Yesterday's losses took indices to test March lows before buyers stepped in to bring things back by the close.

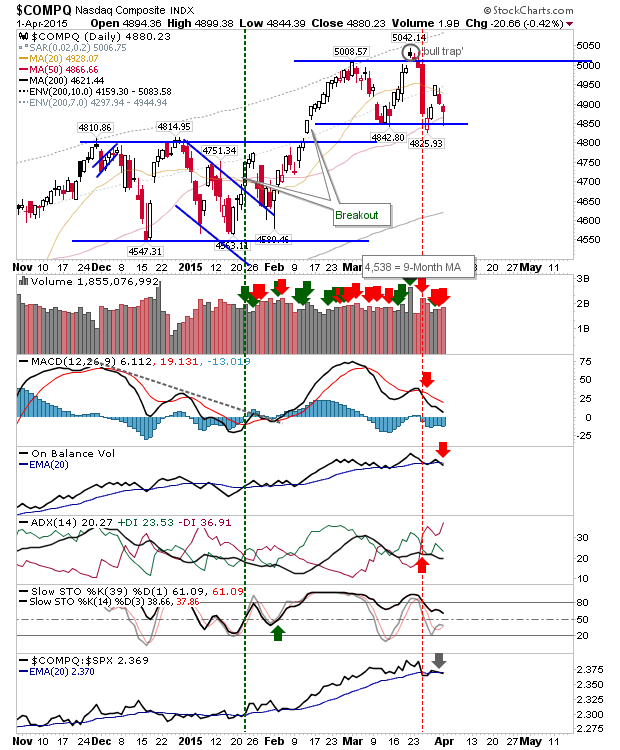

For the NASDAQ, bulls came in at the 50-day MA, although yesterday's action registered as higher volume distribution.

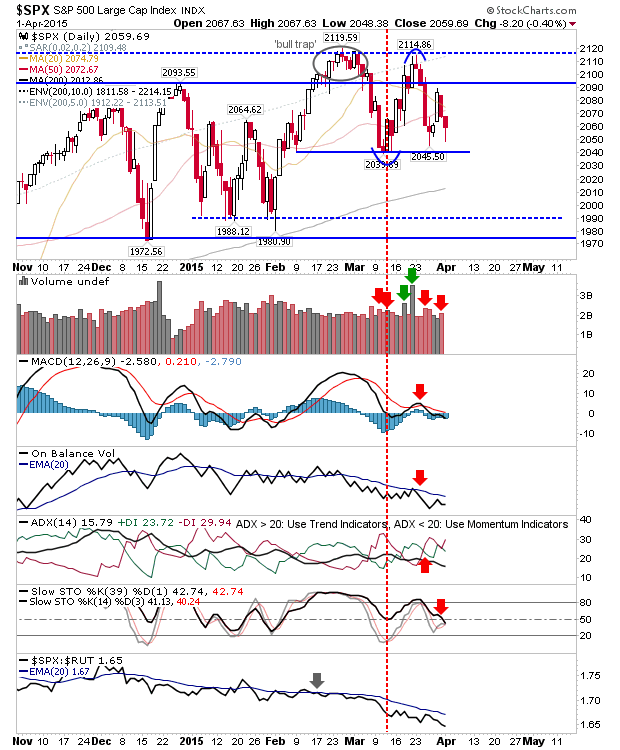

The S&P didn't quite make it to the more significant March low, instead buyers stepped up on the test of last week's swing low. However, technicals returned to net bearishness, with on-balance-volume trending lower across the March double top; whatever late day buying there was, it was outgunned by the selling trend.

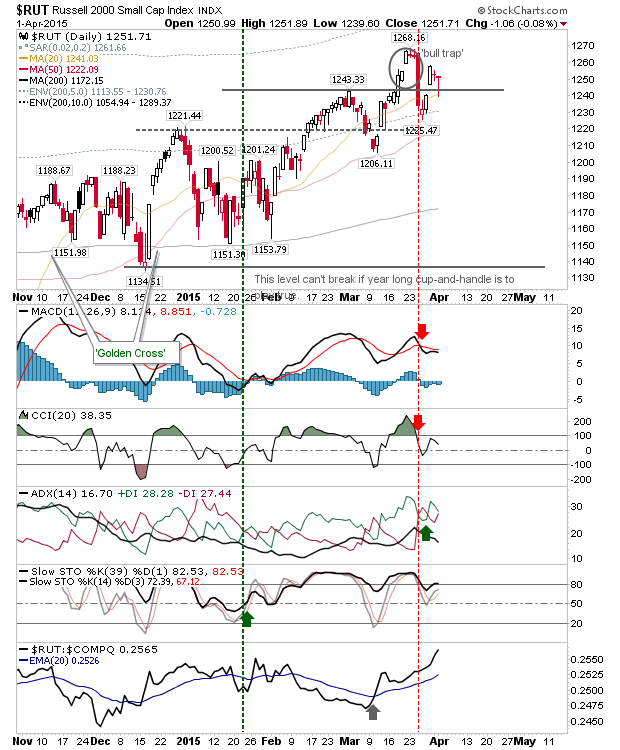

The Russell 2000 had the best of the day's action, finishing with a bullish doji which bounced off the 20-day MA. It also defended support at 1,243.

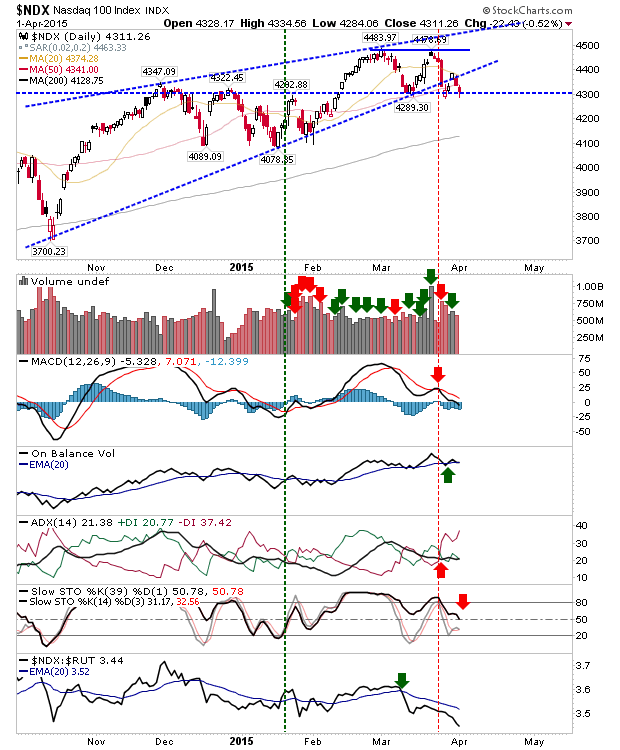

The NASDAQ 100 ranks as a rising wedge breakdown, with it sitting just above a thick band of support around 4,300. A solid day's decline would confirm a break and open up the 200-day MA as a target.

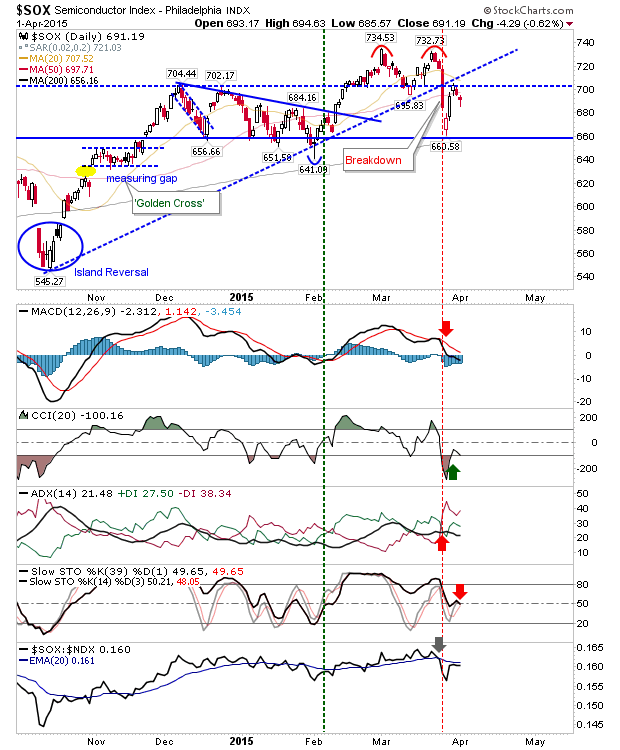

Fueling weakness in the NASDAQ is the bearish breakdown in the Semiconductor Index. It has already confirmed a double top on the loss of the 695 neckline. It too looks destined to test the 200-day MA.

For today, with the shortened week and job data due on Friday, yesterday's weakness may flush itself out. Given the Semiconductor index has already confirmed a double top, it's hard to see other indices not doing likewise.