Today, apart from headlines surrounding the broader market sentiment, CAD-traders may pay extra attention to the BoC monetary policy decision. Although we don’t expect any action today, it would be interesting to see what the Bank’s future plans are. As for tonight, we have New Zealand’s CPI for Q2, and Australia’s employment report for June.

BOJ STANDS PAT, BOC TAKES THE CENTRAL BANK TORCH

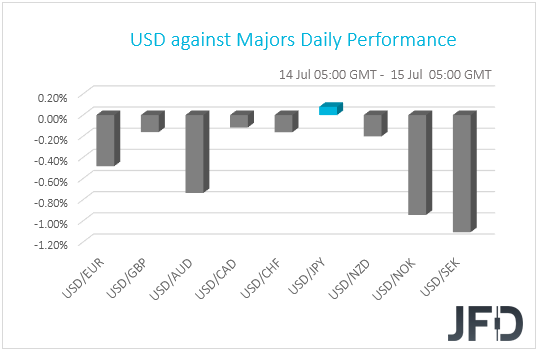

The dollar reversed south against all but one of the other G10 currencies on Tuesday and during the Asian morning Wednesday. It lost the most ground versus SEK, NOK, AUD, and EUR, while it eked out some gains only against JPY.

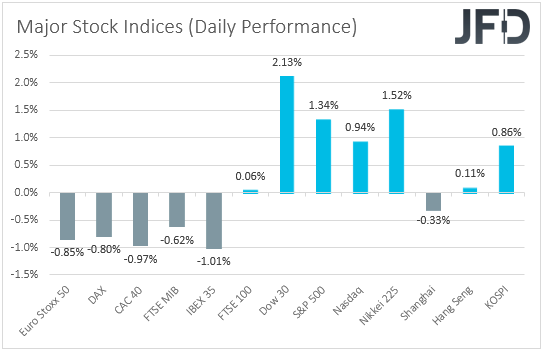

The fact that the Aussie was among the main gainers, combined with the weakness in the dollar and the yen, suggests that risk appetite rebounded again at some point yesterday. Although most EU indices traded in negative waters, perhaps following the new lockdown measures in California and the fresh tensions between the US and China, all three of Wall Street’s main indices rebounded, gaining on average around 1.5%. The relative optimism rolled over into the Asian session today as well. Although China’s Shanghai Composite slid 0.33%, Japan’s Nikkei 225, Hong Kong’s Hang Seng, and South Korea’s KOSPI gained 1.52%, 0.11% and 0.86% respectively.

In our view, there was no clear catalyst behind the rebound during the US session. Perhaps investors saw Monday’s slide as an opportunity to buy again at lower levels. In any case, the frequent up and downs in the markets add more credence to our view of staying sidelined until the fog clears out. As we noted in the past, it seems that there is a battle between those who believe that, due to the better-than-expected data, the global economy is likely to rebound faster than previously thought, and those who are afraid over a second round of restrictions, and thereby a second hit to economic activity.

During the Asian morning today, we also had a BoJ decision. As was widely expected, the Bank kept its short-term interest rates at -0.1% and the target of its 10-year JGB yield at around 0%. In the statement, officials noted that they remain ready to take additional easing steps without hesitation if deemed necessary, also adding that the domestic economy is likely to start improving gradually in the second half of this year. In their quarterly report, the said that the risks to the economic and price outlooks are skewed to the downside and that inflation expectations are hovering on a weak note. As we have been expecting, the yen did not react to the decision, perhaps as it stays mostly linked to developments surrounding the broader investor morale.

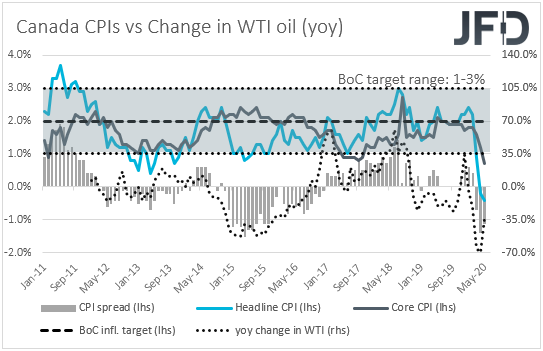

As for later today, apart from headlines and developments surrounding the overall market sentiment, CAD-traders may also pay extra attention to the BoC monetary policy decision. At its most recent meeting, this Bank decided to keep interest rates unchanged and said that given the improvement in short-term funding conditions, it reduced the frequency of its term repo operations and its program to purchase bankers’ acceptances. Officials also said that the Canadian economy appears to have avoided the most severe scenario presented in the Bank’s April Monetary Policy Report and that the economy is expected to resume to growth in the third quarter.

That said, despite last week’s better-than-expected employment report, inflation remains very low, with the headline rate at -0.4% yoy. Therefore, with the Bank also publishing its updated economic projections, it would be interesting to see what officials’ plans are moving forward, even if they are not expected to act this time around.

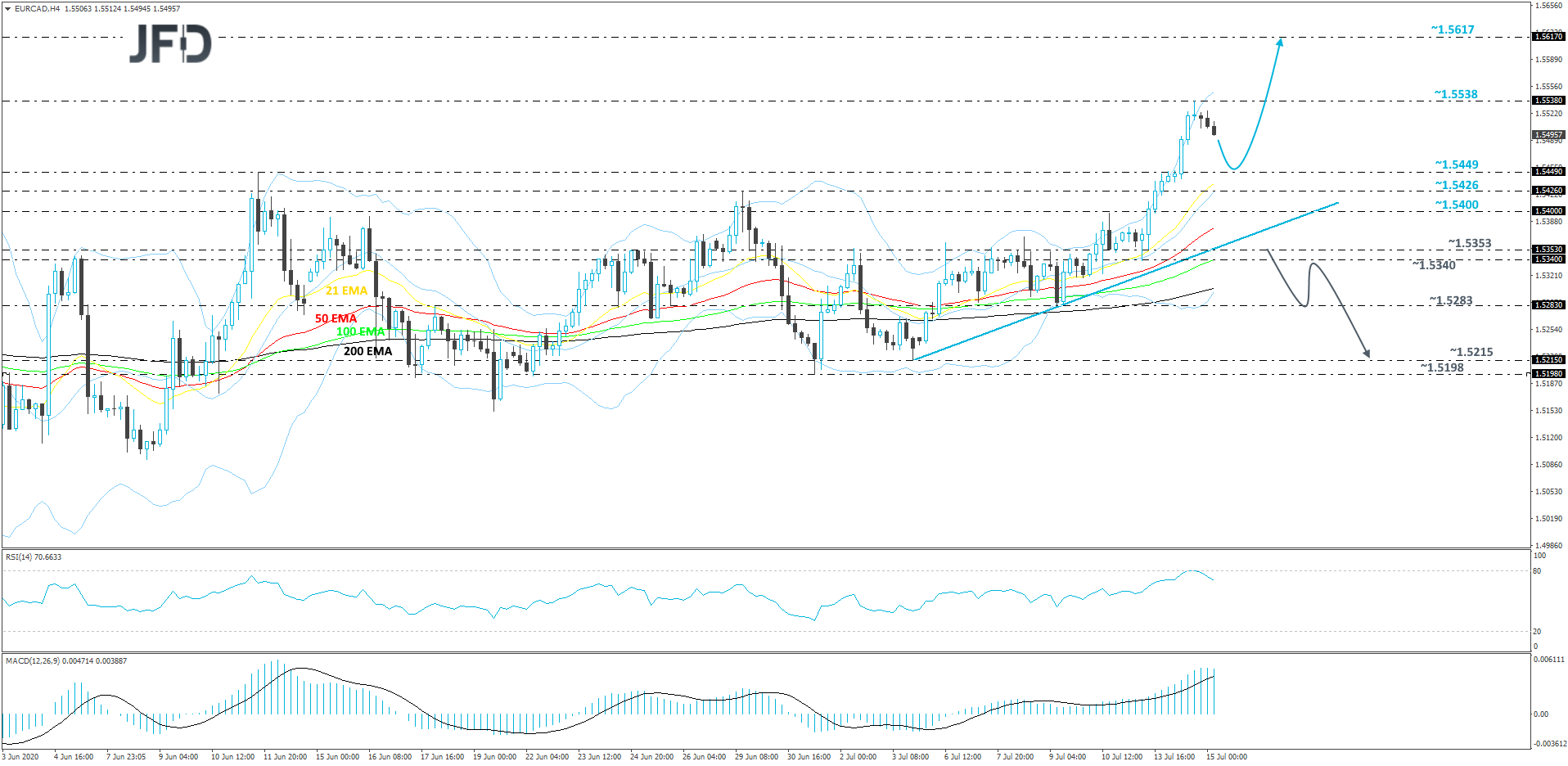

EUR/CAD – TECHNICAL OUTLOOK

From the beginning of this week, EUR/CAD had been moving rapidly to the upside, until it found resistance near the 1.5538 hurdle, after a test of which it started correcting lower. There is a chance to see a bit more movement to the downside, however let’s not forget that the pair is still trading above a short-term tentative upside support line taken from the low of July 3rd, which may continue providing support for the rate. This is why we will stay somewhat positive, at least for now.

A further push down could bring EUR/CAD closer to the 1.5449 zone, marked by the highest point of June, where the pair might get a hold-up. If so, the bulls may try to take advantage of the lower rate and lift it back to the current high of this week, at 1.5538. If this time that area fails to provide resistance and breaks, the next potential target for EUR/CAD could be the 1.5617 level, which is the highest point of April.

Alternatively, if the aforementioned upside line breaks and the rate falls below a support area between the 1.5340 and 1.5353 levels, marked by the low and an intraday swing low of July 13th, that may be sign for more bears to join in. EUR/CAD could then drift to the 1.5283 obstacle, a break of which might clear the path to the low of July 3rd, at 1.5215. Slightly below it lies the current lowest point of July, at 1.5198, which may also get tested.

NEW ZEALAND CPI AND AUSTRALIA’S EMPLOYMENT REPORT IN FOCUS

Two currencies that tend to be very responsive to changes in the broader investor morale are the Kiwi and the Aussie. However, tonight, traders of those risk-linked currencies may also pay attention to New Zealand’s CPI for Q2, as well as Australia’s employment data for June.

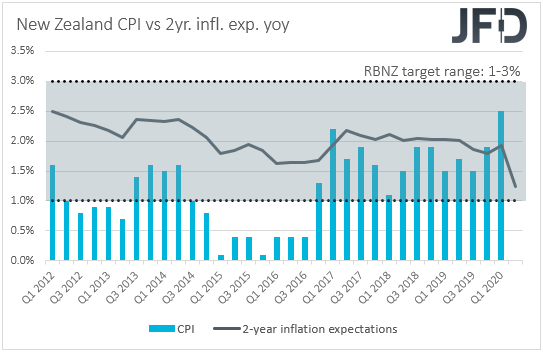

Kicking off with New Zealand’s CPI, the forecast suggests that inflation slowed to +0.4% QoQ from +0.8%, something that will drive the YoY rate down to +2.1% from 2.5%. At its most recent gathering, the RBNZ decided to keep interest rates and its Large Scale Asset Purchase (LSAP) program unchanged, with officials noting that their nation has contained the spread of the virus, enabling an earlier resumption of economic activity than assumed in May. However, they highlighted that the appreciation of their local currency has placed further pressure on exports and that the balance of economic risks remains to the downside, adding that they remain willing to ease their policy further if deemed necessary.

Despite expectations over a slowdown, the YoY CPI rate is expected to stay near the midpoint of the RBNZ’s 1-3% target range, and also well above the Bank’s own forecast, which is at +1.3%. This may allow RBNZ policymakers to stand pat for another meeting, but with the Kiwi slightly higher against the dollar than it was the last time they met, we also expect them to reiterate concerns over its appreciation, as well as their readiness to ease further if needed.

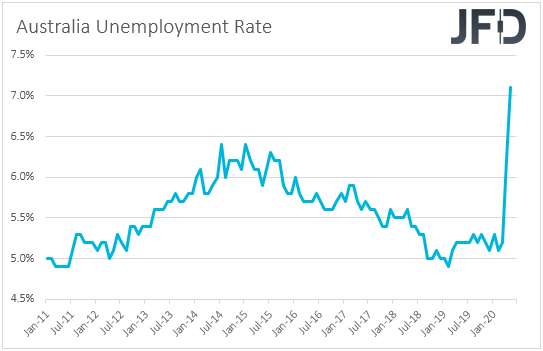

Passing the ball to Australia’s data, the unemployment rate is expected to have ticked down to 7.0% from 7.1%, while the net change in employment is forecast to show that the economy has lost 100k jobs, less than the 227.7k loss in May. That said, the participation rate is expected to have increased to 63.7% from 62.9%, which combined with a slide in the unemployment rate suggests that the people who have joined the labor force may have actually found a job. This means that the employment change may come in positive this time around. Thus, we would consider the risks as tilted to the upside.

A decent employment report may allow the RBA to avoid scaling back up its QE purchases, although we expect them to stay willing to do so if things fall out of orbit. The risk to that view is expanding QE purchases in light of the newly adopted lockdown measures in Melbourne. However, we believe that policymakers may prefer to wait for data to reveal weather this had a serious economic impact or not.

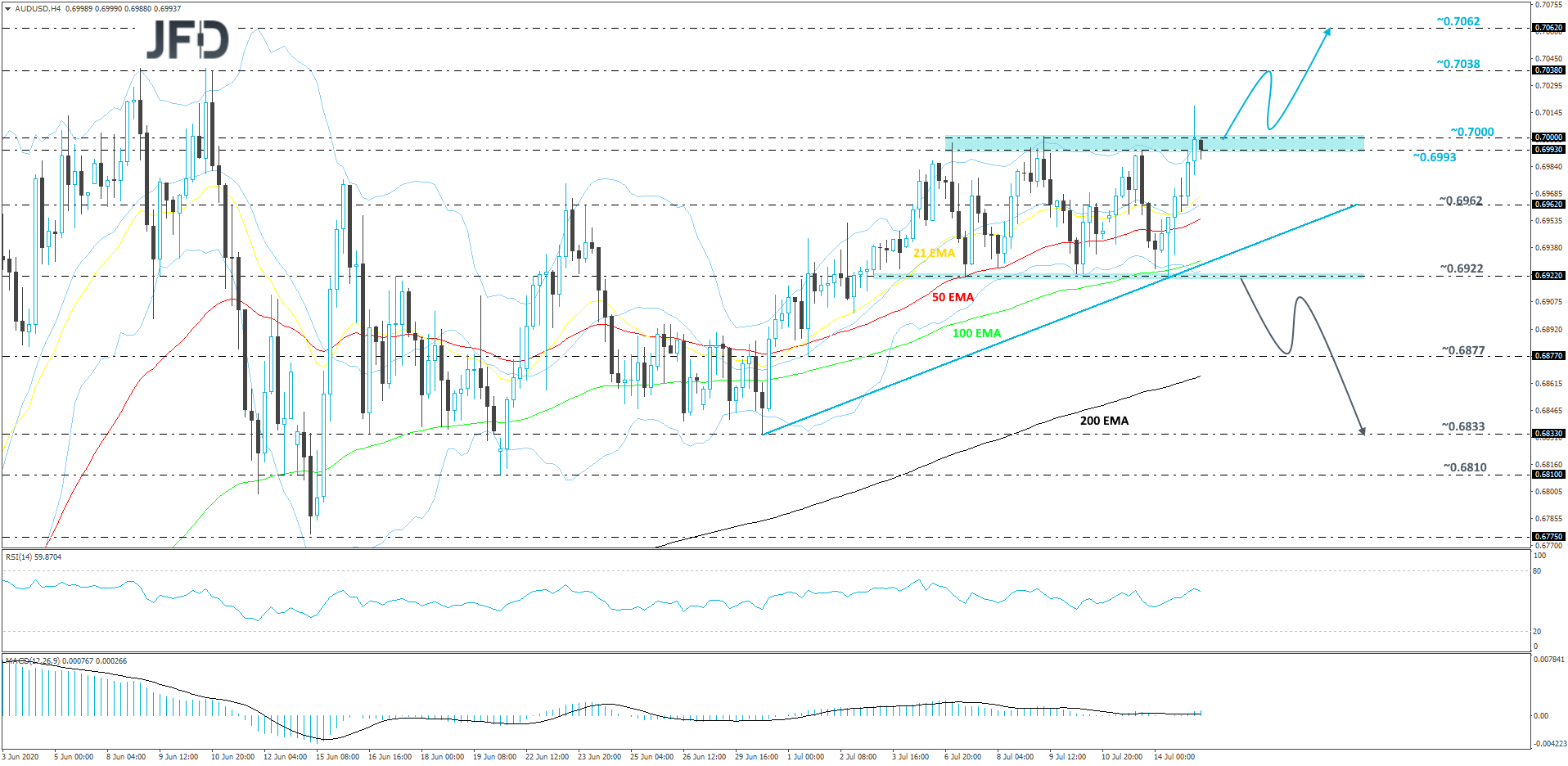

AUD/USD – TECHNICAL OUTLOOK

From the beginning of July, AUD/USD is seen moving sideways, roughly between the 0.6922 and 0.7000 levels, which form the lower and the upper bounds of the range. At the same time, we can draw a short-term tentative upside support line taken from the low of June 30th, which suggests that there is a good chance the pair may travel higher in the near term. For now, we will take a cautiously-bullish approach, as the rate is currently closer to the upper bound of the aforementioned range.

A strong push above the upper side of that range, which is at the psychological 0.7000 mark, might spark more interest among new buyers, as it could clear up the way to some higher areas. That’s when AUD/USD might get closer to the 0.7038 obstacle, a break of which could set the stage for a test of the highest point of June, at 0.7062. The pair could get a temporary hold-up, until the bulls and the bears decide who will grab the steering wheel from there onwards.

On the downside, if the previously discussed upside line breaks, that could be seen as a bearish indication, potentially making a few bulls worried. But more of them might flee the field, if the rate drops below the lower end of the aforementioned range, at 0.6922, which would confirm a forthcoming lower low and may set the stage for further declines. AUD/USD might then drift to the 0.6877 obstacle, a break of which could open the door for a move to the low of June 30th, at 0.6833.

AS FOR THE REST OF TODAY’S EVENTS

During the early European morning, we already got the UK CPIs for June. The headline rate ticked up to +0.6% yoy from +0.5%, instead of sliding to +0.4% as the forecast suggested, while the core rate rose to +1.4% yoy from +1.2%. The forecast was for the core rate to stay unchanged.

Later, from the US, we have the industrial production for June, which is anticipated to have accelerated to +4.3% mom from +1.4%. The EIA (Energy Information Administration) weekly report on crude oil inventories for last week is also due to be released. The forecast is for a 2.098mn barrels decline after a 5.654mn inventory build the week before. That said, bearing in mind that the API report yesterday revealed an 8.322mn slide, we would consider the risks surrounding the EIA forecast as tilted to the downside.

Tonight, during the Asian morning Thursday, apart from New Zealand’s CPI and Australia’s employment report, we also get China’s GDP for Q2, alongside the fixed asset investment, industrial production, and retail sales, all for June. Chinese economic activity is expected to have rebounded 9.6% QoQ after contracting 9.8% in Q1, while fixed asset investment, industrial production and retail sales are all expected to have improved in June. Following the containment of the coronavirus in China during the second quarter, this will not come as a surprise to us and perhaps neither to any other market participant. We believe that investors will be more eager to find out how the world’s second largest economy has been performing in Q3 after the second outbreak of the virus. Thus, we don’t expect this set of data to prove determinant with regards to the broader market direction.

Besides BoC Governor Tiff Macklem, who will hold a press conference after his Bank’s decision, we also have two more speakers on the agenda: BoE MPC member Silvana Tenreyro and Philadelphia Fed President Patrick Harker.