The U.S. stock market indexes gained 1.0-1.5% on Wednesday, following much lower opening of the trading session, as investors' sentiment improved after rebounding off recent local lows. The broad stock market broke above the level of 2,600 again and got closer to 2,650 mark. The S&P 500 index trades 7.9% below January 26 record high of 2,872.87. The Dow Jones Industrial Average gained 1.0%, and the technology Nasdaq Composite gained 1.5%, as big cap tech stocks were relatively stronger than the broad stock market yesterday.

The nearest important level of resistance of the S&P 500 index is now at around 2,650, marked by previous local high. The next resistance level is at 2,660-2,675. There is also a resistance level at 2,695-2,710, marked by March 22 daily gap down of 2,695.68-2,709.79. On the other hand, level of support is at 2,620, marked by Tuesday's daily high. The next important support level is at 2,575-2,600.

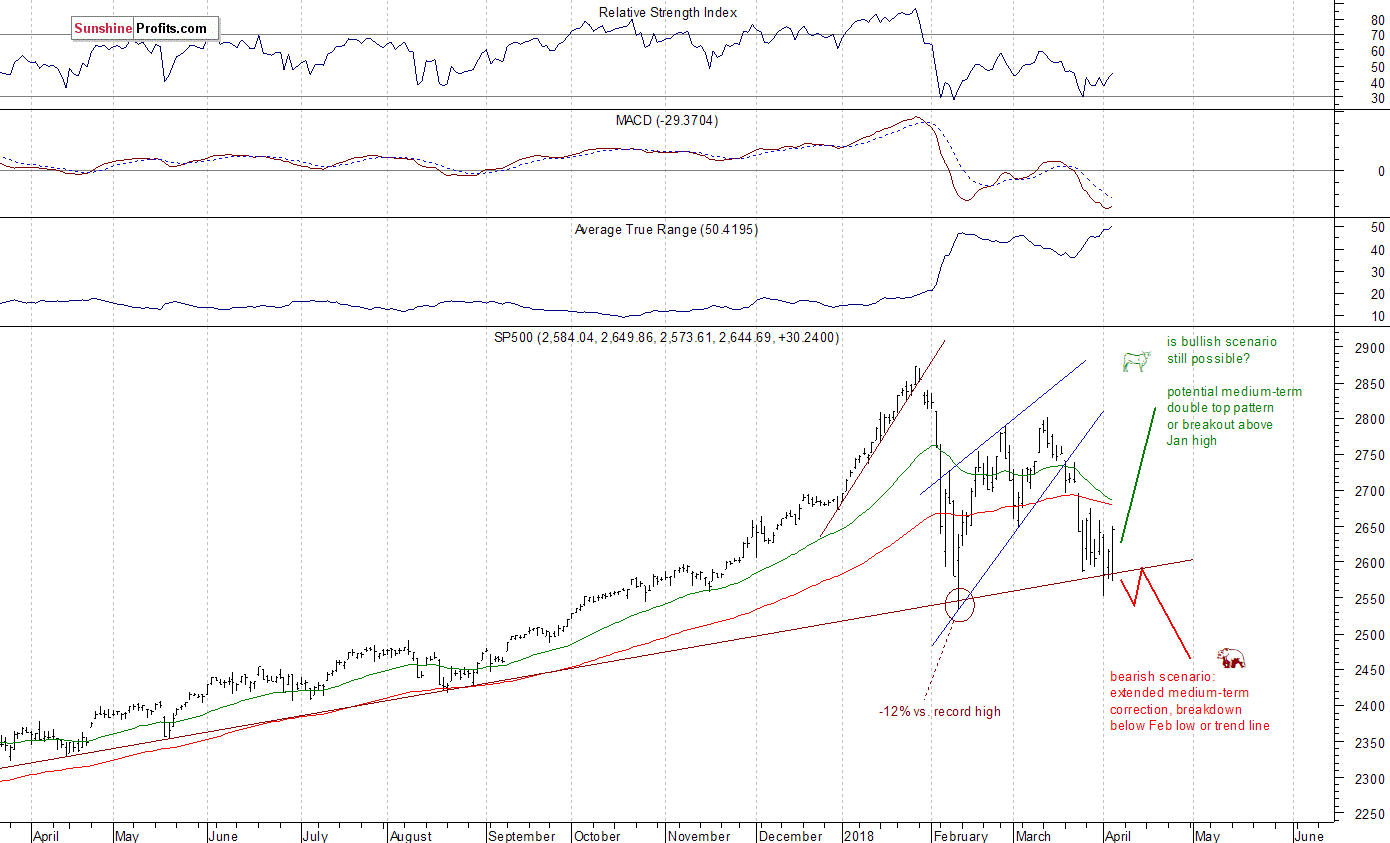

We can see that stocks reversed their medium-term upward course following whole retracement of January euphoria rally. Then the market bounced off its almost year-long medium-term upward trend line, and it retraced more than 61.8% of the sell-off within a few days of trading. The uptrend reversed in the middle of March, and then stocks retraced almost all of their February - March rebound. The most likely scenario right now is still bearish one, leading us to February low or lower after breaking below medium-term upward trend line. The bullish case is a medium-term double top pattern or breakout higher. Previous week's sell-off made the bearish case much more likely, almost a certainty. Last week's Monday's rally gave bulls another chance, but Tuesday's sell-off took it away. Stocks broke below their short-term consolidation on Monday, but they rebounded on Tuesday and they retraced most of their recent losses yesterday. So, is bullish case more likely now? There have been no confirmed positive signals so far. You should take notice of a breakdown below rising wedge pattern. This over month-long trading range was an upward correction following late January - early February sell-off:

Uptrend May Extend

The index futures contracts trade 0.2-0.6% higher vs. their yesterday's closing prices. So, expectations before the opening of today's trading session are positive. The main European stock market indexes have gained 1.3-1.8% so far. Investors will wait for some economic data announcements today: Initial Claims, Trade Balance at 8:30 a.m. The market will probably extend yesterday's move up slightly. Will the index break above its short-term consolidation? Probably not. We may see some uncertainty ahead of tomorrow's monthly jobs data release.

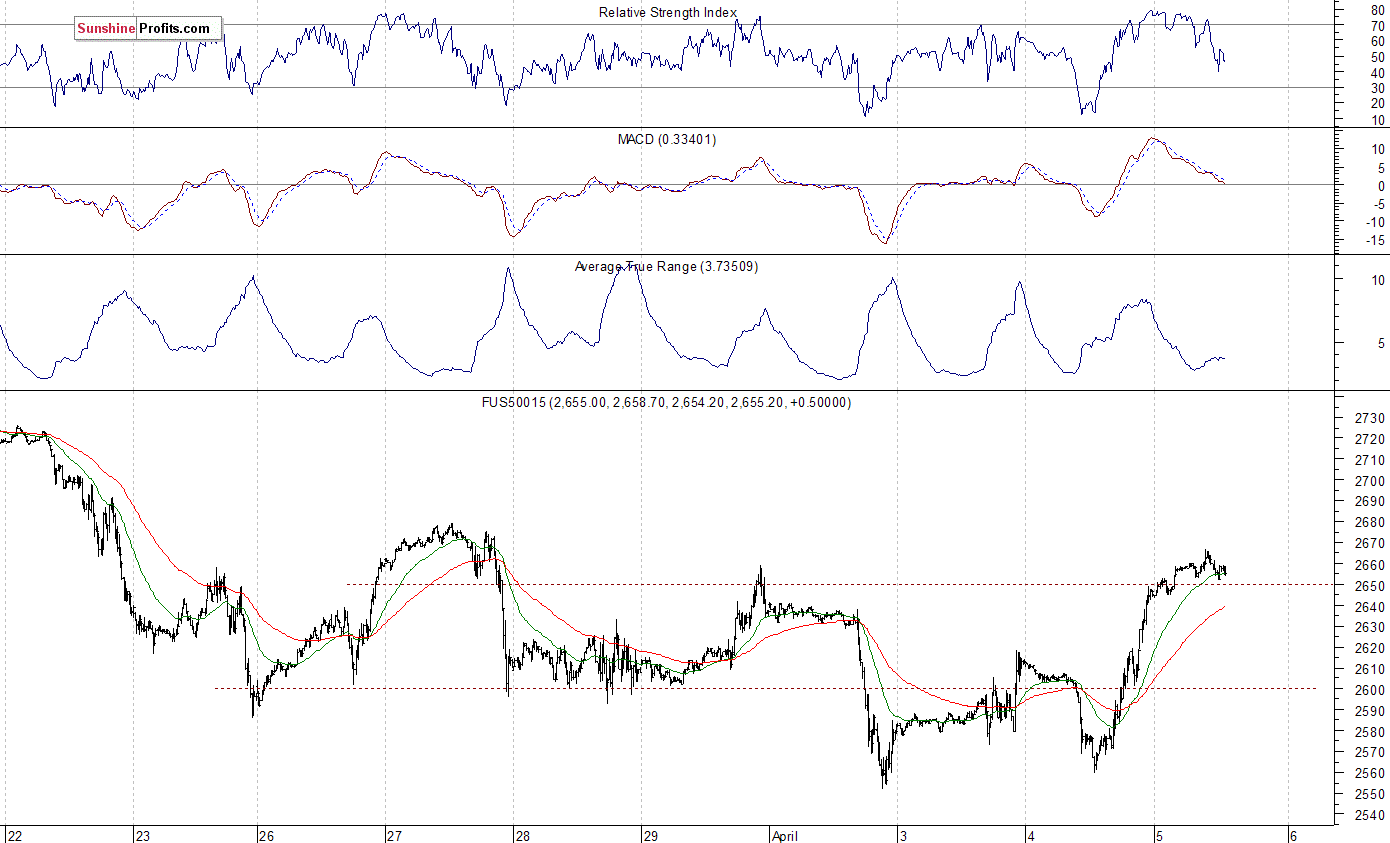

The S&P 500 futures contract trades within an intraday consolidation following yesterday's move up. The nearest important level of support is at around 2,645-2,650, marked by recent fluctuations. The next support level is at 2,620, marked by local high. On the other hand, level of resistance is at 2,665, marked by local high, and the next resistance level is at 2,680, marked by last week's local high. The futures contract continues to trade within a short-term consolidation, following yesterday's bounce off support level, as the 15-minute chart shows:

Nasdaq Rallied Off New Local Low

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation. Big cap tech stocks were relatively stronger than the broad stock market yesterday. The index broke above the level of 6,600, following rebound off 6,300 mark. So, we still see an increased volatility. Was this some final panic selling before more meaningful upward reversal? It is hard to say, but bulls are on the run right now. The Nasdaq futures contract broke sharply above its recent downward trend line, as the 15-minute chart shows:

Did Apple And Amazon Reverse Their Downtrend?

Let's take a look at Apple, Inc. stock Apple (NASDAQ:AAPL) daily chart. The market was bouncing off support level at $165 recently. Is this some bottoming pattern before upward reversal? The market got closer to potential resistance level of $175 yesterday. If it breaks higher, it could retrace more of March sell-off and get close to record high again:

chart courtesy of stockcharts.com

Now let's take a look at Amazon.com, Inc. (NASDAQ:AMZN) daily chart. It was relatively weaker than the broad stock market recently, as it got close to medium-term upward trend line. There were some clear negative technical divergences, along with March 13 bearish engulfing downward reversal pattern. The nearest important support level is at around $1,350, marked by the above-mentioned trend line. On the other hand, resistance level is at $1,500, marked by previous level of support, as we can see on the daily chart:

Dow Jones - Positive Pattern Confirmed

The Dow Jones Industrial Average daily chart shows that blue-chip index was relatively weaker than the broad stock market recently, as it continued to trade well below late February local high. The market broke below its early March local low on March 22, and it continued towards the early February local low. It fell slightly below that level on Monday, as it reached new yearly low of 23,344.52, before bouncing off and closing above 23,600. Daily closing price above previous Friday's closing price was a positive signal. On Tuesday, the blue-chip index formed a positive "Harami" candlestick pattern. We mentioned it yesterday. Then, the market confirmed its reversal pattern despite lower opening of the trading session. However, there is a potential resistance level at around 24,500. Will DJIA break above its short-term consolidation? Bulls have a good chance here:

Concluding, the S&P 500 index will likely extend yesterday's rally a little, but we can see some potential resistance level, marked by recent local highs. Investors will wait for tomorrow's monthly jobs data release, so we may see more short-term volatility.

The early March rally failed to continue following monetary policy tightening, trade war fears, negative political news. What was just profit-taking action, quickly became a meaningful downward reversal. Breakdown below over-month-long rising wedge pattern made medium-term bearish case more likely, and after some quick consolidation, the index accelerated lower, towards its early February low. Just like we wrote in our several Stocks Trading Alerts, the early February sell-off set the negative tone for weeks or months to come.