Market Brief

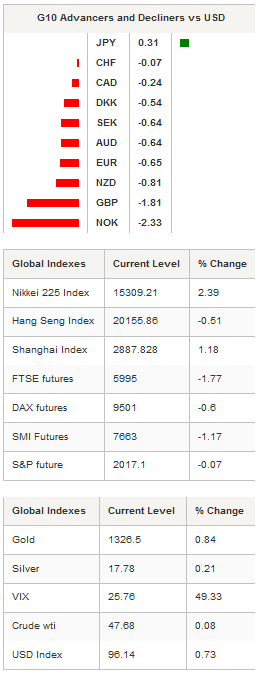

Brexit is and will remain the main driver in financial markets and it will certainly take months before the smoke clears and uncertainty returns to any form of normality. In Japan, the Nikkei and the Topix indices partially recovered from Friday’s massive sell-off. The latter rose 1.77%, while the Nikkei 225 was up 2.39%. Mainland Chinese equities partially reversed last week’s losses, suggesting that the market overreacted - to some extent - to the Brexit vote. However, in Europe, risk sentiment is set to worsen further as the market realises that the uncertainty stemming from the UK’s decision is not only here to stay but that it is likely to grow over time. The UK must now negotiate its exit out of the EU and with a country that appears more than divided than ever - Scotland is determined to secure its position within the EU and is ready to leave the UK, while Northern Ireland will also likely make a move in the same direction - with politicians resigning at every twist and turn and an EU that wants Britain out as soon as possible, the months ahead will be rough and choppy in the financial markets.

European equities took another blow on Monday, failing to follow the Asian lead. Futures on the Euro Stoxx 600 were down 0.97%. In the UK, the Footsie was off 1.77% amid mounting political uncertainty following David Cameron’s resignation on Friday as well as the several Labour official resignations on Sunday, putting Jeremy Corbyn’s leadership of the party in question. In Switzerland, the SMI was off 1.17% and the French CAC was down 0.79%.

In the FX market, the pound sterling took another hit on Monday after falling 9.30% on Friday against the US dollar. In Tokyo, GBP/USD fell another 1.80%. In Norway, one of the countries most exposed to the UK market, the krone was off 2.33% against the US dollar, with USD/NOK jumping to around 8.60. The Japanese yen was trading slightly higher and manged to remain above the 100 threshold.

After hitting 1.0623 on Friday morning and bouncing back to 1.0880, EUR/CHF consolidated at around 1.0750 after the Swiss National Bank declared it was intervening in the market to stabilise the Swiss franc. Before the Brexit vote, we were wondering whether the central bank would have enough fire power to face a Brexit situation. It is clear now that the market still fears the SNB and is confident that the institution is strong enough to face such situation. We are now awaiting the release of SNB data which will reveal the extent to which they have actually intervened in the FX market.

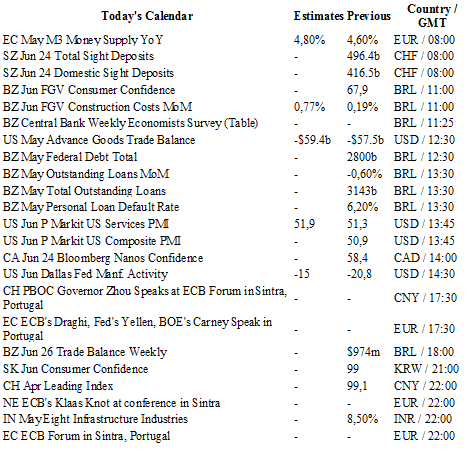

The developments of the Brexit story will continue to remain in the spotlight; however economic indicators will continue to be release as planned.

Currency Tech

EUR/USD

R 2: 1.1479

R 1: 1.1428

CURRENT: 1.1053

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.5018

R 1: 1.3981

CURRENT: 1.3457

S 1: 1.3229

S 2: 1.3045

USD/JPY

R 2: 111.91

R 1: 106.84

CURRENT: 102.11

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9804

CURRENT: 0.9739

S 1: 0.9522

S 2: 0.9444