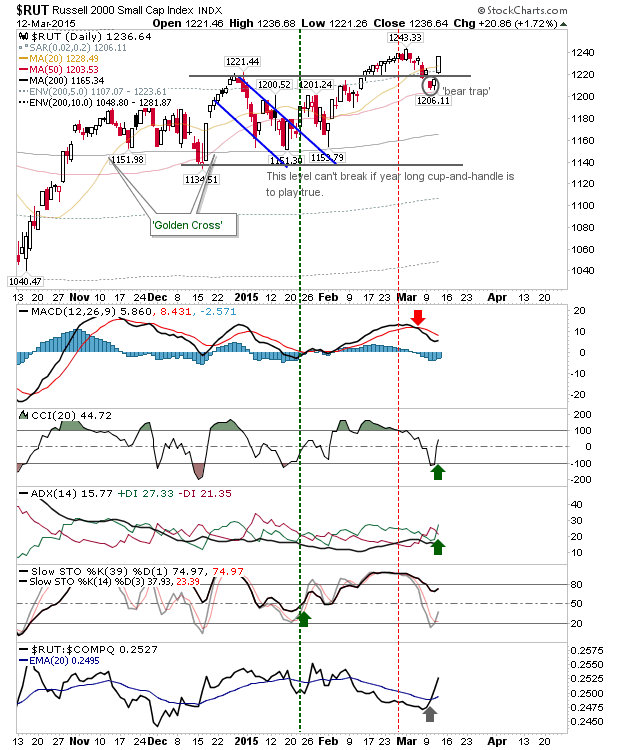

What was on offer for bulls on Wednesday, was delivered yesterday with the 'bear trap' in the Russell 2000. The bounce also occurred off the 50-day MA; an additional confirmation for a swing low. This is good news for bulls looking for a continuation of the broader rally, as it marks cyclical strength.

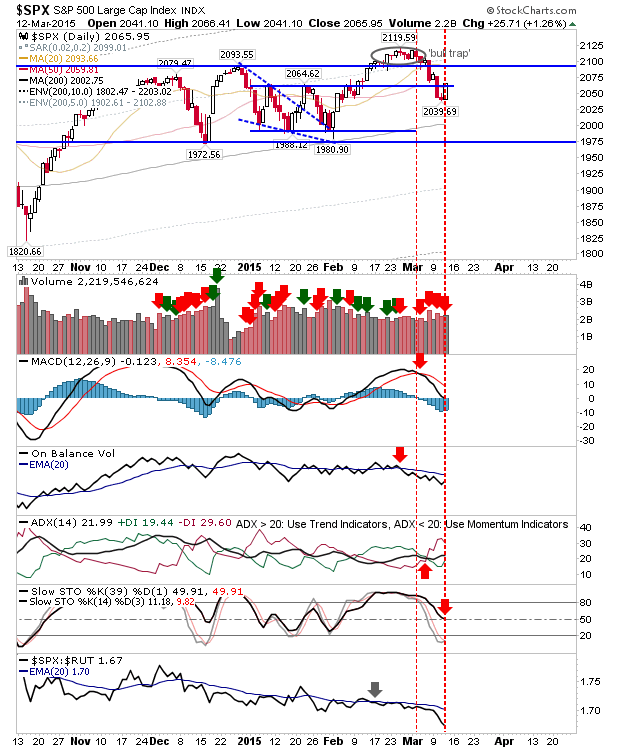

A similar 'bear trap' could also be emerging in the S&P 500, although it's not as clean a play as for the Russell 2000, giving there is still overhead resistance at 2,090.

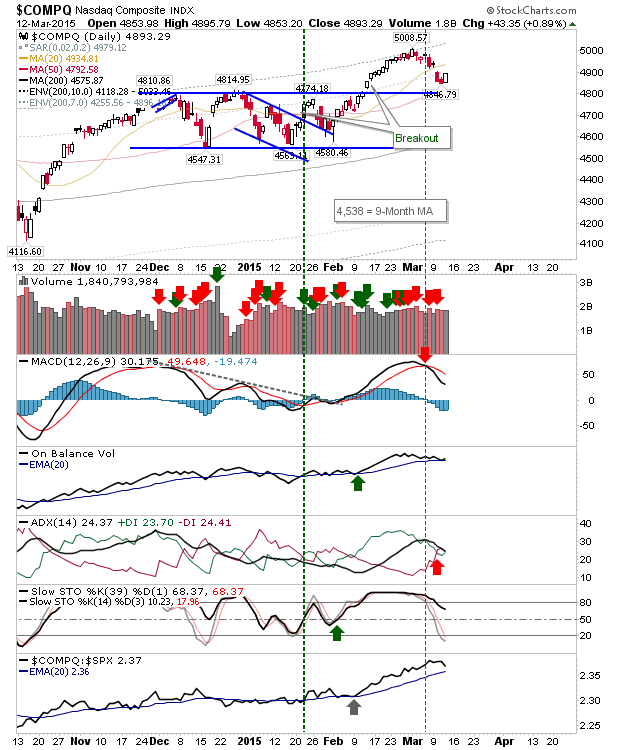

The NASDAQ was more traditional, its swing low occurred above its nearest support, with only recent highs to play as resistance. Yesterday's rally occurred well above support of 4,810, with the 50-day MA support currently at 4,793.

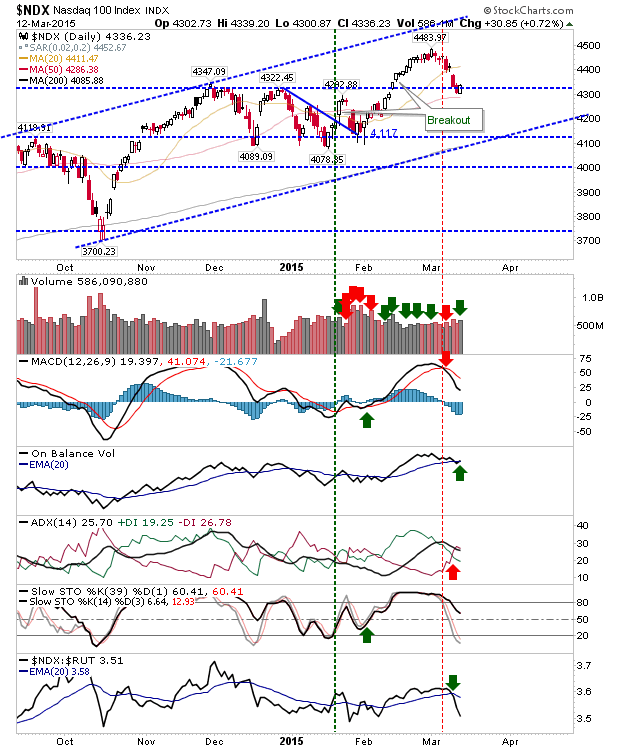

The NASDAQ is right on support, which maybe makes the NASDAQ 100 the bulls' play for today. Higher volume accumulation is another tick in the bull column.

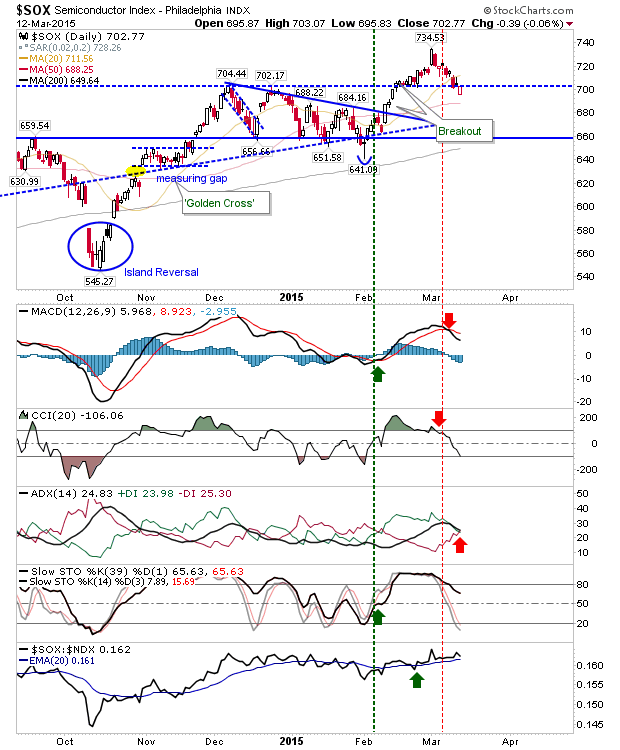

The SOX is another potential swing low (at support) play. Technicals are neutral, and the 50-day MA is at 688, which would suggest lower prices, but the index closed at a level which is attractive for longs.

For today, assuming bulls can continue Thursday's momentum, look to Tech indices to push higher.