Yesterday had the kind of action which allows bulls sleep easy: steady buying action from start 'til finish. If there is a concern, it was opening gap downs which greeted some indices.

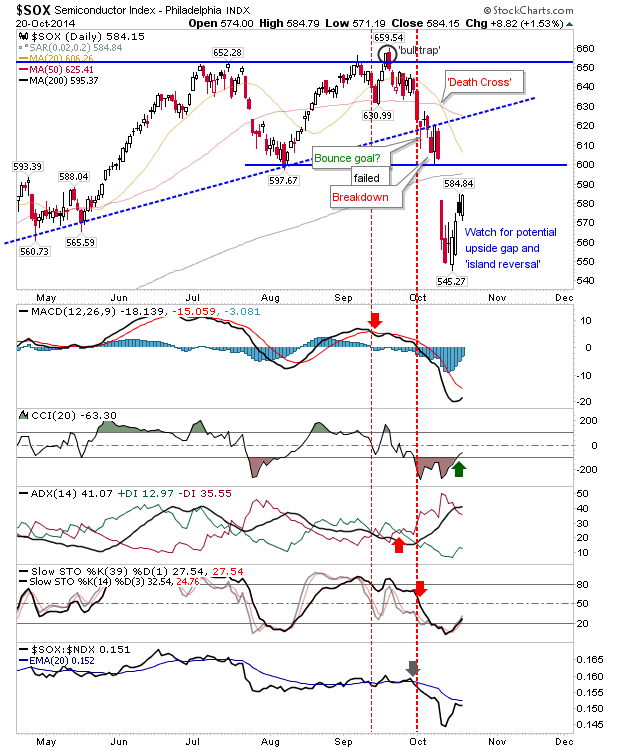

The Semiconductor Index didn't deliver on its island reversal, but it may yet do so later today. Those who bought yesterday's open will be sitting pretty. What may contain bullish enthusiasm is the presence of overhead resistance at the 200-day and/or 20-day MA, but I still like this for an opening upside gap.

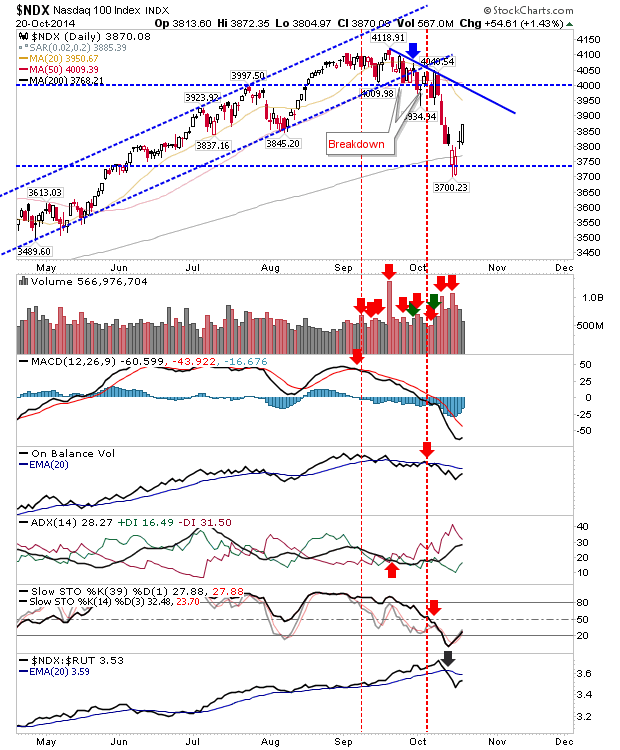

Of the tech averages the Nasdaq 100 is best placed. It successfully defended its 200-day MA, and has room to run to its 20-day MA. Technicals are with the bears and it will take a few days to reverse this, but near term momentum is with bulls. Shorts should wait for a test of 20-day MA before getting aggressive.

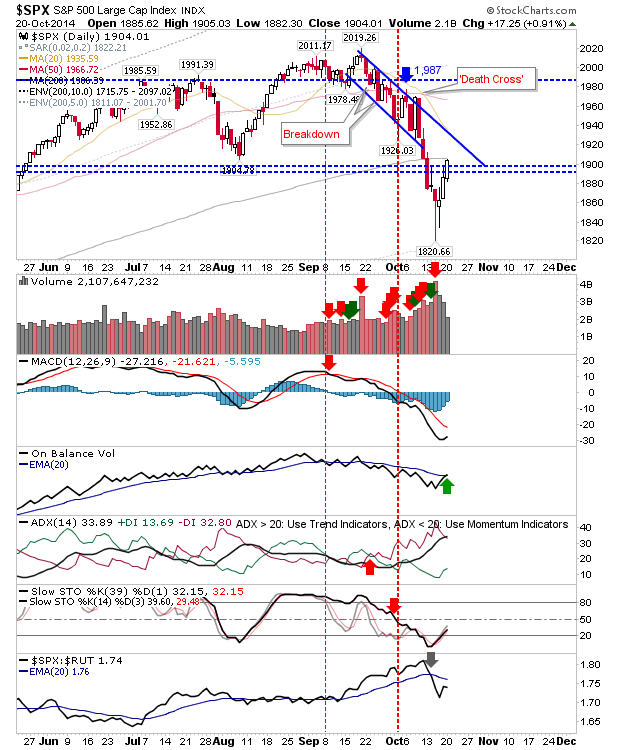

What may give bears something to play with today is the finish of the S&P 500 at the 200-day MA. The high volume undercut of this key moving average will not be so easily regained. If bulls can't push an advance in the first hour of trading it may give bears a downside opportunity, and may open a larger short play as part of a 1,820 retest.

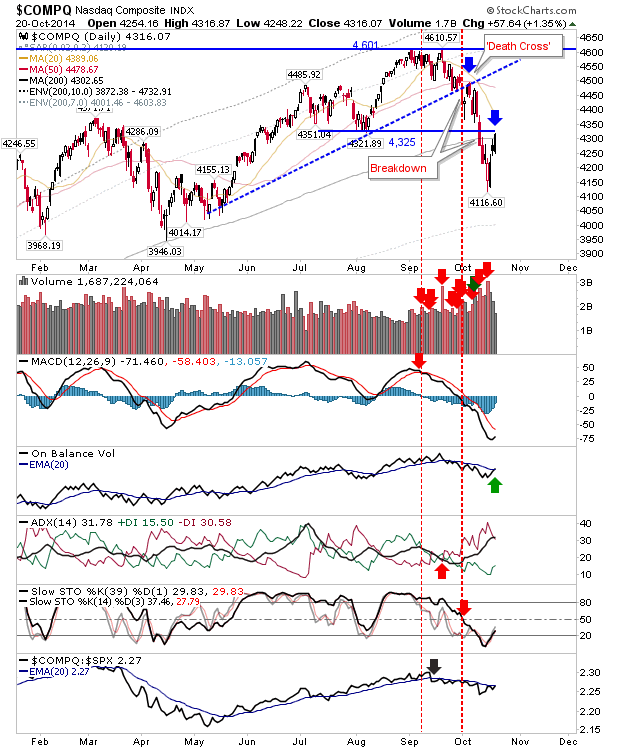

The Nasdaq only edged a close over the 200-day MA, and it may struggle as it tests 4,325 support-turned-resistance.

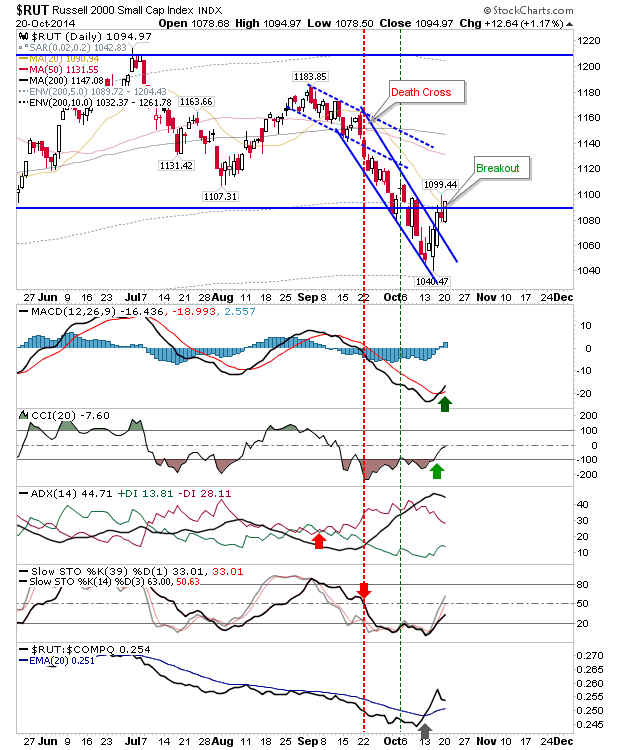

Finally, the Russell 2000 confirmed the channel breakout, and closed day above its 20-day MA. Both CCI and MACD are on the bulls side too. An intraday retest of the 20-day MA may give some value in a move towards the 50-day MA.

For today, bulls should keep an eye on the Semiconductor index: a morning upside gap would be very bullish. Shorts can look to the S&P and its 200-day MA: if there is a weak open it will likely present itself here first.