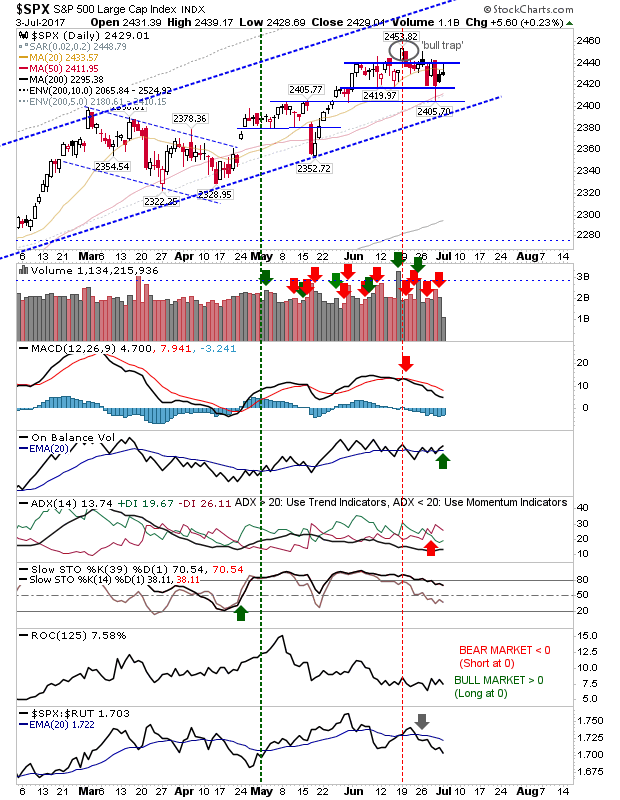

Heading into the July 4th holiday, US indices experienced a mix of reactions. Large Caps came out relatively unscathed with only a minor reaction to last week's selling.

The S&P remains caught inside its tight trading range since the start of June. There is an On-Balance-Volume 'buy' trigger but other indicators like the MACD and ADX are bearish.

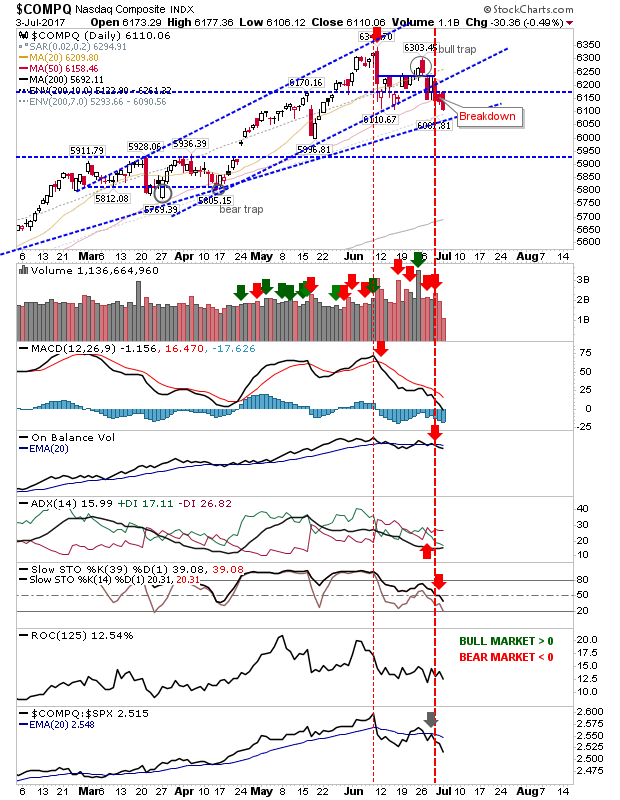

Tech indices continue to feel the pain with the NASDAQ losing 0.5% on a bearish engulfing pattern. Bearish engulfing patterns typically mark reversals, but in this case it points to continued selling pressure in what yet could turn into a new downward channel.

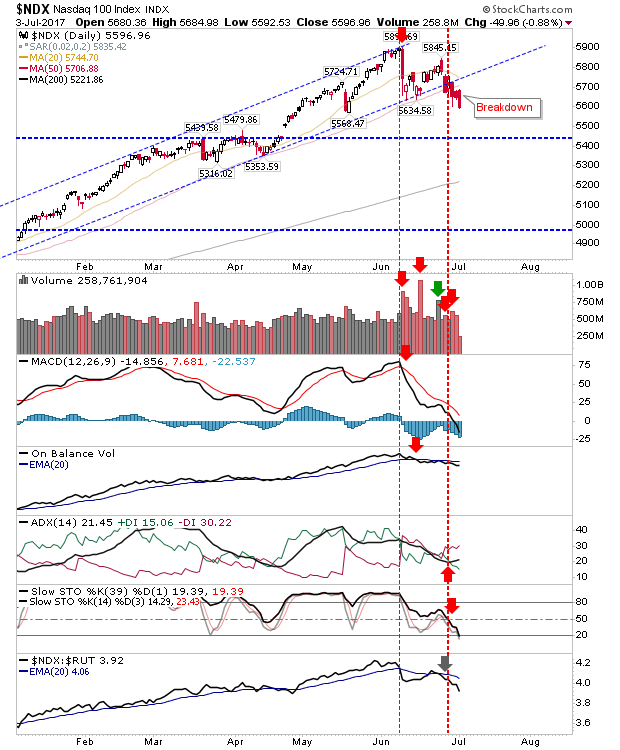

The NASDAQ 100 experienced an even greater percent loss as it drifted ever further out of its rising channel. Technicals are firmly net bearish.

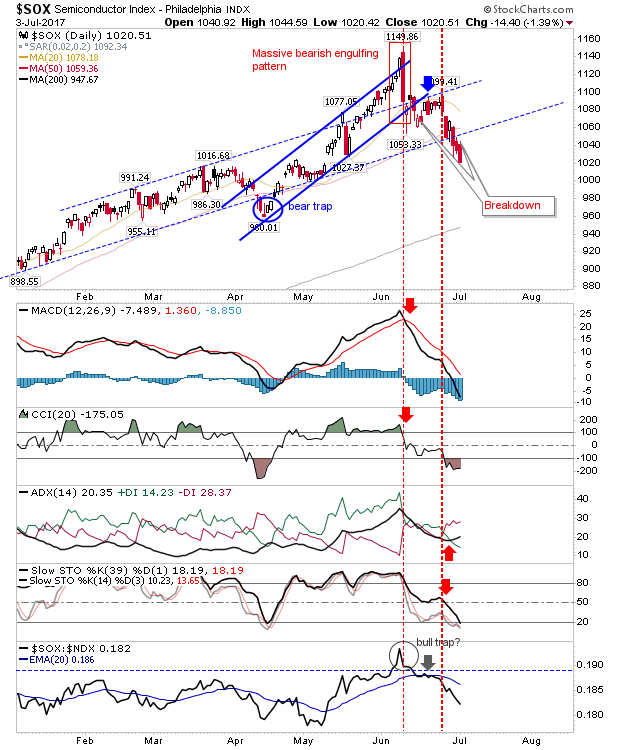

The Semiconductor Index took the greatest hit, losing over 1% as it continues to struggle to recover from its channel loss.

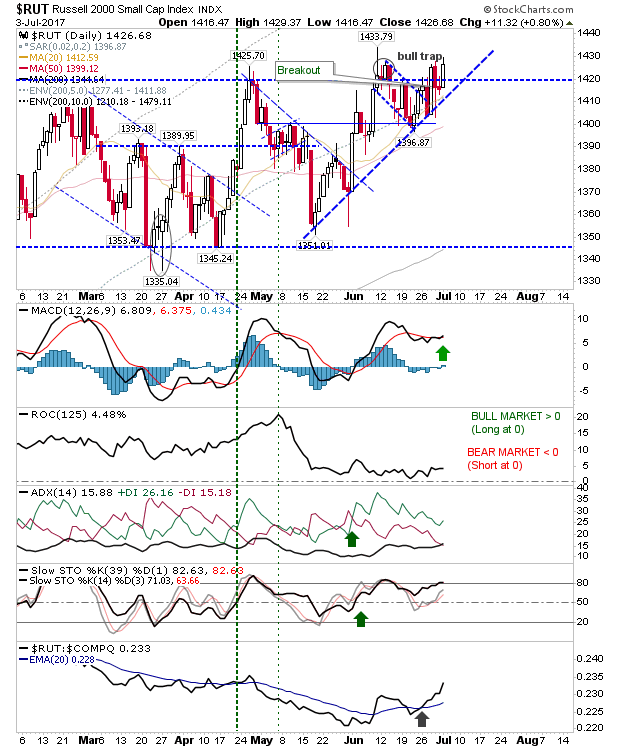

Only the Russell 2000 offered any strength as it again pushed into the June 'bull trap' and continues to suggest a major breakout is pending. Technicals show a fresh MACD trigger 'buy'.

Bulls really have one index to watch, the Russell 2000. Other indices are fishing for a swing low but haven't found one yet. How will traders react post-holiday?