Wednesday June 6: Five things the markets are talking about

Global equities have extended their limited gains overnight on signs that major economies will avoid a fallout trade war.

An outlier was Euro equities, which have stalled as the ‘single’ unit strengthened and government bonds declined amid some ‘hawkish’ messages from the ECB.

Note: The formation of a new government in Italy should help reduce market concerns as elections have been avoided for now, however, the political outlook is still challenging.

Most commodities have rallied, with crude on course to rise for a second consecutive day. Digging deeper, Italian bonds slipped again even after the new PM indicated that any euro exit by the country had “never been discussed.”

The market is looking ahead to this weekends G6 + 1 meeting in Quebec, Canada, that may shed some light on global trade tensions, as well as policy meetings from the Fed and the ECB this month for any guidance on the trajectory of global interest rates.

1. Stocks mixed results

In Japan, the Nikkei share index touched a two-week high overnight as technology stocks edged up after their U.S peers rallied. The Nikkei ended up +0.38%, while the broader Topix added +0.15%.

Note: Both Trump and PM Abe will meet on June 7 and a U.S/North Korea summit is scheduled on June 12.

Down-under, Australia’s S&P ASX 200 was up +0.5%, supported by gains in energy and materials companies, while in S. Korea the KOSPI was up+0.25%.

In Hong Kong, equities ended higher overnight, reporting a fifth consecutive session of gains, with investors keeping an eye on the latest developments in Sino-U.S. trade talks. The Hang Seng index rose +0.5%, while the Hang Seng China Enterprise (CEI) gained +0.2%.

In China, stocks ended flat on Wednesday, as gains in transport and material firms were offset by losses in banking and real estate shares. The blue-chip CSI 300 index ended -0.2% lower, while the Shanghai Composite Index closed flat.

In Europe, regional bourses trade mixed coming off the earlier highs tracking the slight pullback in U.S futures.

U.S stocks are set to open in the black (+0.1%).

Indices: STOXX 600 +0.1% at 387.2, FTSE +0.3% at 7710, DAX +0.4% at 12843, CAC 40 +0.1% at 5467, IBEX-35 +0.2% at 9707, FTSE MIB -1.4% at 21463, SMI +0.2% at 8558, S&P 500 Futures +0.1%

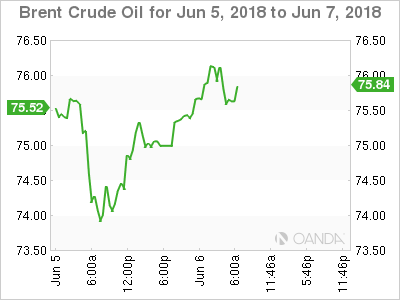

2. Oil rises amid Venezuela oil export concerns

Crude futures remain better bid after Venezuela raised the prospect of halting some crude oil exports, but gains were capped amid reports the U.S government has asked Saudi Arabia and some other OPEC producers to increase output.

Brent crude is up +78c to +$76.16 a barrel after dropping to its lowest since May 8 yesterday. U.S West Texas Intermediate (WTI) crude futures are up +33 c at +$65.85 a barrel, having touched a near two-month low yesterday.

The OPEC and Russia will meet on June 22-23 to decide how much production they will increase as global inventories have tightened while Venezuela’s production has dropped more than expected. U.S. sanctions on Iran are also threatening to reduce oil exports from the OPEC producer.

U.S API data yesterday showed that crude inventories fell by -2m barrels, compared with analyst expectations for a decrease of -1.8m.

Expect investors to take their cues from today’s official DoE EIA energy report at 10:30 am EDT.

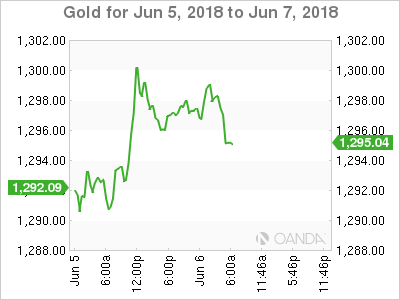

Ahead of the U.S open, gold prices have inched higher overnight on a weaker U.S dollar and lower treasury yields, but expectations of a U.S rate hike next week is keeping a lid on gains. Spot gold is up +0.3% at +$1,298.98 per ounce. U.S gold futures for August delivery are up +0.1% at +$1,303.10 per ounce.

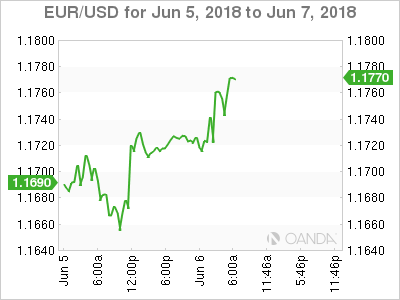

3. Eurozone yields jump as ECB seen disusing QE next week

Hawkish comments by the ECB yesterday has pushed borrowing costs across the region higher overnight, with the impact felt deepest in Italy where markets continue to suffer from the prospect of big spending policies from a new government.

Earlier this morning, ECB chief economist Peter Praet said the “central bank was increasingly confidant that inflation is rising back to its target and will next week debate whether to gradually unwind bond purchases.”

10-year German Bund yields have backed up +5 bps to +0.42%, its biggest daily rise in a week.

Note: With the exception of Italy’s BTP’s, eurozone bond yields are +5-9 bps higher on the day across the bloc.

Elsewhere, the yield on 10-year Treasuries has gained +1 bps to +2.94%, while in India, the Reserve Bank of India (RBI) hiked rates for the first time in four-years. The central bank raised its main lending rate by +25 bps to +6.25% this morning, after inflation picked up following a recent surge in crude-oil prices.

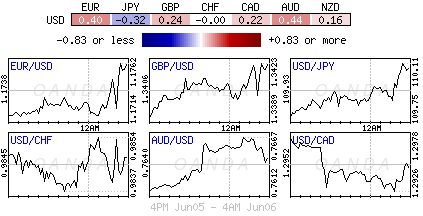

4. U.S dollar remains on the soft side

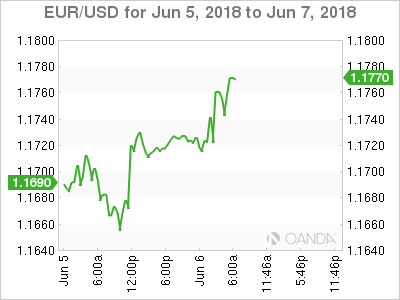

The EUR is benefiting from reports that the next ECB meeting on June 14 may be when an exit from quantitative easing (QE) will be discussed, while the dollar continues to struggle slightly.

EUR/USD is up by +0.4% at €1.1762, while the ‘big’ dollar continues to fall against the AUD (A$0.7646) and CAD (1.2949) after strong Q1 Aussie GDP and on reports that U.S. Treasury Secretary Steven Mnuchin told President Trump to exclude Canada from the aluminum and steel tariffs.

Note: The ECB’s chief economist Peter Praet signalled this morning that officials are increasingly confident that eurozone inflation will return toward target amid strong underlying economic growth and rising wages, suggesting the bank could phase out its giant bond-buying program this year.

Sterling (£1.3416) is likely to be driven by Brexit negotiations in the run-up to the E.U Summit on June 28 and 29. Investors may price out interest rate expectations going further, but any positive developments should outweigh the negatives related to BoE’s monetary policy. If the Irish border issue turns out to be solved in the coming weeks, EUR/GBP could fall. But if the U.K. and the E.U fail to reach an agreement, it would cause investors to price in a higher risk premium for the pound.

5. German engineering orders surge in April

Data from the VDMA showed that orders for Germany’s plant and machinery industry jumped +12% on year in April amid strong domestic demand.

Digging deeper, domestic orders surged +20% from April of last year, reflecting a pickup in investments in Germany, says the VDMA’s chief economist.

Orders from countries outside the eurozone increased +12%, while eurozone demand slipped -2% compared with April 2017.

The VDMA also confirmed its 2018 production forecast. German plant and machinery output is expected to increase by +5% compared with 2017, in real terms.