Market Brief

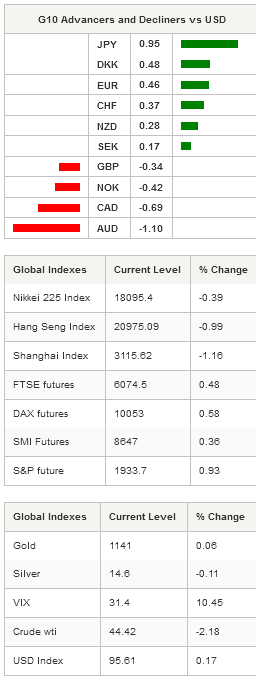

Canada’s June GDP surprised to the upside yesterday as it came in at 0.5%m/m versus 0.2% median forecast and -0.2% previous reading while the economy contracted by 0.5% saar during the second quarter, better than estimate of -1%. USD/CAD dropped more than 1 figure on the headline, reaching 1.3119. However, the respite was short-lived for the loonie due to increase pressure on crude oil prices and weak manufacturing data in August. According to the RBC, the Canadian manufacturing sector entered a contraction phase in August as the PMI printed at 49.4 compared to 50.8 in July. We think that the odds of a rate cut from the RBC have increased significantly and we therefore maintain our negative bias on the CAD ahead of RBC rate decision due next week.

A fresh batch of US data has been made available yesterday. Unfortunately we got no clear signal from the manufacturing sector as the Markit PMI came in at 53 above median forecast and previous read (both at 52.9) while the ISM manufacturing PMI printed at 51.1 versus 52.5 consensus and 52.7 previous read. On the bright side, construction spending rose 0.7%m/m in July, beating market expectations of 0.6%. The single currency is gaining ground on the dollar as the currency pair is back around 1.13, above the 1.1262 threshold implied by the 50% Fibonacci level (on July-August rally).

The Australian economy is not in such a great shape as it expanded by only 0.2%q/q (s.a.) while market participants were looking for a growth figure of 0.4%, this is the weaker result since Q1 2013. The Aussie lost more than 1% against the dollar since yesterday and moved quickly below 0.70 before bouncing back around 0.7030. All in all, the weak data are boosting speculation for another rate cut by the RBA. Traders are now pricing a 50-50 chance of a rate cut at the November meeting, meaning that there is room for further Aussie depreciation against the USD.

On the equity side, Asia regional equity markets are trading into negative territory, again. The Shanghai Composite is down -1.61%, Shenzhen -2.48% while in Hong Kong the Hang Seng retreats -0.99%. In Japan, the Nikkei 225 lost 0.39% and the TOPIX -0.82%. Australian shares edged higher by 0.10% and in New Zealand the S&P/NZX index dropped 1.15% after data indicated that commodity prices fell 5.2% in August. NZD/USD is treading water around 0.6350, slightly below the key level lying at 0.6403 (Fibo 61.8% on March 2009-July 2011).

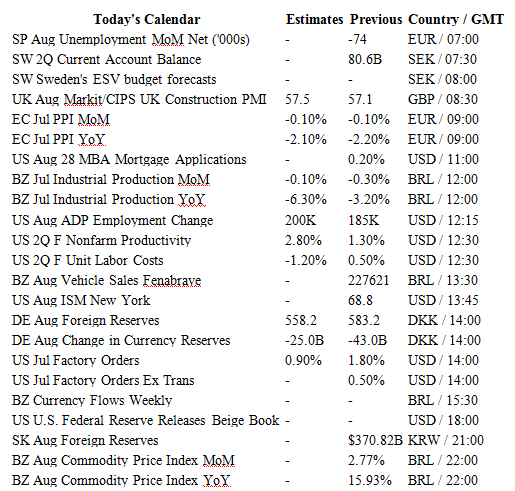

Today traders will be watching MBA mortgage application ADP unemployment change and factory orders from the US; Markit/CIPS construction PMI from UK; industrial production and Selic rate decision from Brazil.

Currency Tech

EUR/USD

R 2: 1.1871

R 1: 1.1714

CURRENT: 1.1257

S 1: 1.1017

S 2: 1.0809

GBP/USD

R 2: 1.5930

R 1: 1.5803

CURRENT: 1.5285

S 1: 1.5330

S 2: 1.5171

USD/JPY

R 2: 135.15

R 1: 125.86

CURRENT: 120.14

S 1: 115.57

S 2: 113.86

USD/CHF

R 2: 0.9904

R 1: 0.9799

CURRENT: 0.9646

S 1: 0.9151

S 2: 0.9072