Monday June 20: Five things the markets are talking about.

With Britain going to the polls Thursday (June 23) to vote on its European Union membership is just one of several significant events this week that could have a massive impact on the ECB.

Elsewhere, in Spain a national election could raise further questions about the future of the EU and the EUR. In Germany, the nation’s top court is expected to deliver its long-awaited verdict on a key ECB crisis-fighting program – a decision that experts suggest could put pressure on the central bank. Finally, Draghi and company is to implement the final leg of their March stimulus program – a series of subsidized loans for banks.

Sterling efforts aside, all the above events could have a significant impact on the single currency (€1.1345).

Elsewhere, Fed Chair Janet Yellen testifies to the U.S. Congress on Tuesday and Wednesday.

1. Risky assets rally as ‘Stay’ camp seizes the lead in new Brexit poll

Global bourses are in rally mode this morning after weekend polls suggested the U.K. was more likely to vote to remain in the European Union in Thursday’s referendum.

The Stoxx Europe 600 has jumped +2.9% in early trade, extending Friday’s momentum. A sector that seeing some of the strongest gains this morning is Europe’s banking sector (+4.2%). The MSCI Asia Pacific Index rose +1.7%, led by gains in raw-materials producers and energy stocks. Currently, futures prices are pointing to a +1.2% opening gain stateside for the S&P 500.

A survey published in the Mail on Sunday showed that +45% backed the U.K. staying in the E.U, compared with +42% in favour of leaving. Opinium poll for The Observer Brexit poll: +44% for remain, +44% for leave (conducted before most respondents had heard the news of the murder of MP Jo Cox. A BMG phone poll for the Herald Brexit poll: +46% for remain, +43% for leave while BMG Online poll: +41% for remain, +51% for leave (both polls conducted on June 10-15, before the murder of MP Jo Cox)

A concern about a U.K. ‘Brexit’ has sent stocks plummeting in recent sessions, while pushing sovereign bond yields to new record lows, as investors feared a prolonged period of uncertainty.

Indices: Stoxx50 +3.5% at 2,944, FTSE +2.6% at 6,179, DAX +3.4% at 9,959, CAC 40 +3.2% at 4,329, IBEX 35-35 +3.3% at 8,640, FTSE MIB +3.2% at 17,466, SMI+2.5% at 7,906, S&P 500 Futures +1.4%

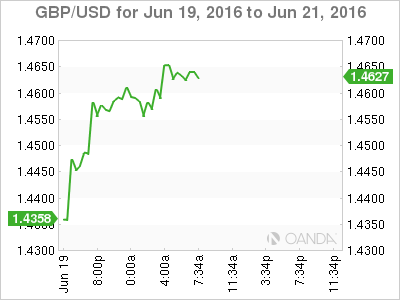

2. Sterling jumps by over +2% for its biggest gain since 2008

The pound has extended its gains overnight, hitting a three-week high outright (£1.4674) on the back of the weekend opinion polls support. EUR/GBP has fallen -1.5% to a two-and-a-half week low of €0.7731.

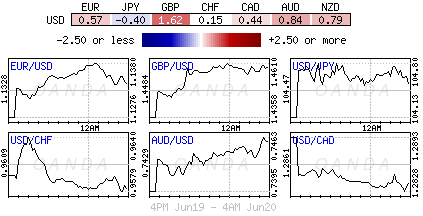

It is not only the pound that is benefitting from the polls pointing to a lower risk of a U.K. vote to leave the EU on Thursday. The EUR has risen +0.6% outright (€1.1345), having earlier hit an overnight peaked at €1.1384.

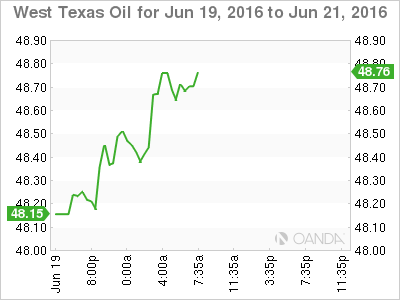

Declining risk aversion and gains in crude oil (WTI +$48.72, Brent +$50) prices are helping riskier and commodity-linked currencies.

The Aussie has risen +1% to a one-and-a-half week high outright (A$0.7472). The USD/CAD has fallen -0.6%, while USD/NOK and USD/RUB lose 1%.

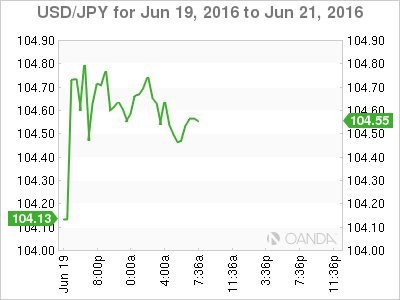

Meanwhile, the safe-haven yen slides. USD/JPY is over +100 pips off the lows from last week to test above ¥104.80. However, the pair still remains below the pivotal resistance area of ¥105.50 that was breeched after the Bank of Japan (BoJ) did not add any stimulus measures last week.

3. Yields, Gold and Oil

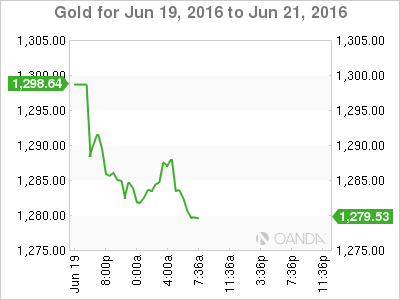

Last week sovereign bonds staged a global rally with G7 yields (Japan, Germany and the U.K.) sliding to all-time lows as the potential for a British exit from the E.U fueled demand for the safest assets.

A Fear of Brexit also influenced the Fed to stand pat last week. This morning’s increased risk appetite to start this week has global yields backing up – U.S. 10-Year treasuries +3bps to +1.64%, Bunds +2bps to +0.04%.

Deflated Brexit risks has the ‘yellow’ metal slipping -1.1% ($1,284) this morning. Last week gold had surged +1.9% ($1,313.50) on exit fears. As of June 14, CFTC reports indicated that gold speculators held the second biggest bet ever that the precious yellow metal would rally further.

With the ‘big’ dollar declining this morning across the board is lending support to crude oil prices – WTI +$48.72, Brent +$50.

4. Reserve Bank of India’s (RBI) Rajan bows to pressure

India’s rupee (INR 67.41) has clawed back nearly all of its earlier overnight losses after the shock announcement by Raghuram Rajan, the governor of the Reserve Bank of India, would not serve a second-term after September.

The Governors departure has raised the probability of more aggressive rate cuts, by the incoming governor, which in theory could help Indian’s equity market. To date, Governor Rajan has been reluctant to ease monetary policy due to persistently high inflation in India.

The benchmark BSE Sensex 30 stock index opened -0.5% lower, but has since recovered to close flat on the day.

5. BoJ’s Kuroda will not abandon his +2% inflation target

Earlier this morning, BoJ’s Kuroda indicated that the central bank would not abolish its +2% inflation target, even though Japanese policy makers have not been able to meet the goal and have even pushed back the deadline (four occassions).

He said given that Japan has experienced prolonged deflation, it requires “a strong commitment” to overcome such conditions. He reiterated the BoJ’s view that changing deflationary mindset was absolutely necessary. Achieving a positive inflation rate was not sufficient; it was also necessary that a “self-reinforcing cycle of strengthening economic activity gained traction with prices increasing moderately.”

Kuroda came to office three years ago vowing to generate +2% inflation in Japan within two years. The Governor has repeatedly been forced to push back the target, citing falling energy prices as one reason why significant inflation has not domestically.

The BoJ recently said +2% inflation would to be achieved between April 2017 and March 2018, compared with a previous target range of April 2017 to September 2017.