Investing.com’s stocks of the week

Nothing spectacular but after Monday's of tight intraday action, yesterday's action belonged firmly in the bull column. In percentage terms there wasn't a whole lot to yesterday's gain but relatively, the gain was key.

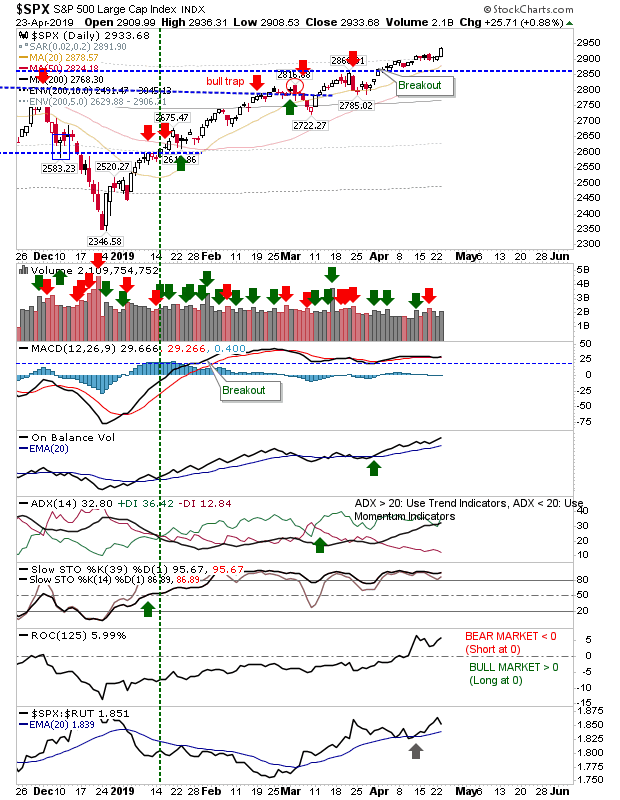

For the S&P we now have a new closing high on slightly higher volume accumulation. While the MACD has flatlined there is still bullish accumulation trends in On-Balance-Volume and relative performance, alongside strongly overbought stochastics; what is bullish stays bullish until proven otherwise.

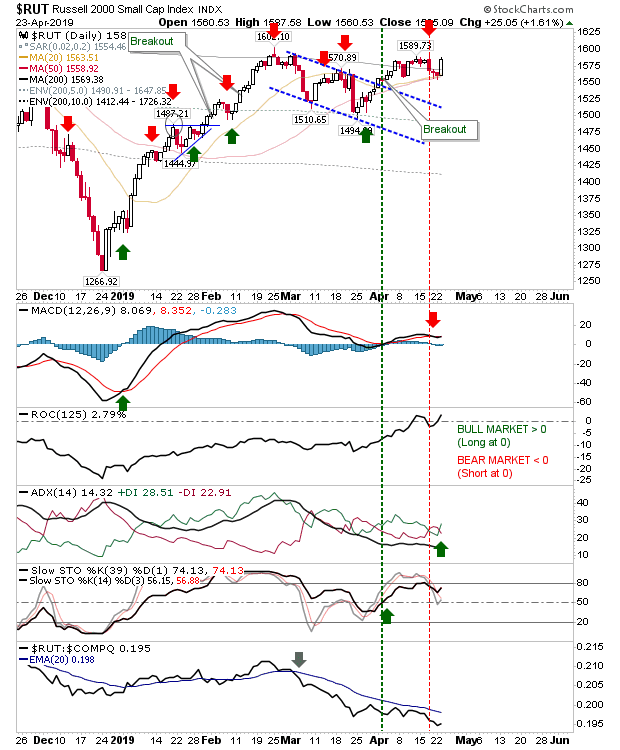

Of greater concern for me is the Russell 2000. The home of more speculative issues was able to generate a bounce off converged 20-day and 50-day MAs. The gain of nearly 2% was enough not just to bounce off former moving averages but also offer a close above the 200-day MA. While yesterday's action was healthy, the index still has to work off a strong relative underperformance against Large Caps and Tech indices. However, yesterday was a step in the right direction.

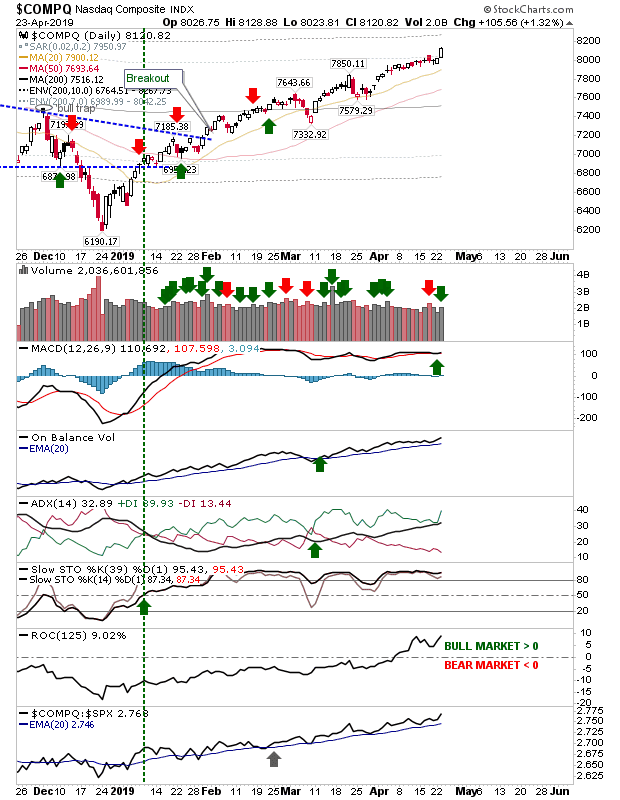

The NASDAQ added over 1% as it reignited the rally. Volume climbed to register as accumulation.

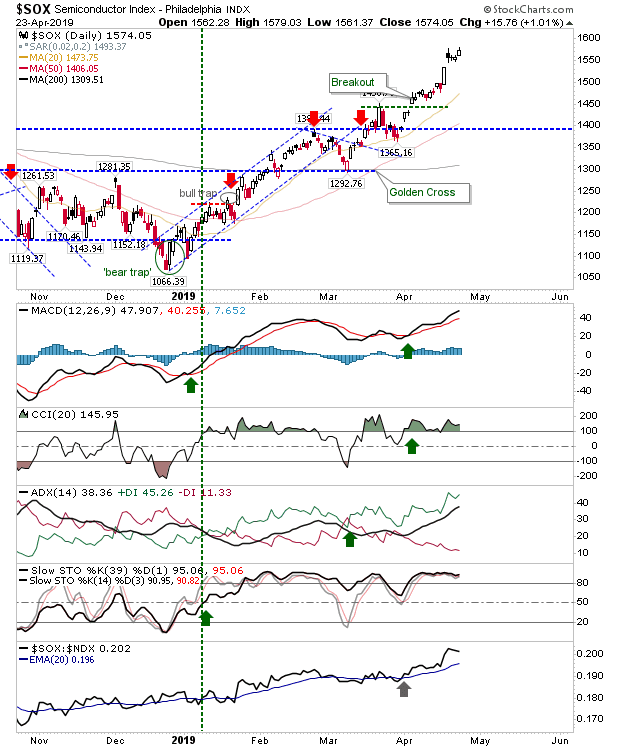

The Semiconductor Index closed at a new closing high, negating what had been a bearish black candlestick. Current action in the Semiconductors Index will help the NASDAQ and NASDAQ 100.

For today, with markets at new highs, look for a consolidation of yesterday's gains - or even better - further gains.