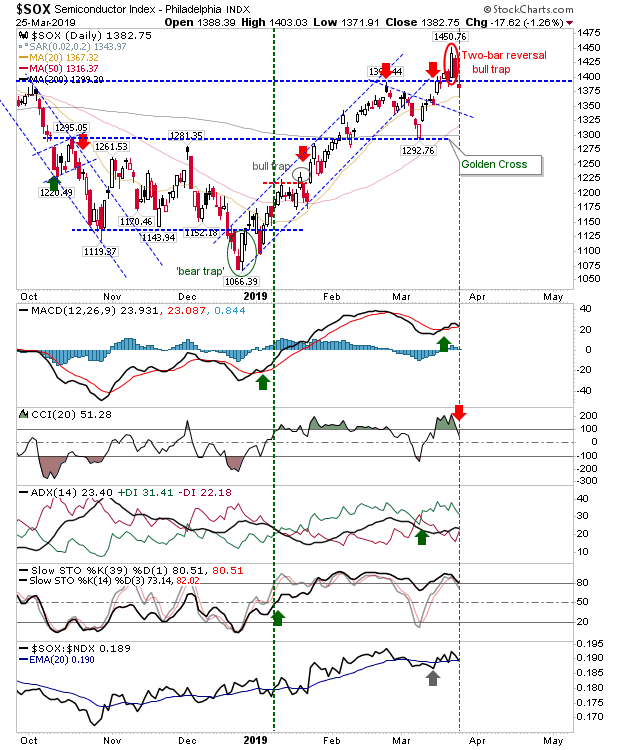

Semiconductors confirmed a 'bull trap' yesterday, as it failed to reverse Friday's losses. The index hasn't yet managed an initial test of 20-day MA support but technicals have started to turn bearish with the CCI 'sell' trigger. The MACD looks likely to switch to a 'sell' trigger in the next couple of days.

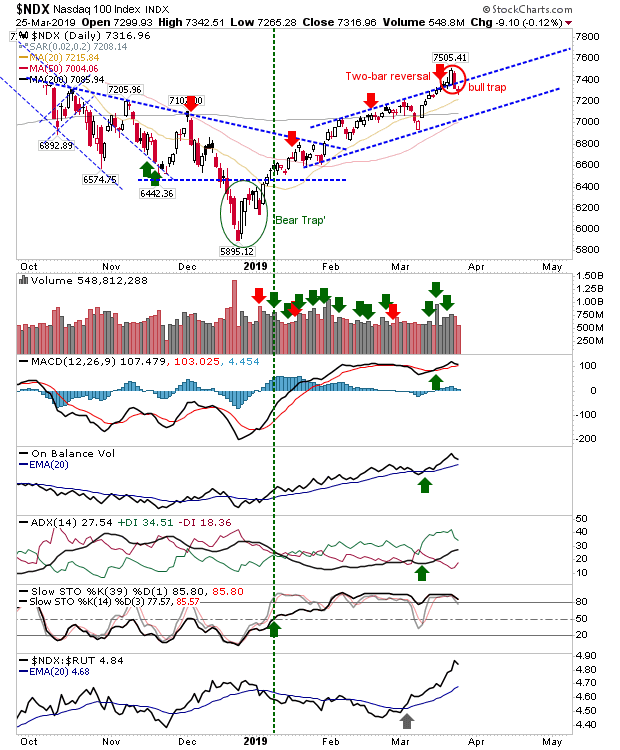

The NASDAQ 100 also posted a 'bull trap' as it dropped back inside it's rising channel on Friday. The next target is 20-day MA, but more likely is a push back to channel support.

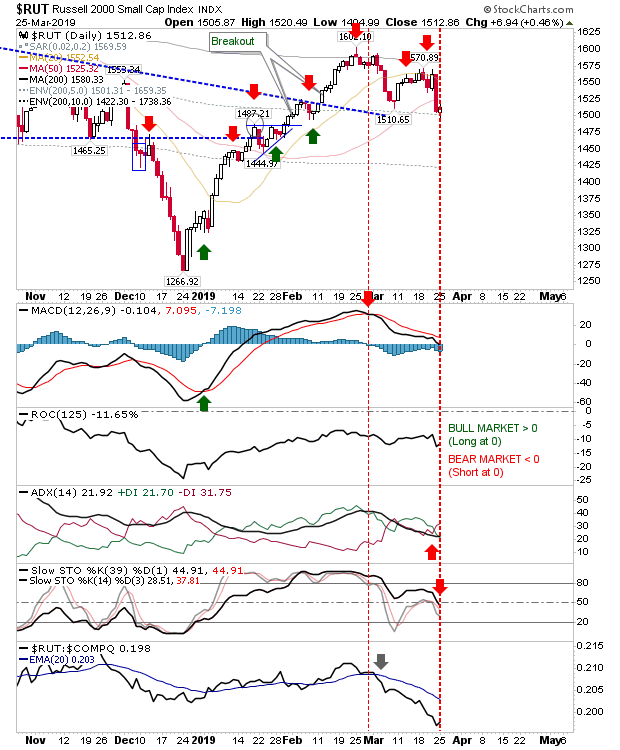

There was a modest improvement in the Russell 2000, although the recovery was initiated below the 50-day MA. Despite the small recovery, technicals turned net bearish as relative (under-)performance against indices peers widened.

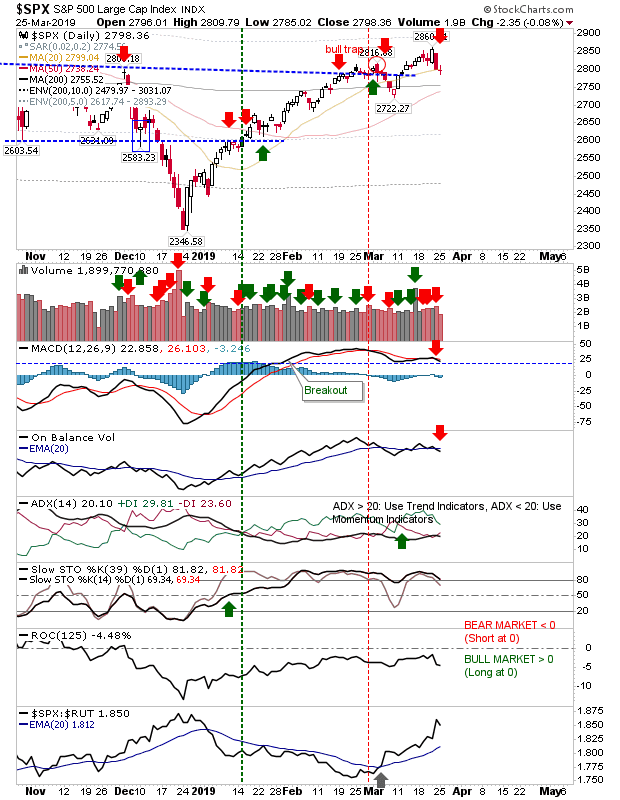

The S&P finished with a neutral doji on its 20-day MA. Volume was well down on Friday's so this was a quiet day for the index with no edge offered to either side.

For today, Tuesday, it will be a question as to whether the 'bull traps' in the NASDAQ 100 and Semiconductor will start to expand out. Should we start to see a broadening of the weakness in Tech indices it will only increase the pressure on whatever recovery the Russell 2000 tried yesterday. Eventually, this weakness will spread to Large Cap indices, but we are not there yet.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI