Technical Analysis

In this review, we would like to draw your attention to the Australian dollar vs. the Swiss franc currency pair. Will the AUD/CHF continue to rise? Such dynamics is observed in case of the strengthening of the Australian dollar and the weakening of the Swiss franc.

The rate of the Swiss National Bank (SNB) is negative - minus 0.75%. Meanwhile, inflation in March of the current year rose to plus 0.7% compared with + 0.6%. Inflation in Switzerland has been positive since the beginning of 2017. An additional negative factor for the franc was the decrease in the manufacturing PMI for March to 50.3 points, which is the low since December 2015. Despite the risks of a slowdown in the economy, the head of the Swiss National Bank Thomas Jordan said at the end of the last week that there was no need to tighten the monetary policy. In turn, the rate of the Reserve Bank of Australia (RBA) is positive and is equal to 1.5% with + 1.8% inflation. Macroeconomic statistics of China, which is the main trading partner, may be a positive factor for the Australian dollar. Data on Chinese GDP for the 1st quarter of the current year, as well as retail sales and industrial production for March will come out on Thursday. If they turn out to be positive, then this may support the Australian dollar. It may also be affected by data on the Australian labor market, which will be published on Thursday, April 18. In case of an increase in unemployment, the RBA threatens to lower the rate.

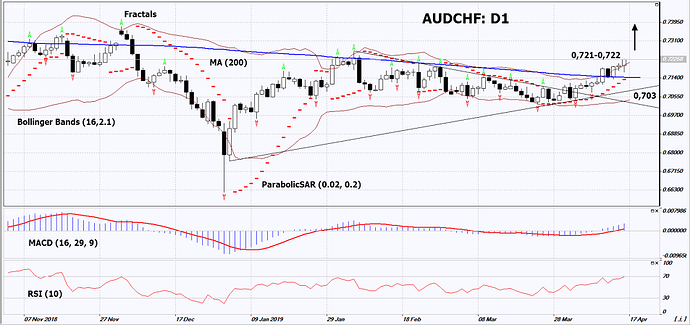

On the daily time-frame, AUD/CHF: D1 has left the downtrend and moved upward. A number of technical analysis indicators formed buy signals. The further price increase is possible in case of the publication of positive data in Australia and negative data in Switzerland.

- The Parabolic Indicator gives a bullish signal.

- The Bollinger® bands have started to widen, which indicates low volatility. Both Bollinger bands are titled upward.

- The RSI indicator is above 50. No divergence.

- The MACD indicator gives a bullish signal.

The bullish momentum may develop in case AUD/CHF exceeds its last high at 0.721-0.722 This level may serve as an entry point. The initial stop loss may be placed below the two last fractal lows, the Parabolic signal and the lower Bollinger band at 0.703. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point. More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level (0.703) without reaching the order (0.721-0.722), we recommend to close the position: the market sustains internal changes that were not taken into account.

Summary Of Technical Analysis

- Position Buy

- Buy stop Above 0.721-0.722

- Stop loss Below 0.703

Market Overview

US stock market resumed advancing on Tuesday with 60% of companies that have reported quarterly results so far beating the revenue forecasts. The S&P 500 rose 0.3% to 2907.06. Dow Jones Industrial Average added 0.3% to 26452.66. The Nasdaq gained 0.3% to 8000.23. The dollar strengthening accelerated as home builder sentiment rose to a six-month high in April, while industrial production fell 0.1% in March. The live dollar index data show the ICE (NYSE:ICE) US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.1% to 97.06 but is lower currently. Futures on US stock indexes point to higher openings today.

DAX 30 Outperforms On ZEW Investor Sentiment Surprise

European stocks added to gains on Tuesday on positive data and earnings reports. Both the EUR/USD and GBP/USD turned lower but are higher currently. The Stoxx Europe 600 gained 0.4%. The German DAX 30 rose 0.7% to 12101.32 as German ZEW investor sentiment index improved in April, France’s CAC 40 added 0.4%. UK’s FTSE 100 advanced 0.4% to 7469.92.

Asian indices mixed while China’s growth beat expectations

Asian stock indices are mostly higher today. Nikkei added 0.3% to 22277.97 with yen little changed against the dollar while Japan suffered first trade deficit in three years. Chinese stocks are mixed as China’s 6.4% growth rate for January-March beat analysts’ expectations: the Shanghai Composite is up 0.3% while Hong Kong’s Hang Seng index is 0.1% lower. Australia’s All Ordinaries index turned 0.3% lower as Australian dollar accelerated its climb against the greenback.

Brent Gains

Brent futures are edging higher today. The American Petroleum Institute late Tuesday report indicated US crude inventories fell by 3.1 million barrels last week while gasoline inventories dropped by 3.6 million. Prices ended higher yesterday. June Brent rose 0.8% to $71.72 a barrel on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.