- 10-year futures show a key bearish reversal.

- USD/JPY prints back-to-back hammers on the daily chart.

- Risk appetite returns after tariff threat shock.

- Key support building beneath 145.

An epic reversal in US bond yields and stabilization in riskier asset classes delivered two powerful bullish signals for USD/JPY traders on Monday, seeing the pair jackknife higher in the North American session. While market volatility remains elevated, the price action over recent days points to the potential for an extension of the bullish move into Tuesday’s session.

From a fundamental perspective, news that US Treasury Secretary Scott Bessent has been appointed to lead trade negotiations with Japan, focusing on tariffs, non-tariff barriers, currency, and subsidies, may also boost risk appetite, which generally promotes USD/JPY upside. It suggests Donald Trump may still be willing to negotiate down tariffs he announced late last week.

Brutal Bond Reversal

As covered in our USD/JPY outlook note released over the weekend, economic data and central bank speeches are likely to be a distant secondary consideration for traders in market conditions such as these, superseded by price signals in major asset classes such as bonds and equities.

Source: TradingView

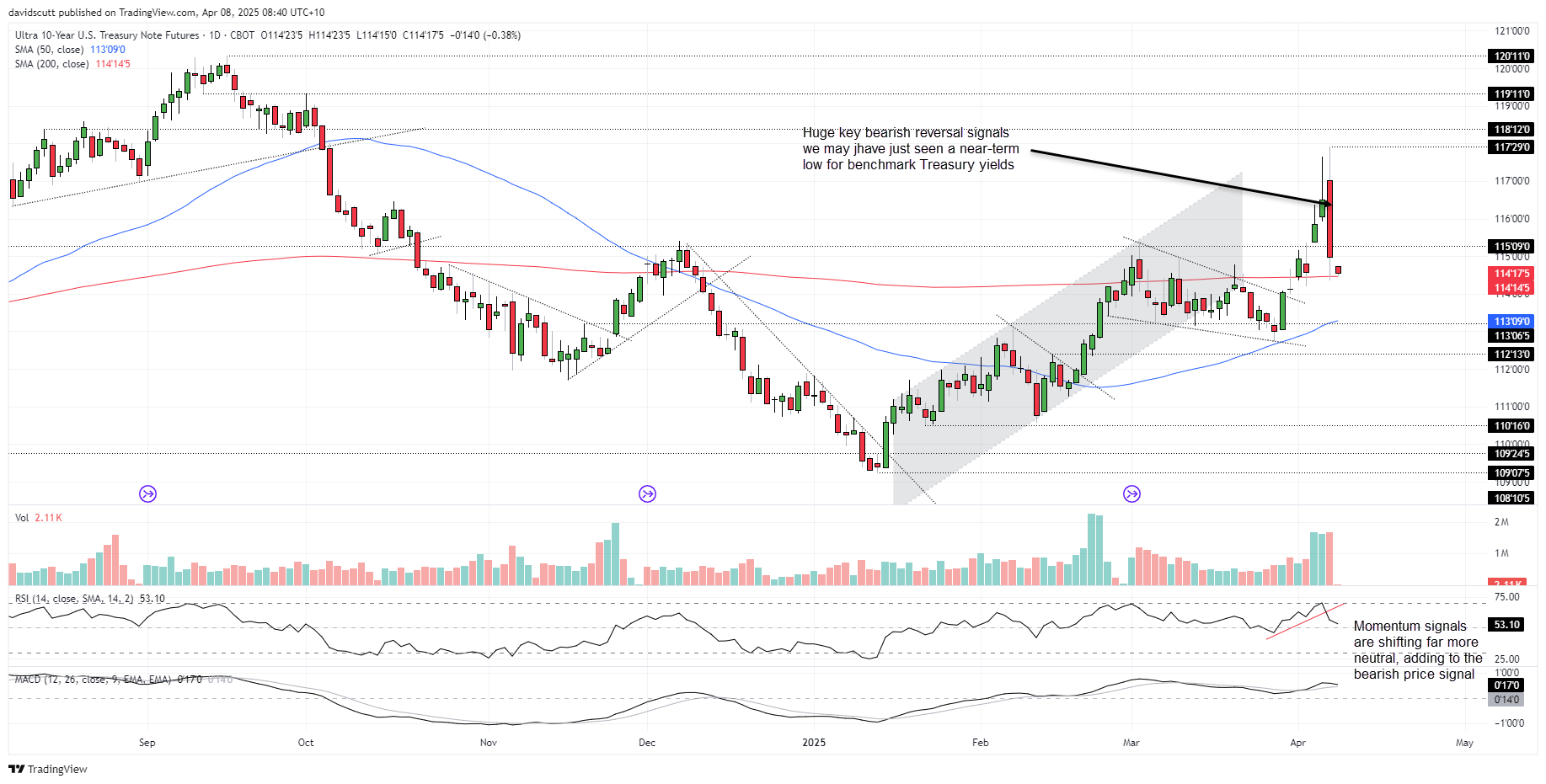

For a pair well known for its strong relationship with U.S. interest rates, USD/JPY traders were provided a strong signal from US 10-year Treasury note futures on Monday, with an enormous decline seen during the session, delivering a key bearish reversal candle that suggests we may have seen the lows for US Treasury yields near-term.

That’s important considering higher U.S. Treasury yields usually mean upside risks for USD/JPY.

Momentum indicators are also in the process of turning less bullish, with RSI (14) breaking its uptrend while MACD is starting to curl towards the signal line, hinting we could be in the early stages of an elongated reversal. The increasingly neutral momentum puts more emphasis on price action in the near term.

USD/JPY Bounces Again Below 145

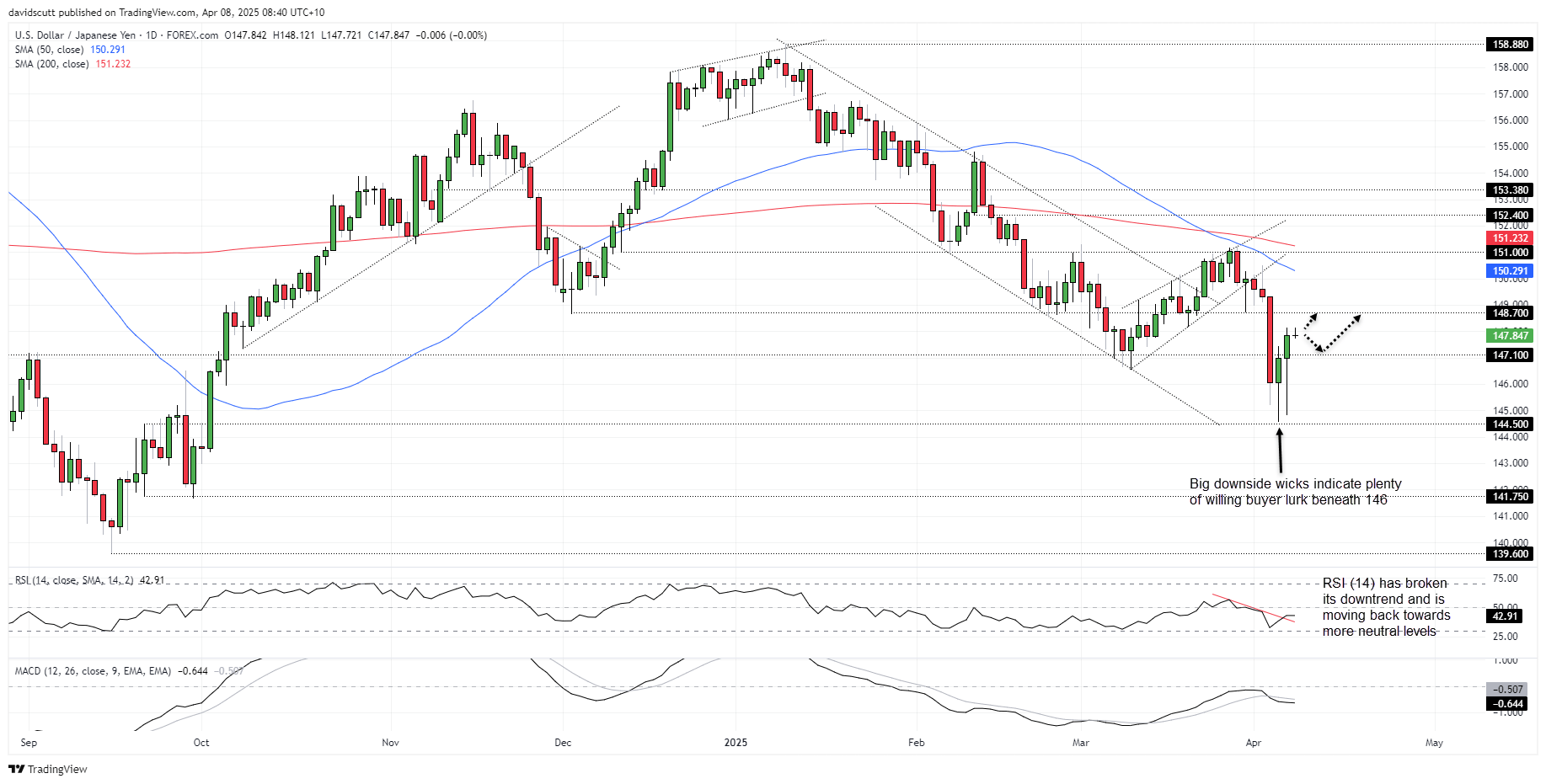

Just as price signals for U.S. benchmark Treasuries turn bearish, the opposite has been seen for USD/JPY. Just look at the size of the downside wicks on the daily candles over the past three sessions beneath 146.00, including two consecutive hammer candles that point to building upside risks.

Source: TradingView

The momentum picture is also showing signs of shifting from bearish to bullish, with RSI (14) breaking its downtrend and moving back towards neutral levels. MACD is yet to be confirmed, but it’s starting to curl higher as well. There’s no definitive signal right now, ensuring traders should adopt a neutral bias.

After breaking and closing above 147.10, the next topside target for bulls will be 148.70, a level the price has done substantial work either side of over recent months. Beyond, the 50 and 200-day moving averages beckon, although it would likely take a substantially bullish shift in the macro backdrop to deliver such an outcome.

On the downside, 147.10 may now revert to support, as was the case for periods in March. If that were to give way, dips beneath 145 down to 144.50 were bought aggressively over the past two sessions.