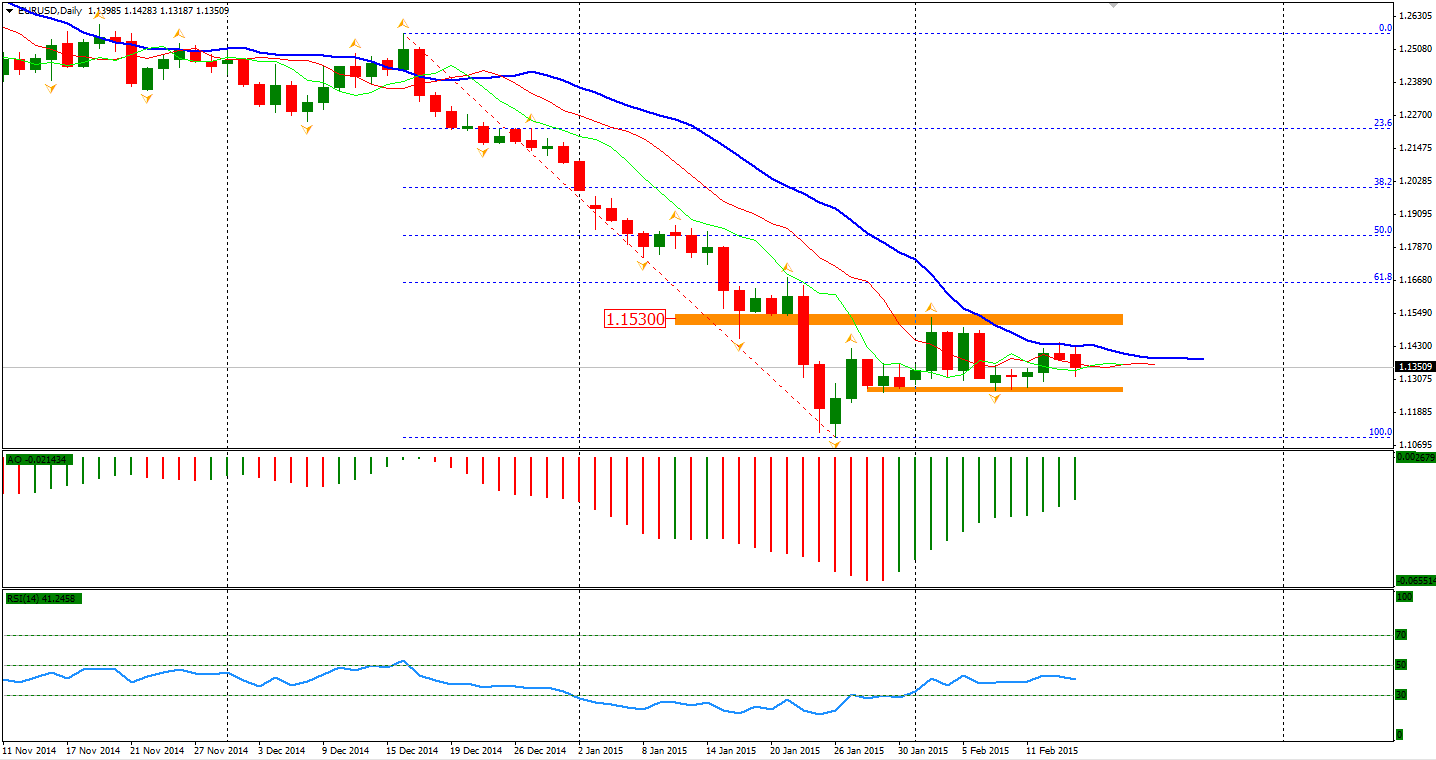

The Euro dropped to a 1.1320 level against the Dollar following news that the Eurogroup and Greek leaders failed to reach an agreement for the bailout program. The new Greek administration tends to continue on its political gaming while the time left for Greece is less than two weeks before the bailout will be withdrawn at the end of this month. There will most likely be another meeting this Friday. The support below for EUR/USD will be 1.1260.

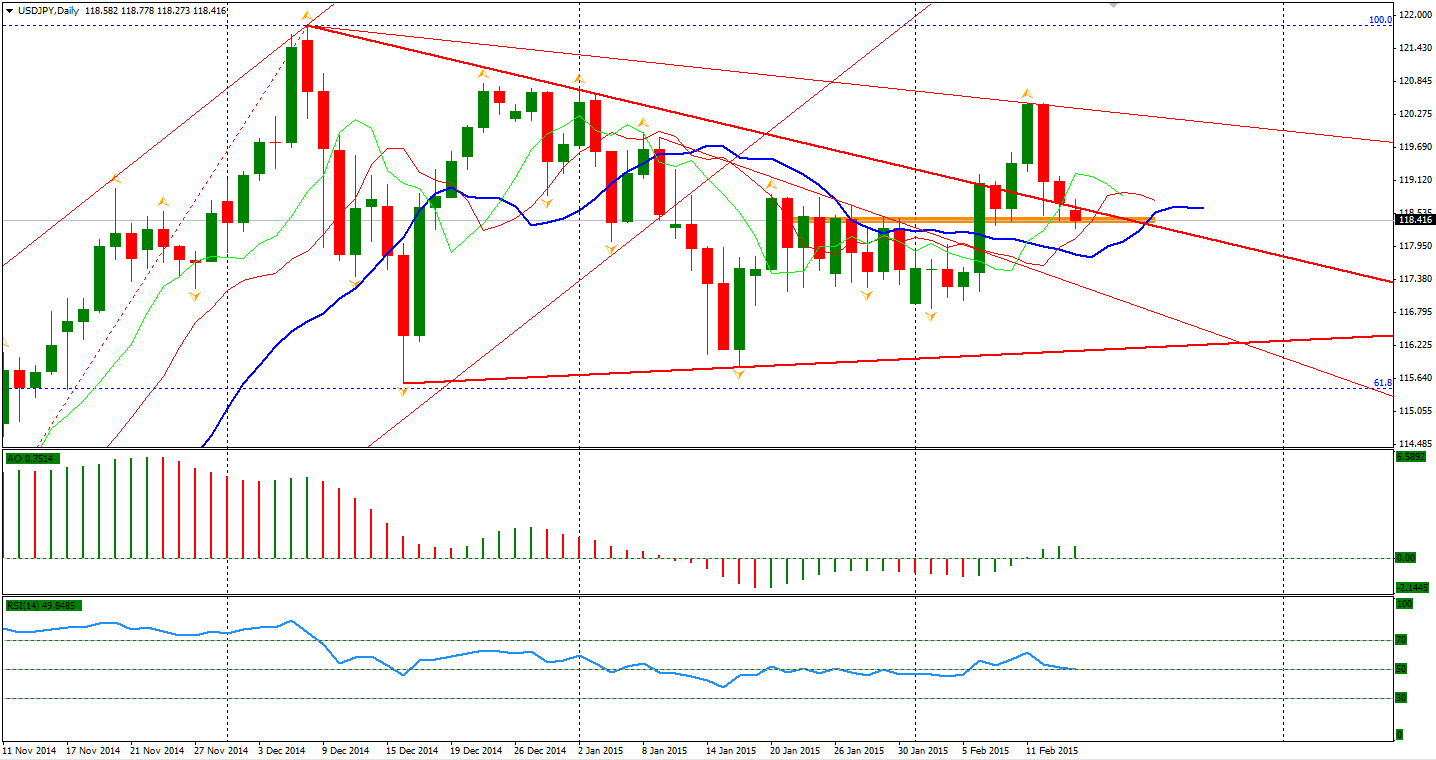

USD/JPY remains above the critical support level of 118.30, whereby a breakout of which may lead to a further fall down to 116. In that case, the previous triangle pattern will turn to a wedge pattern (yes, still a consolidation pattern) and the breakout last week will be confirmed as a false one. Japan recorded a positive GDP growth in the last quarter of 2014. Although the 0.6% quarterly expansion is slower than forecasted, it’s still showing the Japanese economy as temporarily being pulled out of a technical recession.

Market participants now are waiting for the BOJ policy decision this Wednesday, which may disclose whether the central bank will implement additional stimulus for the year. The current outlook of Yen remains uncertain. The significant depreciation as seen in the last 2-3 years is unlikely to happen in 2015. The consolidation may continue in mid-run.

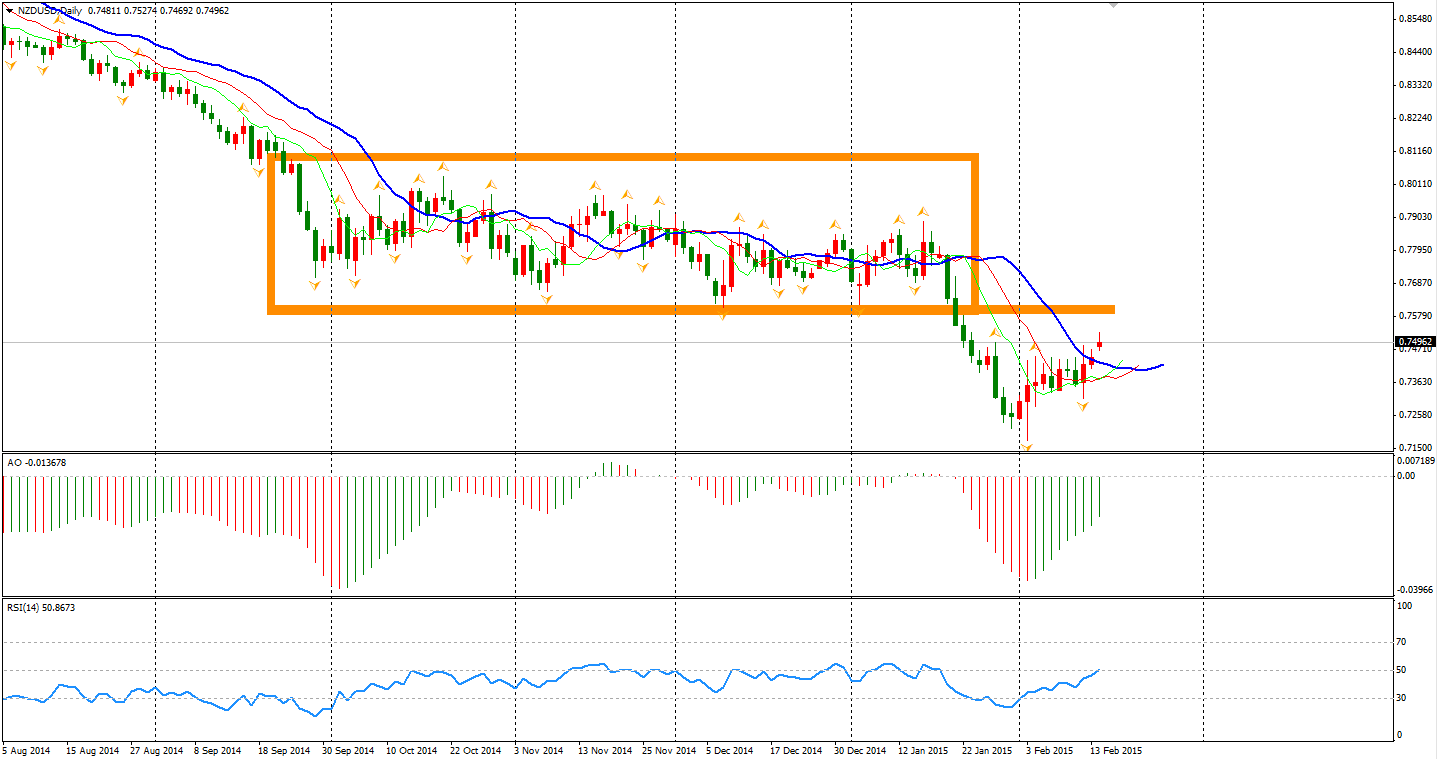

The Kiwi Dollar was the best performer of major currencies as retail sales for this Southern Pacific nation rose by 1.7% in 2014 Q4 – higher than the expected 1.3% growth. NZD/USD rose to 0.75 – the highest level since January 23rd. As to technical indicators, alligator turns into a bullish order and RSI climbed above 50. The resistance level above is 0.76.

Looking to the stock markets, the Shanghai Composite rebounded by 0.96% to 3203. The Nikkei Stock Average lost 0.37% on higher Yen exchange level. Australia 200 surged by 2.33% to a new high of 5877. European markets refreshed a 7-year high on an upbeat Eurozone GDP, the UK FTSE 100 was up 0.67%, the German DAX rose by 0.4% and the French CAC 40 Index gained 0.7%. US stocks rose broadly as well. The S&P 500 closed 0.41% higher at 2097. The Dow Jones 30 gained 0.26% to 18019, and the Nasdaq Composite Index rose by 0.75% to 4894.

On the data front, Japan Prelim GDP will have a speech at 10:50 AEDST. The Eurogroup Meetings will continue during the day and US banks will mostly be closed for Presidents’ Day.

Have a great trading day!

Anthony