Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

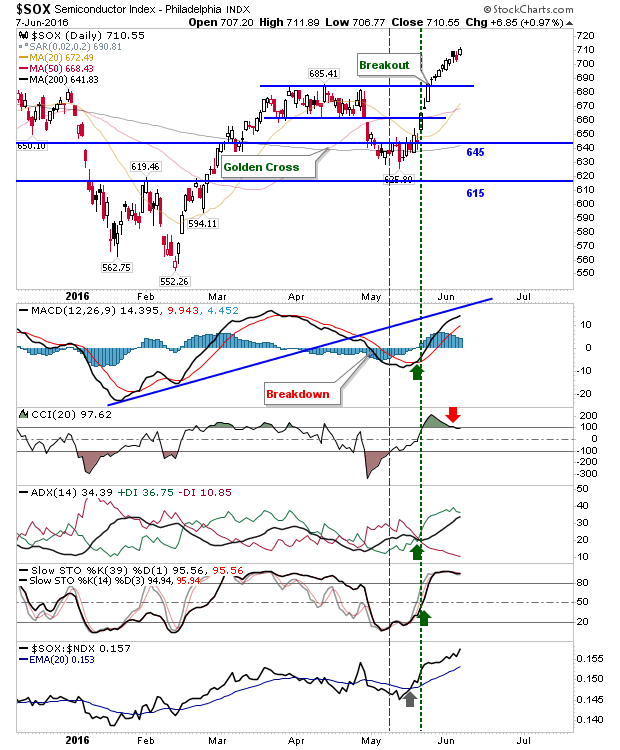

There wasn't a whole lot to say about lead indices yesterday, but buyers of the Semiconductor Index will be very happy heading into today. After what amounted to two days of bearish action, yesterday's buying was enough to negate the black candlestick and return the index to its earlier rally. The relative performance of this index against the NASDAQ 100 continued to improve.

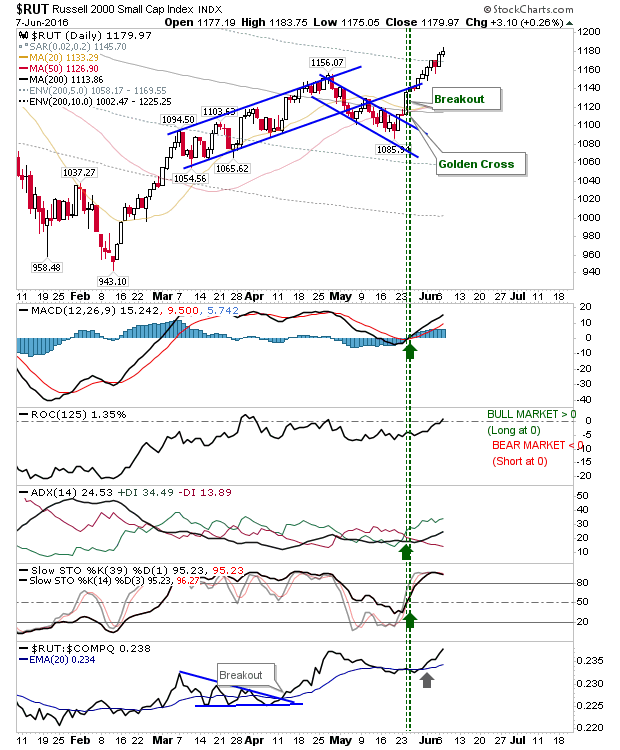

The Russell 2000 was another index to register a successful day yesterday. While its gain was more modest compared to the Semiconductor Index, it continued to post strong out-performance gains relative to the NASDAQ and S&P.

What's key about the action in the Semiconductors and the Russell 2000 is its importance for secular bull market leadership. Weekly charts haven't yet reflected this, but the daily charts are looking particularly good in this regard.

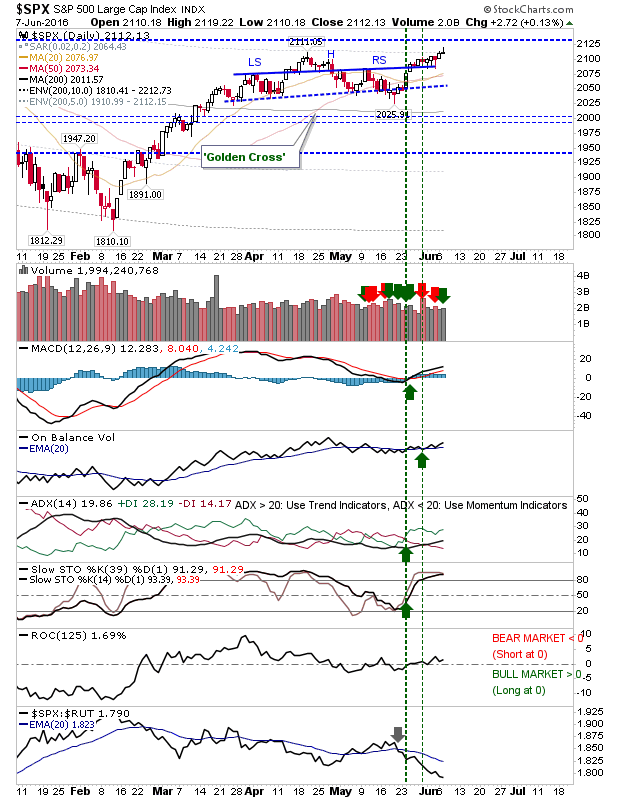

Not enough to say about other indices. Some may argue for a potential topping 'doji' in the S&P, but the index has effectively negated the bearish head-and-shoulder pattern with technicals all strongly positive.