S&P 500, Nasdaq log sixth straight gain

US stock indices march to new record highs continued on Tuesday. The dollar strengthening persisted: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 92.494. The S&P 500 gained 0.1% to record high 2751.29 led by healthcare and financial shares. Dow Jones industrial average rose 0.4% to new record 25385.80. The NASDAQ Composite index added 0.1% to all-time high 7163.58. Both S&P 500 and Nasdaq logged a sixth straight gain for 2018. Futures indicate lower market openings today.

German data surprise lifts European stocks

European stocks advanced on Tuesday on positive German data. The British Pound joined the euro in pullback against the dollar. The Stoxx Europe 600 rose 0.4%, the fifth winning session in a row. The German DAX 30 added 0.1% to 13385.59. France’s CAC 40 jumped 0.7% and UK’s FTSE 100 gained 0.5% to 7731.02. Indices opened lower today.

China’s December inflation less than expected

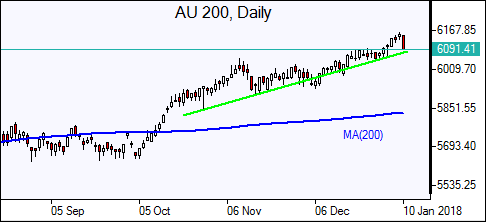

Asian stock indices are mixed today. Nikkei slipped 0.2% to 23797.50 with yen strengthening against the dollar accelerating as Japanese bond yields rose after the Bank of Japan trimmed its purchases of longer dated bonds. Chinese stocks are extending gains despite below expectations December inflation: the Shanghai Composite Index is up 0.2% and Hong Kong’s Hang Seng Index is 0.4% higher. Australia’s ASX All Ordinaries Index is down 0.6% as Australian dollar resumed advancing against the greenback.

Oil steady

Oil futures prices are steady today. Prices rose Tuesday on expectations for an eighth straight weekly drop in US crude inventories. The American Petroleum Institute industry group reported late Tuesday US crude stocks fell by 11.2 million barrels to 416.6 million. March Brent rose 1.5% to $68.82 a barrel Tuesday.Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.