Monday, March 11: Five things the markets are talking about

A U.S budget, a ‘meaningful’ Brexit vote and U.S-China trade talks are to dominate proceedings this week.

President Trump is expected to release his proposed fiscal 2020 budget today, four-weeks later than scheduled, due to his partial government shutdown. Expect the President to be looking for more money to build his wall.

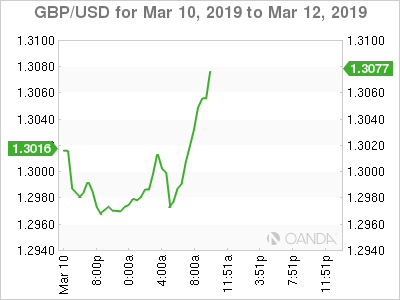

We are 24-hours away from PM May’s supposed ‘meaningful’ Brexit vote and the rumor is that Ms. May could lose this vote by a wider margin than the last one. Britain is scheduled to exit the E.U in just 20-days. As expected, sterling remains volatile.

On the trade front, China and the U.S are said to be in general agreement “on many crucial issues and have held meaningful discussions on foreign exchange,” according to the PBoC.

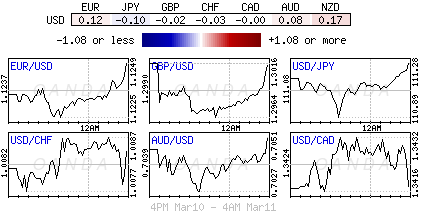

In an interview last night, Fed Chair Powell indicated that he is in no hurry to change interest rates and acknowledged that over the past few months there’s been increasing evidence of the global economy slowing down. Equities traded mostly higher overnight following their worst week for three months. Sovereign yields trade atop of their lows, while ‘big’ dollar trades steady.

On tap: A slew of data from China this week (retail sales, investment, credit, and industrial production) is expected to give the market a fresh insight on the impact of the monetary stimulus. The BoJ will also meet to set policy. This morning, its U.S retail sales (0:8:30 am EDT).

1. Stocks rise to start the week

Global stocks are climbing at the start of the week, after reassuring comments from Fed Chair Powell and on signs that the U.S and China are nearing a trade deal.

In Japan, the Nikkei share average snapped a four-session losing streak overnight, although gains were limited as much weaker-than-expected U.S jobs report reduced the outlook for the global economy. The Nikkei ended the day up +0.47%, while the broader climbed +0.57%.

Down-under, Aussie shares ended lower overnight, led by financial and energy stocks, after last week’s downbeat data stateside increased global concerns about an economic slowdown. The S&P/ASX 200 index dipped -0.4% at the close of trade. The benchmark fell -1% on Friday. In S. Korea, the KOSPI stock index ended flat, tracking the rebound in China stock markets on Chinese stimulus hopes.

In China, stocks rebounded overnight, after suffering heavy losses on Friday, after the PBoC governor pledged more support for a slowing economy. At the close, the Shanghai Composite index closed up +1.92%, while the blue-chip CSI300 index was up +1.98%.

Note: PBoC Governor Yi Gang said yesterday that the PBOC’s “prudent” monetary policy will emphasise counter-cyclical adjustments. He indicated that there is still some room for the PBoC to cut RRR and said the bank “will work on lowering risk premiums that have kept lending rates for small firms relatively elevated.”

In Europe, regional bourses are trading higher across the board, led by the FTSE on a weaker sterling (£1.2989) and on reports that PM May to most likely change the planned meaningful vote scheduled for tomorrow, to a provisional one.

U.S stocks are set to open in the ‘black’ (+0.1%)

Indices: Stoxx600 +0.14% at 371.10, FTSE +0.76% at 7,158.75, DAX +0.14% at 11,474.16, CAC-40 +0.04% at 5,233.15, IBEX-35 -0.16% at 9,115.05, FTSE MIB +0.10% at 20,504.50, SMI +0.06% at 9,266.80, S&P 500 Futures +0.01%

2. Oil prices rally as Saudi stands by OPEC cuts, gold lower

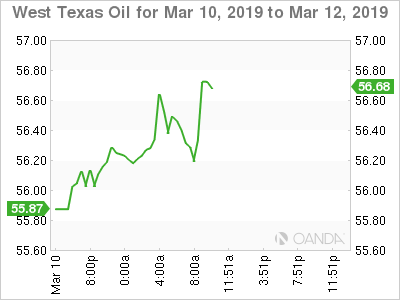

Oil prices start the week better bid, supported by comments from the Saudi oil minister Khalid al-Falih that an end to OPEC+ led supply cuts was unlikely before June. Also providing support is Friday’s U.S drilling activity report which showed a decline.

Brent crude futures are at +$65.02 per barrel, up +28c, or +0.4%, while U.S West Texas Intermediate (WTI) crude oil futures are at +$56.36 per barrel, up +30c, or +0.5% from Friday’s close.

Despite the gains, markets are being held back by revisions to global growth by OECD and G7 central banks.

Note: OPEC meets in Vienna on April 17-18, with another gathering scheduled for June 25-26, to discuss supply policy.

Crude prices are also being supported by Baker Hughes’ latest weekly report showing the number of U.S rigs drilling for new oil production stateside fell by nine to 834.

This is the third consecutive week of declines as U.S oil producers trim their 2019 spending budgets. Nevertheless, because the overall U.S drilling level remains relatively high, the market still expects U.S crude output to rise above +13M bpd sooner than later.

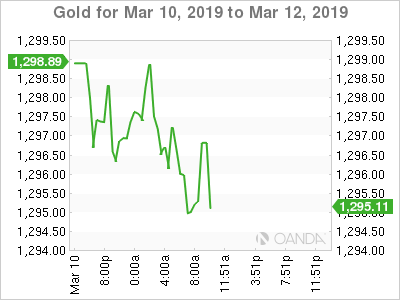

Ahead of the U.S open, gold prices trade in a tight range, hovering near its one-week high print hit last week after a disappointing U.S NFP report increased concerns about a global economic slowdown. Spot gold has eased about -0.1% to +$1,296.62 per ounce. The ‘yellow’ metal rallied +1% on Friday, in its biggest one-day gain in a fortnight. U.S gold futures have slipped -0.2% to +$1,296.70 an ounce.

3. German Bund yields looking to go negative

Germany’s 10-year Bund yield, the eurozone’s most closely followed government bond, is close to trading in negative territory for the first time in three-years. This highlights the markets increasingly bleak outlook for the European economy.

Last week the ECB slashed its growth forecasts for 2019 to +1.1% from +1.7% and have basically ruled out hiking interest rates, currently negative, before the start of next decade at the earliest. The 10-year Bund yield trades at +0.06%.

Further pressure on eurozone bond yields has come from this morning’s disappointing German data – German industrial production fell in January (see below).

Elsewhere, the yield on 10-year Treasuries has backed up +1 bps to +2.64%, while in the U.K, the 10-year Gilt yield has eased -2 bps to +1.165%.

Note: Tomorrow’s Brexit votes will be a key driver for bonds.

4. Dollar confined to tight ranges

GBP/USD (£1.2979) is lower by -0.3% as the Brexit situation enters an important week with the U.K parliament expected to vote this week on the plan to leave the EU. There is a lot of talk whether PM May would have the planned ‘meaningful’ vote tomorrow as scheduled or that she might change into a ‘provisional’ vote. There are concerns that if PM were to delay the ‘no-deal,’ Brexit or Article 50 extension votes then she could face resignations and possible removal as leader.

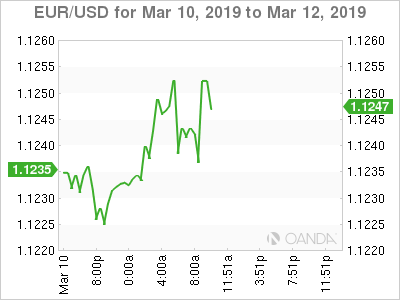

EUR/USD (€1.1240) is a tad higher as the market continues to focus on any divergence in central bank policies. The pair tested below the psychological €1.12 level after the ECB pushed back its view for the first potential hike until after 2019, but a soft U.S jobs report has given the ‘single’ unit some support.

USD/JPY (¥111.20) trades steady as the market focuses on the BoJ rate decision later this week.

5. German Industrial output falls

Data this morning showed that German industrial production fell in January, missing expectations, and exports were flat. This suggests that Europe’s largest economy continues to flounder.

According to Destatis, the total industrial output declined -0.8% from the month before. The outcome missed the markets forecast of a +0.4% gain. But revised data for December now show a +0.8% M/M rise in industrial production, compared with a -0.4% drop previously reported.

Reflecting the trend, Destatis said that German exports were flat in December compared with November, whereas imports rose +1.5%. As a consequence, Germany’s adjusted trade surplus narrowed to +€18.5B from +€19.9B in December last year.