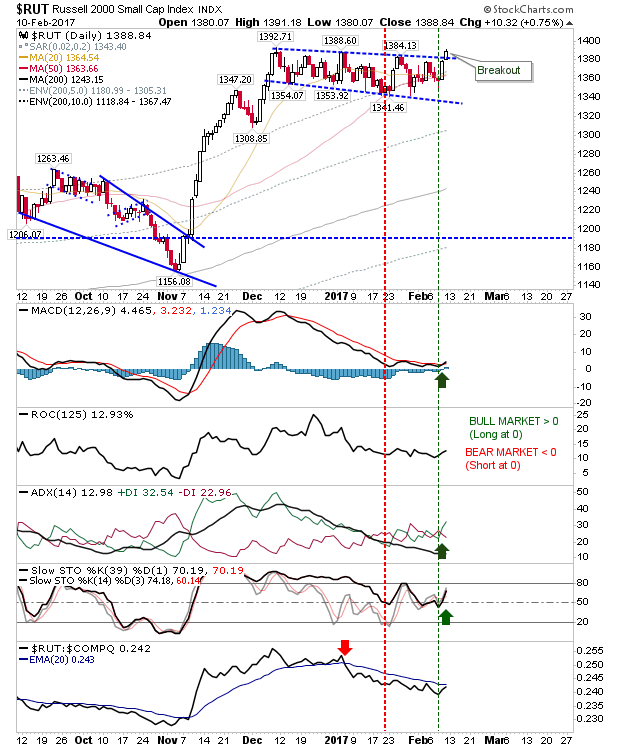

While volumes have hardly been inspiring, last week was another good week for markets. Best of the action came in the Russell 2000, which has traded sideways since the start of December and didn't kick on after the 'huge' rally following Trump's election. Friday's 0.75% gain didn't look like much but it did take it above the previous set of swing highs. It also helped in that it was supported by fresh 'buy' triggers for the MACD, Slow Stochastics and ADX

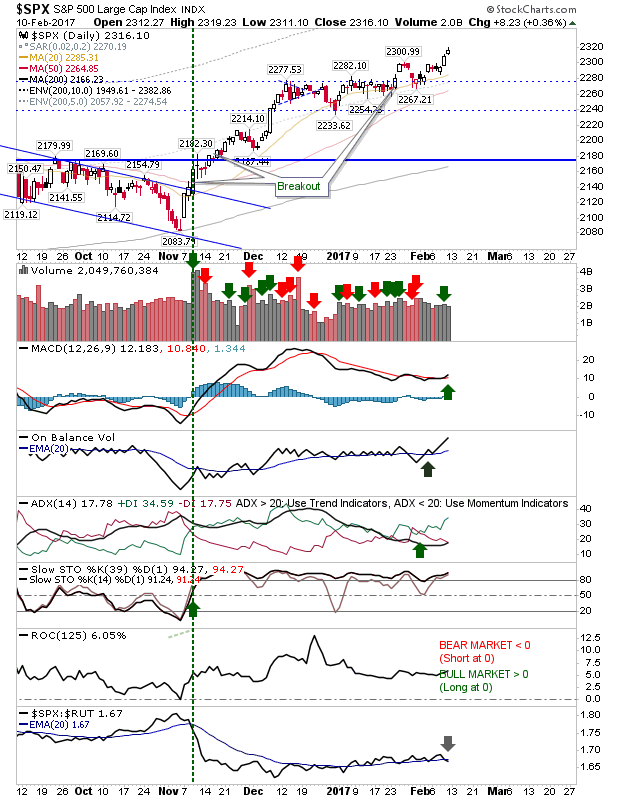

The S&P and Dow Industrials managed new closing highs; albeit on light enough volume and with relative under-performance against the Russell 2000. Having said that, On-Balance-Volume has consistently climbed higher, while the MACD generated a fresh 'buy' trigger above the bullish zero line. Slow-and-steady may win the race here.

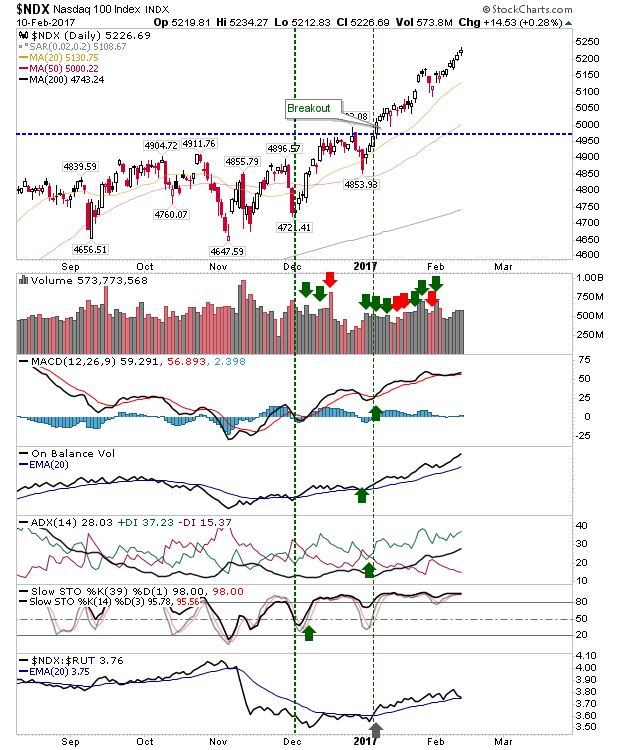

The NASDAQ 100 has been the real high flyer. It trades 10.2% above its 200-day MA, which is getting a little rich, but any sharp decline on profit-taking is likely to get bid up quickly; it would take a failure to post a new high following such a decline to make bulls worry.

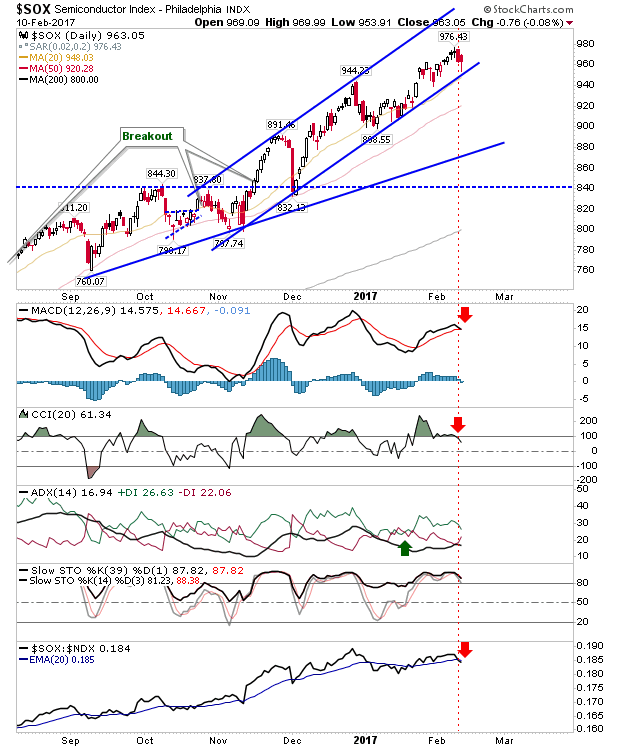

The index which may time the next decline is the Semiconductor Index. It generated a 'sell' trigger in its MACD and CCI as prices returned to rising channel support. Watch for a break of this channel in the coming week. Should one emerge, then profit-taking may spread into the NASDAQ and NASDAQ 100.

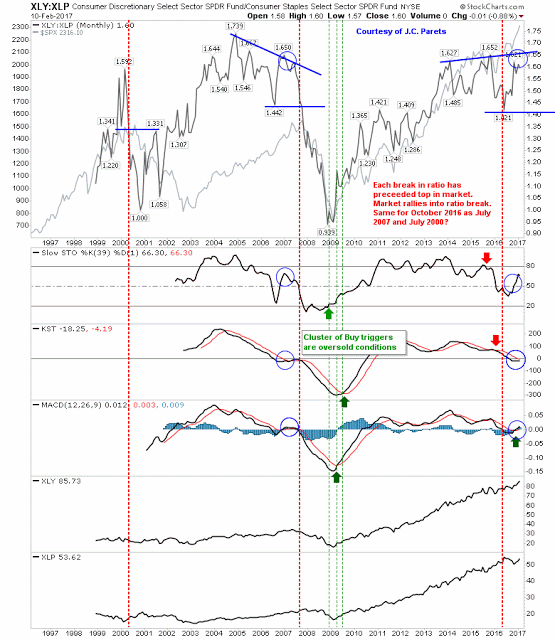

Breadth metrics have recovered enough to suggest there is still more upside. The relationship between Consumer Staples (via Consumer Staples Select Sector SPDR (NYSE:XLP)) and Discretionary ETFs (via Consumer Discretionary Select Sector SPDR (NYSE:XLY)) suggest there is room to run before getting to tag resistance at 1.65.

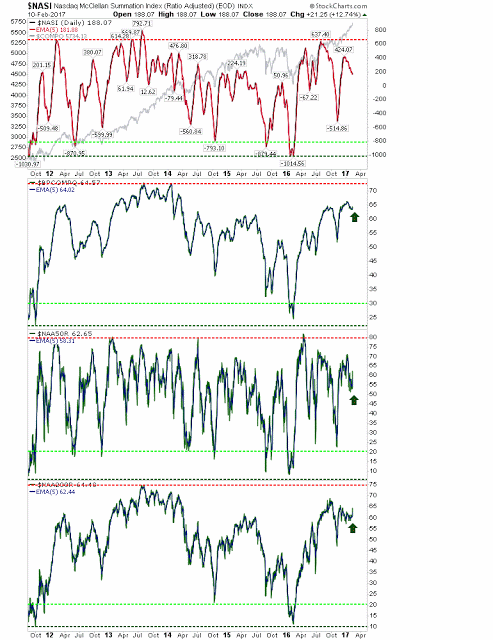

The NASDAQ Summation, Bullish Percents, and Percentage of Stocks above 50-day/200-day MAs are also on the rise, but not yet overbought. This rally could last well into the latter part of 2017.

This coming week, it will be about tracking the gains of this past week and watching for any heavier volume profit-taking, which may be followed by low volume buying.