Market Brief

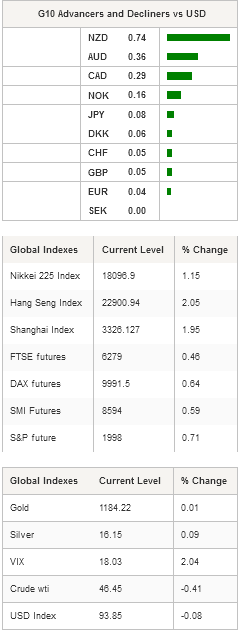

The selling pressure on the greenback continues and shows no sign of weakness as bad news from the US keeps piling up. Retail sales only grew 0.1%m/m versus 0.2% median forecast, while the previous figure was downwardly revised from 0.2% to 0.00% as Americans decided to put savings from lower oil prices aside. When excluding auto sales, retail sales contracted -0.3%m/m in September, below market expectations of -0.1% and a downwardly revised figure of -0.1% in August. On the inflation front, the disappointing PPI figures are raising concerns about when inflation will start picking up. Headline PPI missed expectations as it printed at -0.5%m/m, while economists were expecting a contraction of -0.2%. More worryingly, core PPI indicated that prices only increased 0.8%y/y in September, while economists were looking for an increase of 1.2%. As a result, the US dollar lost ground against all G10. The dollar index fell 0.90% yesterday and is currently stabilising around 93.88.

The entire US yields curve shifted lower yesterday, with the 10-year slipping as much as 10bps to 1.9720%, while the monetary policy sensitive 2-year slid 7bps to 0.5490%. However, yields recovered slightly in the Asian session as the market realised the overreaction.

The rally in EUR/USD accelerated in Wall Street yesterday. The pair reached 1.1495 in Asia, its highest level since August 26th. The euro will likely turns the 1.1475 (Fib 61.8% on August-September rally) resistance into a support. On the upside, the closest resistance stands at 1.1714 (high from August 24th), while on the downside, a support can be found at 1.1345 (low from October 13th).

In Australia, the latest employment report surprised to the downside, despite a stable unemployment rate (participation rate fell to 64.9% from 65%). The Australian economy lost 5.1k jobs in September, while the market expected that the economy had actually created 9.6k jobs. However, this was only a minor setback for AUD/USD; the pair continues to rally and is now heading toward the next resistance standing at 0.7382 (high from October 12th). With the RBA staying on the sideline, the $0.74 is now within reach.

As expected, the Bank of Korea left the repo rate unchanged at 1.5%. The less dovish statement allowed the won to print some solid gains against the US dollar. USD/KRW fell to 113.30, the lowest level since July 14th.

On the equity front, Asian regional equity markets are all trading in positive territory despite Wall Street’s negative lead. The Japanese Nikkei rose 1.15%, while the broader Topix index soared 1.35%. In mainland China, the Shanghai Composite climbed 1.95% and the tech-heavy Shenzhen Composite soared 2.59%. Hong Kong’s Hang Seng rose 2.05%. South Korea’s Kospi jumped 1.18%.

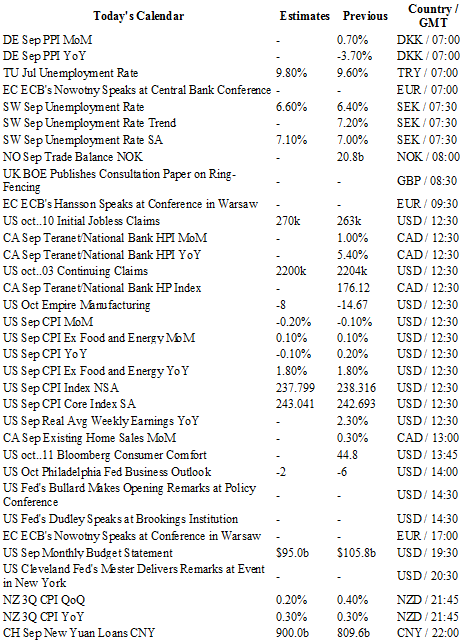

Today, traders will focus on the US with September CPI report and a few speeches from Fed members. Bullard, Dudley and Mester will talk today. New Zealand’s CPI report is expected in the evening.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1561

CURRENT: 1.1479

S 1: 1.1106

S 2: 1.1017

GBP/USD

R 2: 1.5819

R 1: 1.5659

CURRENT: 1.5485

S 1: 1.5202

S 2: 1.5089

USD/JPY

R 2: 125.86

R 1: 121.75

CURRENT: 118.71

S 1: 118.61

S 2: 116.18

USD/CHF

R 2: 0.9844

R 1: 0.9741

CURRENT: 0.9490

S 1: 0.9384

S 2: 0.9259