Finance and technology rally despite GDP downgrade

US stocks recovered most of previous day loss on Thursday led by finance and technology rally. The S&P 500 gained 0.6% to 2716.31. Dow Jones average added 0.4% to 24216.05. The NASDAQ Composite rose 0.8% to 7503.68. The dollar strengthening slowed as Q1 GDP was downgraded to 2% from initial reading of 2.2%: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, added less than 0.1% to 95.28 but is lower currently. Stock index futures point to higher openings today.

DAX leads European indices losses

European stock indices pulled back erasing previous session gains as the two-day European Union meeting in Brussels started Thursday. The euro turned higher against the dollar while the British Pound continued the slide and both are up currently. The Stoxx Europe 600 index fell 0.8%. Germany’s DAX 30 dropped 1.4% to 12177.23. France’s CAC 40 lost 1% and UK’s FTSE 100 slipped 0.1% to 7615.63.

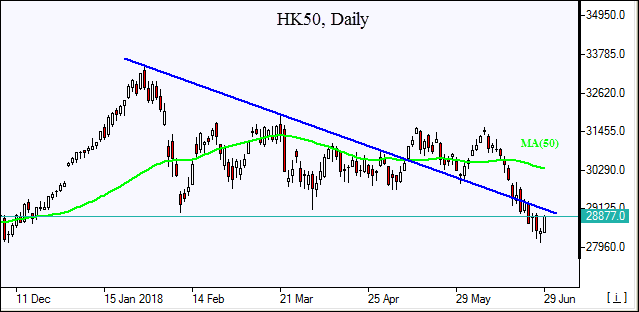

Chinese stocks lead Asian indices recovery

Asian stock indices are mostly higher today after China eased foreign investment limits. Nikkei ended 0.1% higher at 22304.51 helped by yen continued climb against the dollar. Chinese stocks are rallying: the Shanghai Composite Index is 2.2% higher and Hong Kong’s Hang Seng Index is up 1.6%. However Australia’s ASX All Ordinaries Index is down 0.3% as Australian dollar accelerated gains against the greenback.

Brent climb persists

Brent prices are rising today. Prices ended higher yesterday on supply concerns about US sanctions on Iranian oil and production issues at a Canadian oil sands facility: Brent for August settlement closed 0.3% higher at $77.85 a barrel on Thursday.