It seems every market gain is soon followed by a loss (and a potential shorting opportunity), but each time shorts are left hung out to dry. Will yesterday any different? Probably not, but whipsaw trades remain a key risk after a bounce like the one we have seen.

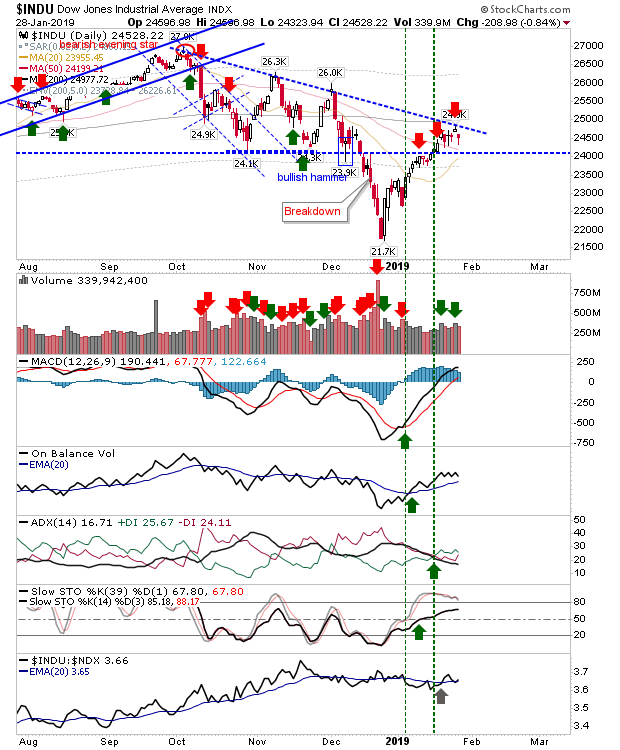

Of the low hanging fruit, we have a Dow Jones Index which has reversed off resistance (and 200-day MA), albeit with a small bullish hammer (the significance of which is reduced as the index is overbought on near term stochastics—but not on an intermediate time frame). The 50-day MA is available to use as support, and relative performance is positive versus the NASDAQ 100. While action suggests this will break through its 200-day MA, the short position has a small edge until proven otherwise.

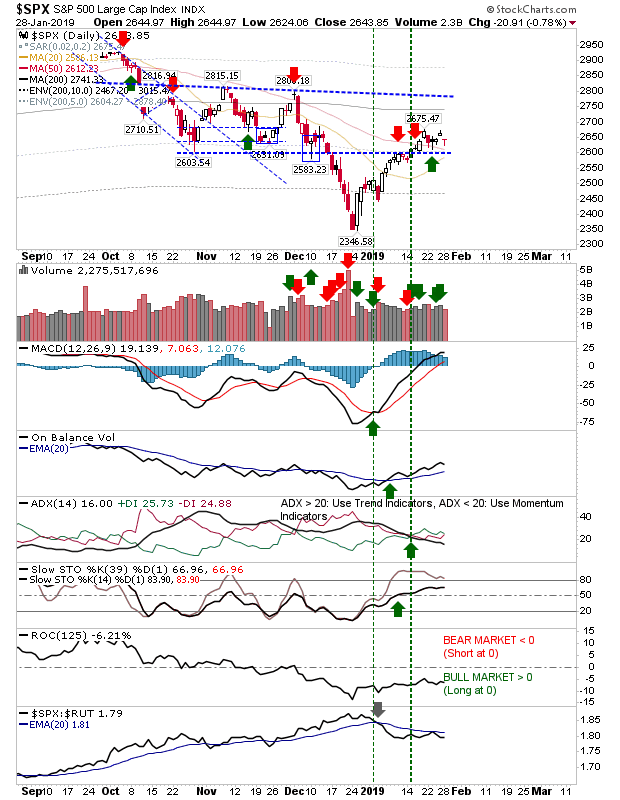

The S&P is clustered around the 50-day MA with bullish technicals, bar the relative underperformance against the Russell 2000. Selling volume was also lighter, which is another tick in the bull column. Action over the past week looks like a consolidation of the rally; look for another move higher as long positions look favored.

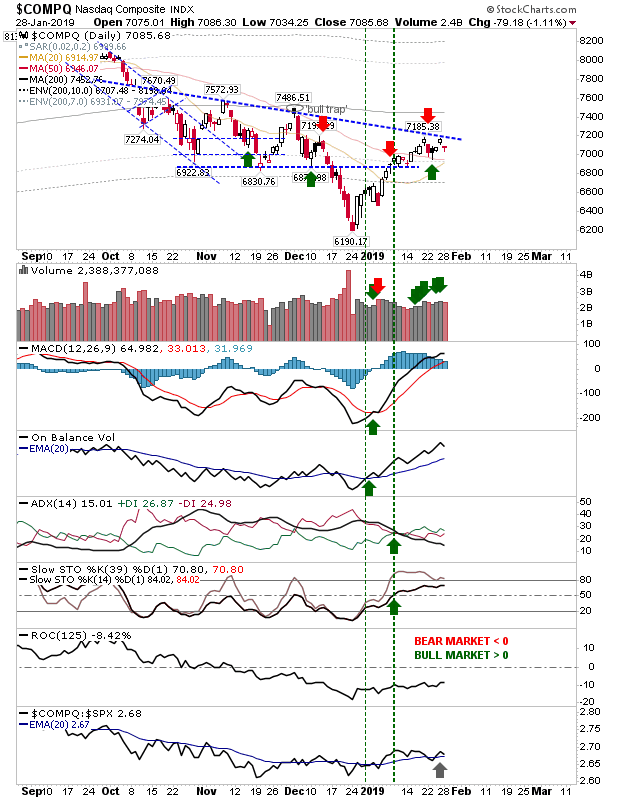

The NASDAQ also is lingering at declining resistance. I had marked a resistance-level shorting opportunity, which would still be in play, but yesterday's action with technicals the way they are, suggests bulls are going to outlast bears.

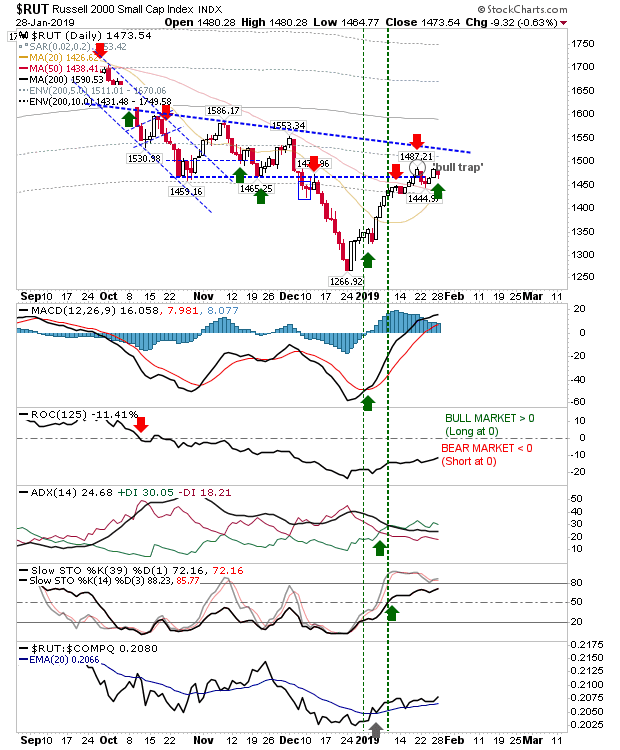

The Russell 2000, having recovered support, is challenging the 'bull trap' with room for upside to declining resistance. With technicals bullish and relative performance in the ascendancy, it looks like longs will get another chance to press their advantage and potentially push through declining resistance.

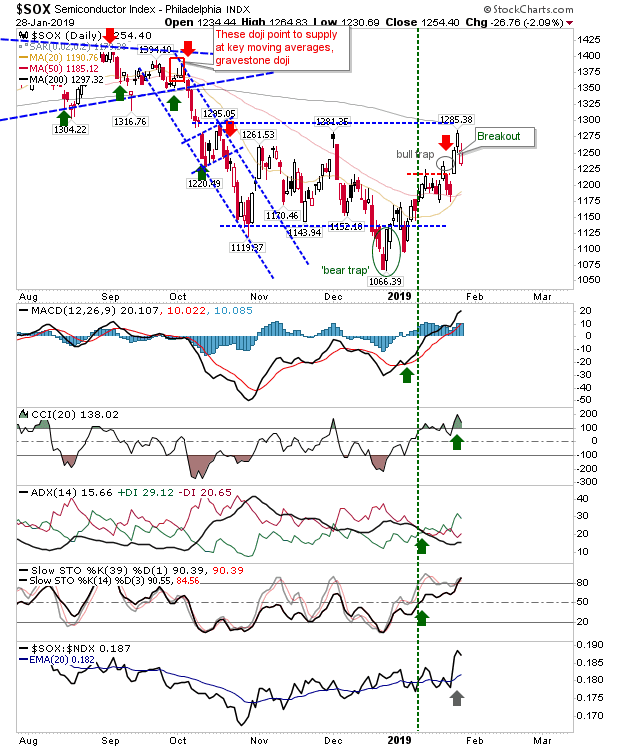

Semiconductors took the biggest loss on the day but this is coming after a couple of days of stronger gains; the index has the volatility but it has so far sided with bulls. This index looks like it will be the guide for the lead indices.

Those who are short may get another day out of their trades. Longs can look to trade with risk measures on a loss of last week's lows or 50-day MAs. With technicals still bullish, odds remain favorable for long positions.