Forex News and Events

FOMC meeting to take centre stage

The US dollar tumbled during the Asian session on Wednesday, losing ground against all G10 currencies, as investors across the globe prepare for the second interest rate hike in the US since the Federal Reserve started its normalisation process exactly one year ago. The euro stood out as the best performer this morning as it rose 0.32% against the greenback, while the New Zealand dollar gained 0.30%. Asian equities were mostly trading in negative territory with Chinese stocks sliding 0.78%, while the Japanese Topix was off 0.10%.

European stocks were no exception with the Euro Stoxx 600 falling 0.40% as the DAX and the CAC were off 0.30% and 0.39% respectively. Such market reaction is quite normal, as investors typically prefer to scale down the risk of their portfolio ahead of a FOMC rate decision.

Even though today's rate hike sounds like a done deal and there is almost no doubt that the Fed will push the button and increase its benchmark rate by 25bps, which would lift the target band to between 0.50% and 0.75%, there is much more at stake in fact. Indeed, the only thing the market will care about is the dots plot (FOMC members' own projections for future policy) and any insight into Janet Yellen’s thinking during the press conference.

We do not expect Yellen to mention the upcoming Trump presidency as the Fed has reiterated many times that the Committee does not talk about politics during the meeting. However, she may suggest that the upside risk to inflation has recently increased, but she will most likely not mention the fact that it is linked to rising inflation expectations amid Trump’s fiscal stimulus plan.

In our opinion, the market has been overly optimistic regarding the potential positive effects of a Trump presidency. Many of his promises would take time to be implemented, in addition to the fact that a few of them will be difficult to pass at congress. Therefore, we do expect a correction of the US dollar as the current strength is overdone in our opinion.

Tankan survey shows optimism in the Japanese economy

The last quarter Tankan survey of business sentiment issued by the Bank of Japan was released last night. The report highlighted improving market business conditions from big manufacturers. The Tankan large Manufacturing Index hit a one-year high, going from 6 to 10. We recall that a positive reading indicates optimism on the economic outlook.

According to the survey, Japanese companies are likely to keep their spending plan alive, which is a good indicator for the Japanese economy. Indeed, big firms should increase their capital expenditure by 5.5% before the current fiscal year ending in March 2017. This definitely supports market expectations that monetary stimulus will not be added in the medium-term. In our view, we believe that there is an ongoing recovery in global trade and that should support Japanese exports.

Next week, the Bank of Japan will review its monetary policy and we believe that it should remain steady. It is also clear that the ongoing yen weakness is providing some relief to Japanese policymakers.

Swiss FX Reserves Surge

For the Swiss National Bank a Fed rate hike cannot come fast enough. IMF Special data disseminations released today indicated an almost CHF17bn surge in total reserves excluding gold. The total figure climbed to 653,786 from 636,091, which represents just south of 100% of current GDP, a daunting figure for any policymaker. Given the lower exchange rate given to EUR/CHF at 1.0883 from 1.0922 this jump is not a function of valuation but rather SNB FX intervention.

The cost of protecting the Alpine economy from excessive CHF appreciation is mounting. A Fed 25bp hike this evening should temporarily take pressure off the CHF, however, since political uncertainty has been a primary driver of FX movement and is expected to continue in 2017, the CHF will remain under constant appreciation threat. The SNB policy meeting tomorrow should come under the light of new global reflation hopes and increasing prospects for central bank normalization.

Macro trends which should help the SNB challenging task of debasing the CHF. The SNB will also publish an updated inflation forecast and growth outlook. While in the near term focus on interest rate differentials should give EUR/CHF a minor boost, growing event risks in Europe and uncertainty over the meaning of the ECB policy strategy EUR/CHF should shift lower.

Currently, FX intervention seems to be the policy tool of choice for the SNB as lower interest rates, despite insistence of board members is an unlikely tool. With inflation starting to increase, we could see the SNB become less rigid in protecting the EUR/CHF unless moves get excessive.

Gold - Pausing Above Former Resistance.

The Risk Today

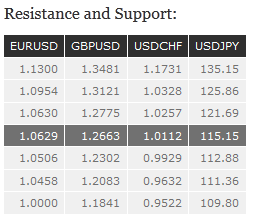

EUR/USD is pushing slightly higher ahead of the Fed meeting. Yet, hourly resistance is far away given at 1.0874 (08/12/2016 high). Support can be found at 1.0506 (05/12/2016 low). Buying pressures seem nonetheless stronger around 1.0600. Expected to keep pushing slightly higher. In the longer term, the death cross late October indicated a further bearish bias. The pair is monitoring key support given at 1.0458 (16/03/2015 low) is on target. Key resistance holds at 1.1714 (24/08/2015 high).

GBP/USD is riding higher within uptrend channel. Hourly support is given at 1.2302 (18/11/2016 low). Expected to show renewed pressures towards resistance at 1.2771 (05/10/2016 high). The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY's bullish momentum is fading. The pair is having some difficulties to break 116.00. Hourly support can be found at 114.74(12/12/2016 low). Stronger support lies at 112.88 (05/12/2016 low). Expected to see continued short-term bearish pressures. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF is trading lower. Key support is given at the parity. Hourly resistance lies at 1.0205 (30/11/2016 high). The technical structure suggests that the buying pressures are not enough. The road is wide-open for continued weakness. In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.