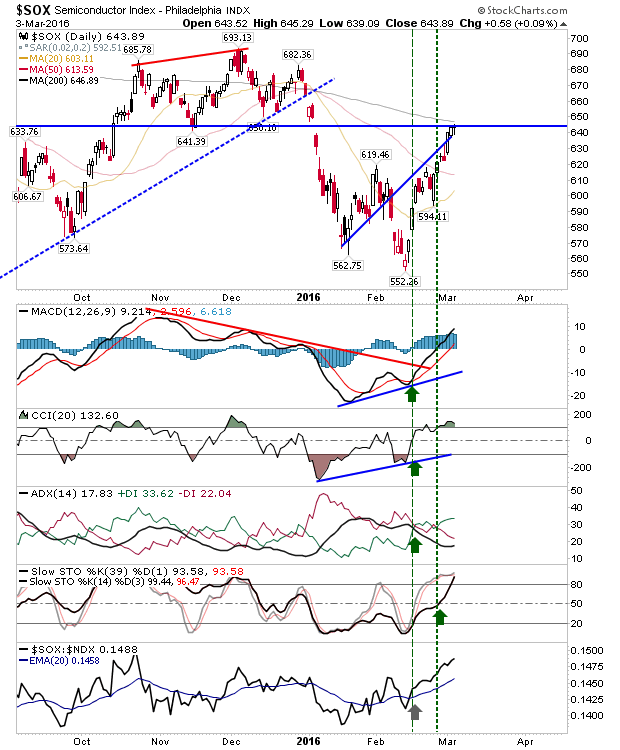

The Semiconductor Index is up against its 200-day MA and finished with a neutral doji. If there is an index ready to push lower it's this one.

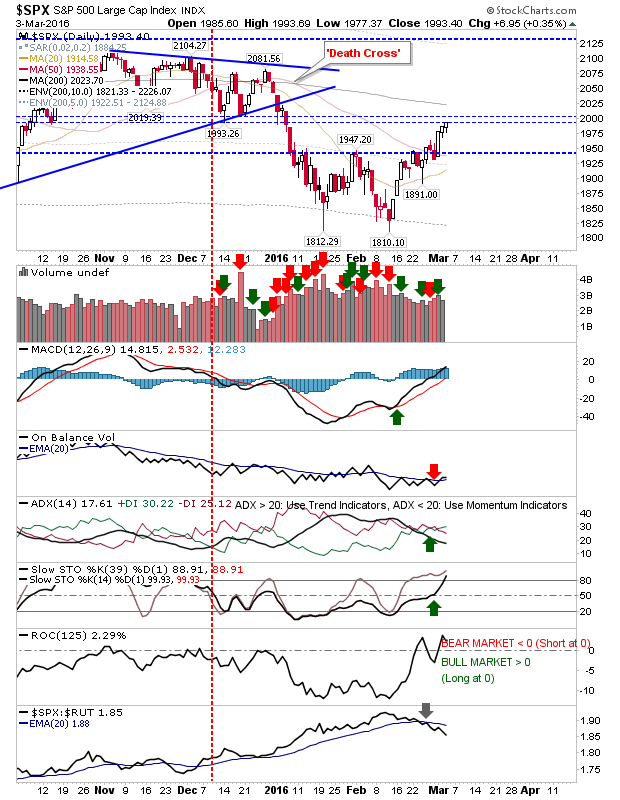

The S&P has reached the lower bar of a thick band of resistance. Things start to get a little tougher with the 200-day MA not far overhead.

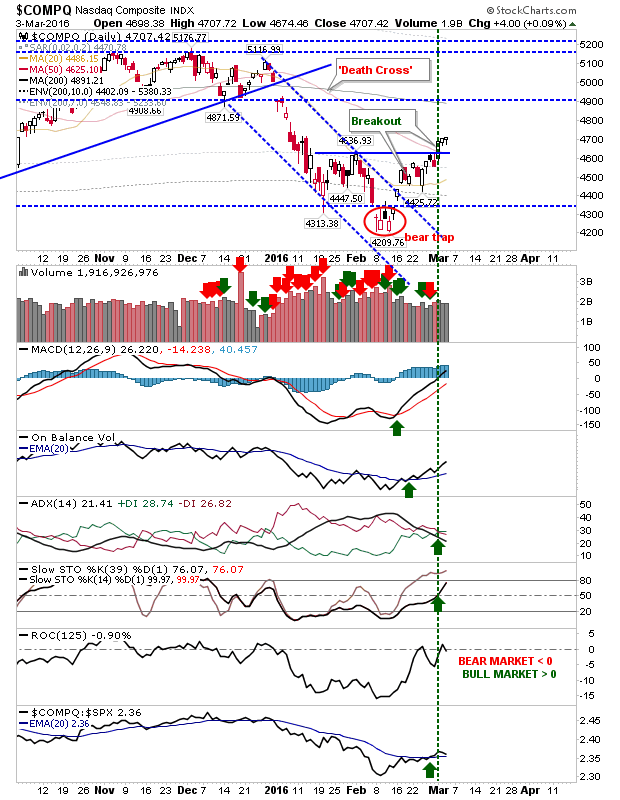

The Nasdaq has cleared its 50-day MA, but now it has quite a bit of room before to run before it encounters next resistance at 4,900 and/or 200-day MA. Bulls may find the most joy here.

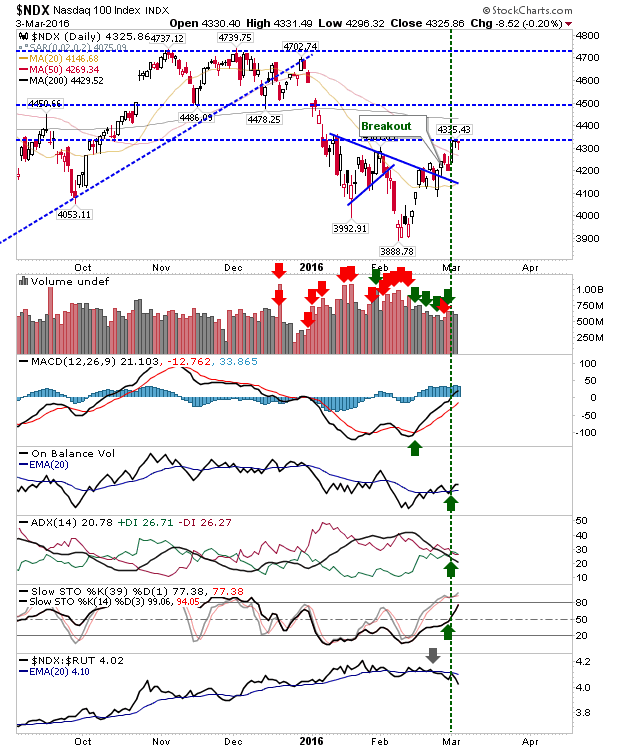

The Nasdaq 100 has less wiggle room before it gets to resistance. The 4,500 and 200-day MA at 4,430 are its next challenge. However, relative performance remains an issue

With only small changes for the day there wasn't too much to consider as markets await the next big move. Bears should focus on the Semiconductor Index, bulls can probably stick with the Nasdaq.