Wednesday November 23: Five things the markets are talking about

Death, taxes, and a Fed rate hike in December are life’s only certainties according to the bond market which now has the odds of an increase on Dec 14 at +100%.

Markets will be watching todays FOMC minutes at (2:00pm EST) for that vindication, while seeking out the prospect for further rate increases in 2017.

With only one Fed rate hike already priced in for next-year, it seems to be very conservative considering how aggressive the market has priced in the past two weeks the Trump ‘reflation’ trade.

What’s the possibility of a repeat of what happened after last December’s rate increase, a stock-market collapse, a plunging yuan and soaring demand for U.S Treasuries as a safe haven?

This go around should be different; there is no Fed four-hikes being projected, and U.S data is on much firmer footing. The China’s yuan will be an issue in 2017 only because the new-President elect will make it one. Despite weakening against the ‘mighty’ dollar outright, it has been gaining against a regional basket of currencies.

1. Global stocks mixed results

Again, the potential of aggressive stimulus packages is trumping the possibility of “not so free” trade pacts.

Asian shares were largely positive overnight, taking a lead from record gains stateside. Industrial metals along with crude oil remain the biggest supports for regional bourses.

The S&P/ASX 200 was up +1.3%, Hong Kong’s Hang Seng Index closed flat and South Korea’s KOSPI gained +0.2%. Japanese markets were closed for a public holiday.

The Shanghai Composite closed down -0.2% even as sinking bond yields push money into equities. Analysts note that the margin loans-which investors use to buy equities-hit a 10-month high this week, which would suggest that stock appetite may be picking up sharply in China.

In Europe, equity indices are trading mixed across the board; French, German and Eurozone PMI data came in overall better than expected and is supporting the recent positive market sentiment. Gains across the FTSE 100 are being led by energy, commodity and mining stocks as oil and copper consolidate marginally higher around weekly highs.

S&P futures are set to open relatively flat.

Indices: Stoxx50 -0.2% at 3,037, FTSE 100+0.6% at 6,860, DAX -0.3% at 10,685, CAC 40 -0.2% at 4,539, IBEX 35 -0.1% at 8,641, FTSE MIB -1.1% at 16,332, SMI +0.1% at 7,746, S&P 500 Futures flat

2. Crude oil prices capped, gold in demand

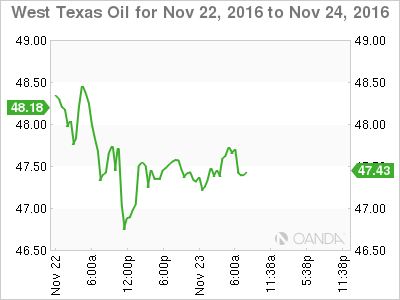

Oil prices edged a tad higher overnight, but gains are capped on doubts that OPEC would agree to a large enough production cut to significantly reduce the global surplus when it meets on Nov 30.

A stronger dollar, trading atop of its 14-year highs, is also weighing on prices ahead of the U.S. Thanksgiving holiday tomorrow.

Brent crude futures have rallied +11c to +$49.23 a barrel, while U.S. West Texas Intermediate (WTI) crude oil futures rose +12c to +$48.15.

The market is expecting a deal from OPEC, but fear the aim, proposed by Algeria, of cutting production by -4 to 4.5%, or over -1.2m barrels per day may not be reached. Currently, the deal’s success hinges on an agreement from Iraq and Iran.

Dealers will take direction from this morning’s U.S. crude inventories report (EIA 10:30 EST), which is expected to rise by +700k barrels, while distillates will fall and gasoline will rise.

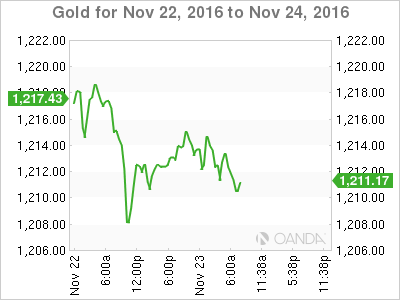

Gold continues to trade in a tight range overnight ahead of today’s FOMC minutes. The yellow metal is trading unchanged at +$1,212.45 an ounce. Yesterday, the metal eased -0.15%, hurt by strong equities and the possibility of higher rates.

3. Sovereign bond rout takes a breather

Sovereign bonds are taking a breather from their 10-day selloff driven by Trump’s “reflation” trade.

U.S. 10-Year's are trading atop of +2.304% ahead of the open. Some investors are seeing value at current levels, believing that the past fortnights sell off from +1.86% is a tad overdone.

Yesterday’s U.S Treasury +$34b five-year auction drew average demand. Today’s +$28B seven-year note sale is the last of this weeks offering.

Note: U.S bond market will be closed tomorrow for Thanksgiving.

In Europe, regional bonds are under pressure on rumours that ECB may lend more bonds to avert a market freeze. 10-year German bunds have backed up + 5 bps to +0.261%.

4. Dollar steady, Sterling to be volatile on the “Autumn Statement”

The Dollar Index (DXY) remains steady in quiet pre-holiday trading, holding near its 14-year highs. Current price action would suggest that dealers and investors prefer to keep positions close to home ahead of the holiday shortened trading week.

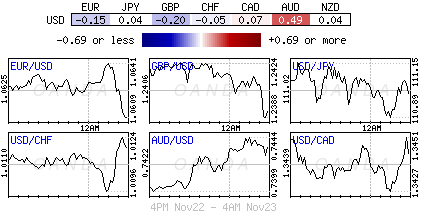

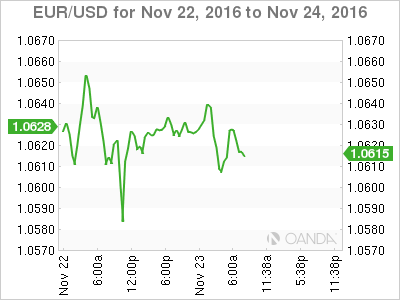

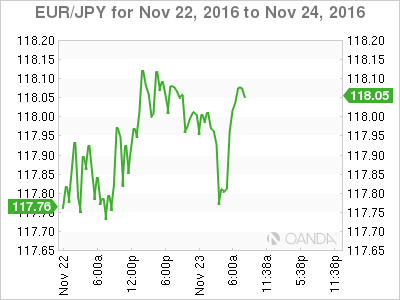

The EUR/USD has drifted lower to approach €1.0620 on continued speculation about what the ECB will do at its Dec 8th meeting. The pound is a tad softer by almost -0.5% at £1.2380 ahead of the U.K autumn budget statement this morning (07:30am EST). USD/JPY trades flat at ¥111.07, atop of its multi-month high reached yesterday. The offshore Yuan has fallen to new all-time lows through ¥6.92 despite a stronger fix.

In emerging markets, the PHP brushed up against its eight-year low outright, falling about -0.1% overnight and is currently off -2.7% since Trump’s victory. The dollar continues to remain better bid against MYR (+0.5%, o/n) and KRW (+0.3%, o/n).

5. Good news for ECB from Germany

It’s not all doom and gloom in the headlines from Europe’s largest economy.

Germany’s composite PMI fell to 54.9, a two-month low. The manufacturing PMI fell to 54.4, while the services component rose to 55.0, a six-month high.

Note: The activity eased only slightly from a robust level, owing to a slowdown in manufacturing and despite quicker growth in the services sector.

Also, some good news for ECB policy makers who are desperately trying to boost inflation is that there are reported signs of intensifying price pressures – companies are managing to pass on higher input costs to customers. German input cost inflation is at a five-year high.