Market Brief

USD/JPY was trading substantially higher in early Asian session amid speculations concerning the expansion on the quantitative easing program by the Bank of Japan. However, Governor Kuroda announced that the BoJ will maintain the stimulus at ¥80tn per year despite a weak inflation outlook and anemic growth. We think it’s only a matter of time before the BoJ increases the size of the stimulus with October being our best guess. As a result of the comment, USD/JPY lost previous gains and quickly returned to ¥120. The pair is trading right in the middle of its short-term range, between the resistance and support lying at 121.75 and 118.61, respectively. The Nikkei is up 0.80%, while the broader TOPIX index rose 0.34%.

In Australia, the minutes from the RBA’s September meeting triggered a mini Aussie sell-off. AUD/USD fell 0.60% to $0.7110 as the Central bank declared that “international economic developments had increased the downside risks to the outlook, but it was too early to assess the extent to which this would materially alter the forecast for GDP growth in Australia's trading partners to be around average over the next couple of years”. The S&P/ASX fell 1.53% as iron prices remain under pressure. January futures are down more than 2% today and 4.70% from last week’s peak.

Elsewhere, Chinese mainland shares are extending losses for the second straight day. The Shanghai Composite is down 2.47%, while the Shenzhen Composite printed a 7-month low at 1,575.95, down 3.18% on the session. In South Korea the local gauge edges higher by 0.14% while in Hong Kong, the Hang Seng declines -0.27%.

Overnight, the US dollar gained ground against most G10 currencies. EUR/USD is back around 1.13 after testing the resistance lying at 1.1368 (Fib 38.2% on July-August rally) and is heading to the support standing at 1.1262 (Fib 50%). GBP/USD is also taking a breather after the previous day’s strong gains; the pair is under pressure this morning ahead of August’s inflation report. A support can be found at 1.5373 (September 14th low), then 1.5339 (September 10th low).

In Brazil, in the wake of Brazil’s credit downgrade to junk, Joachim Levy has proposed a new round of austerity measures aimed at cutting expenses and raising taxes. Dilma Rousseff’s government hopes to trim BRL 26bn of expenses in 2016 while increasing tax revenue by BRL 28bn. As a result, the BRL appreciated 1.61% against the EUR and 1.45% against the USD. This downgrade by S&P is a blessing for Joachim Levy as it will help to convince lawmakers and will sweeten the pill of austerity for Brazilian people.

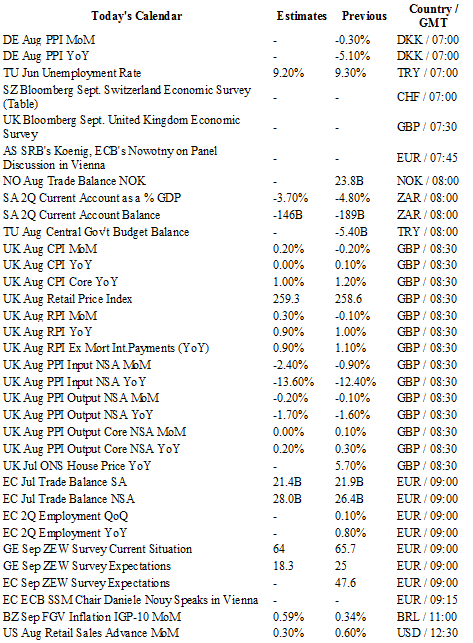

Today traders will be watching current account balance from South Africa; inflation report (CPI and PPI) from UK; ZEW survey from Germany; retail sales, empire manufacturing, industrial production and capacity utilization from the US; tax collection and formal creation from Brazil.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1438

CURRENT: 1.1301

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5819

R 1: 1.5628

CURRENT: 1.5427

S 1: 1.5346

S 2: 1.5165

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 119.74

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 1.0240

R 1: 0.9903

CURRENT: 0.9696

S 1: 0.9513

S 2: 0.9259