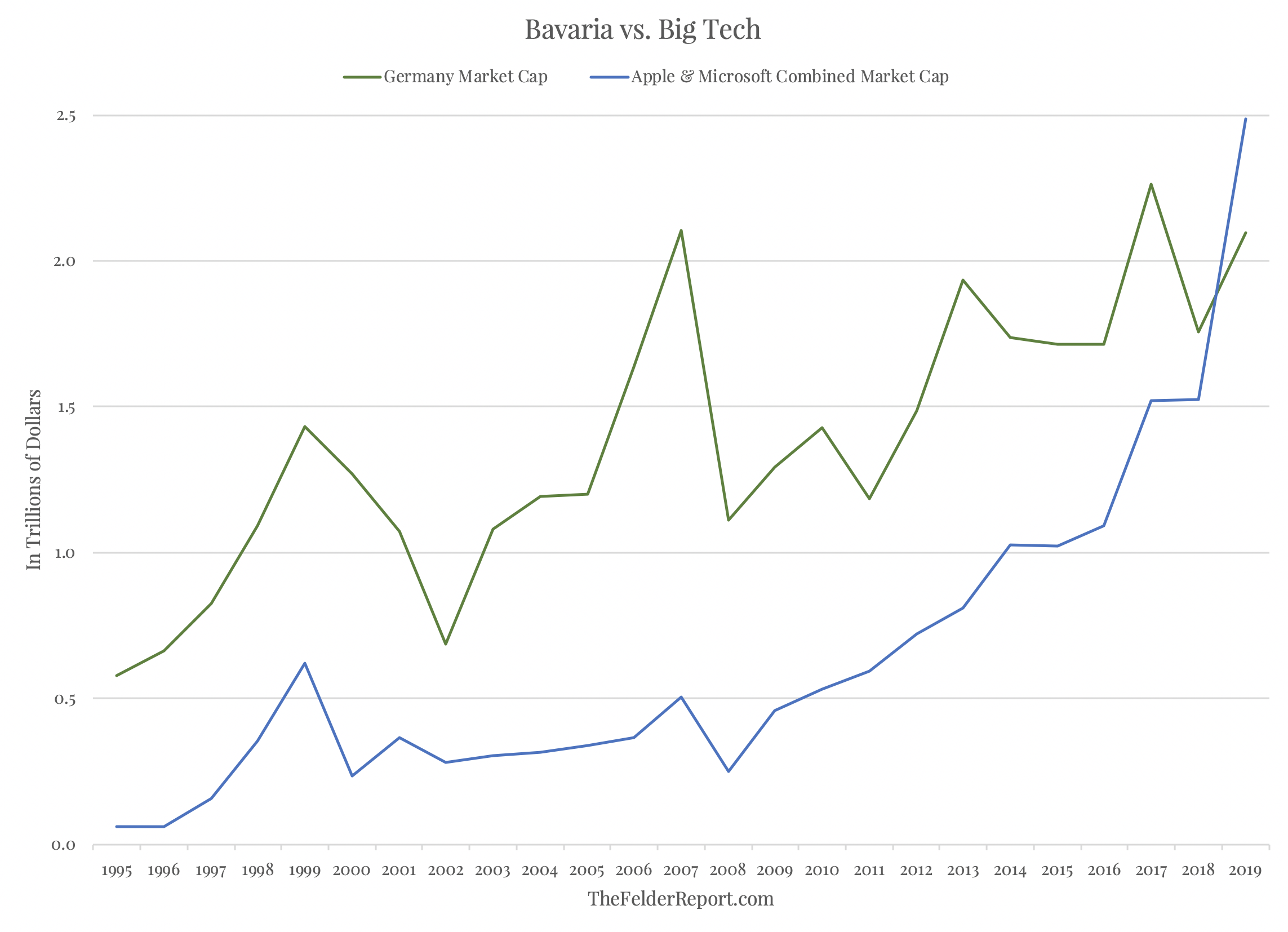

It should come as no surprise to most investors that U.S. stocks have dramatically outperformed the rest of the world over the past decade. People have come up with tons of stats demonstrating the extremes that our stock market has reached in this regard. For example, the combined market capitalization of just Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) is now larger than that of the entire German stock market.

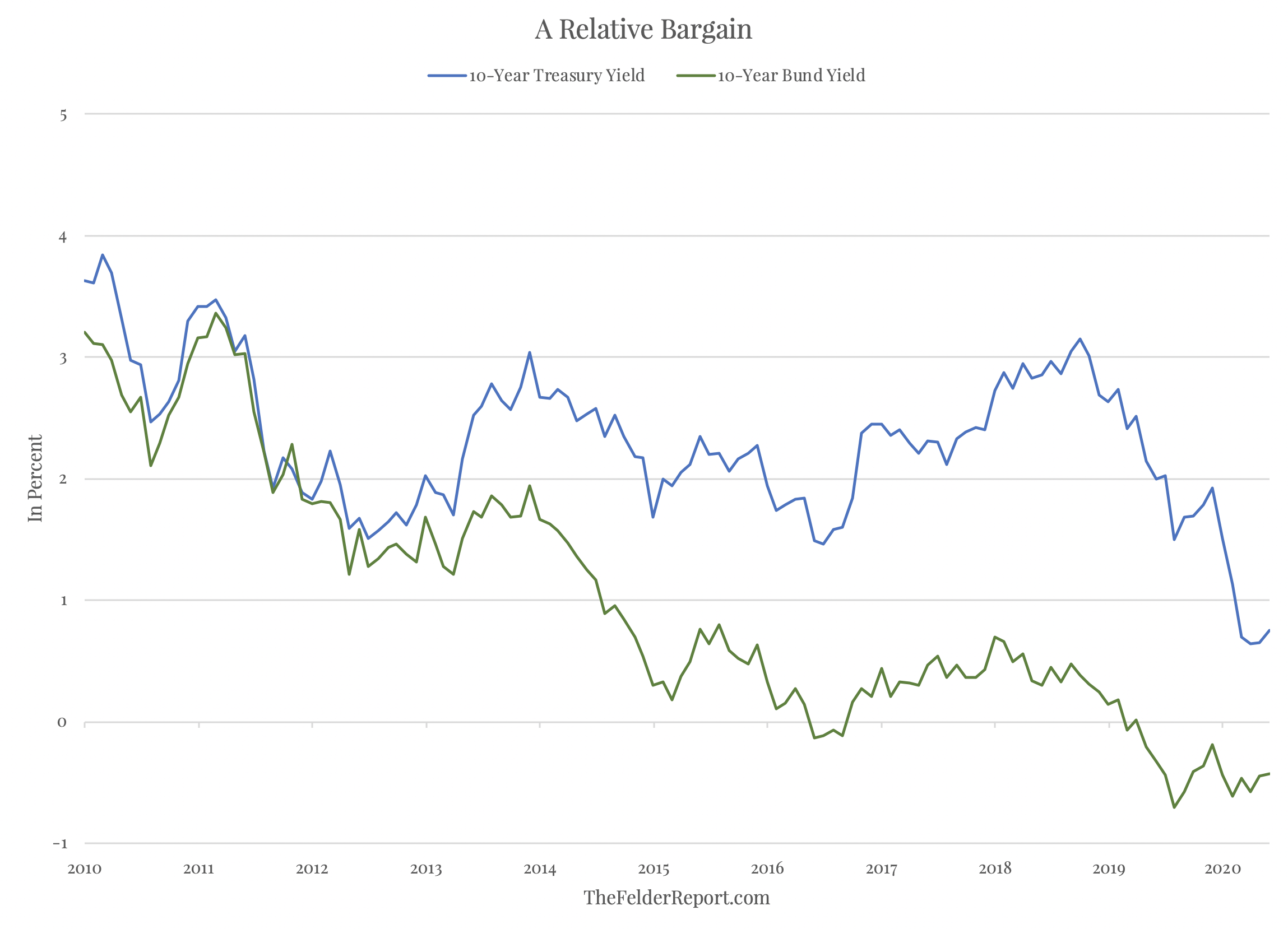

But it might behoove investors to try to understand why U.S. equities have been relatively attractive versus overseas equities for so long. One reason (among several) is simply that U.S. assets have consistently offered higher rates of return than similar overseas assets. A good example of this is the difference in yield between the 10-year Treasury note and the 10-year bund.

Since 2009, the spread between the two has consistently grown as bunds yields have fallen and Treasury notes have not kept up with the pace of the decline. The result was Treasury notes (and other securities like dividend-paying stocks) became more and more of a relative bargain.

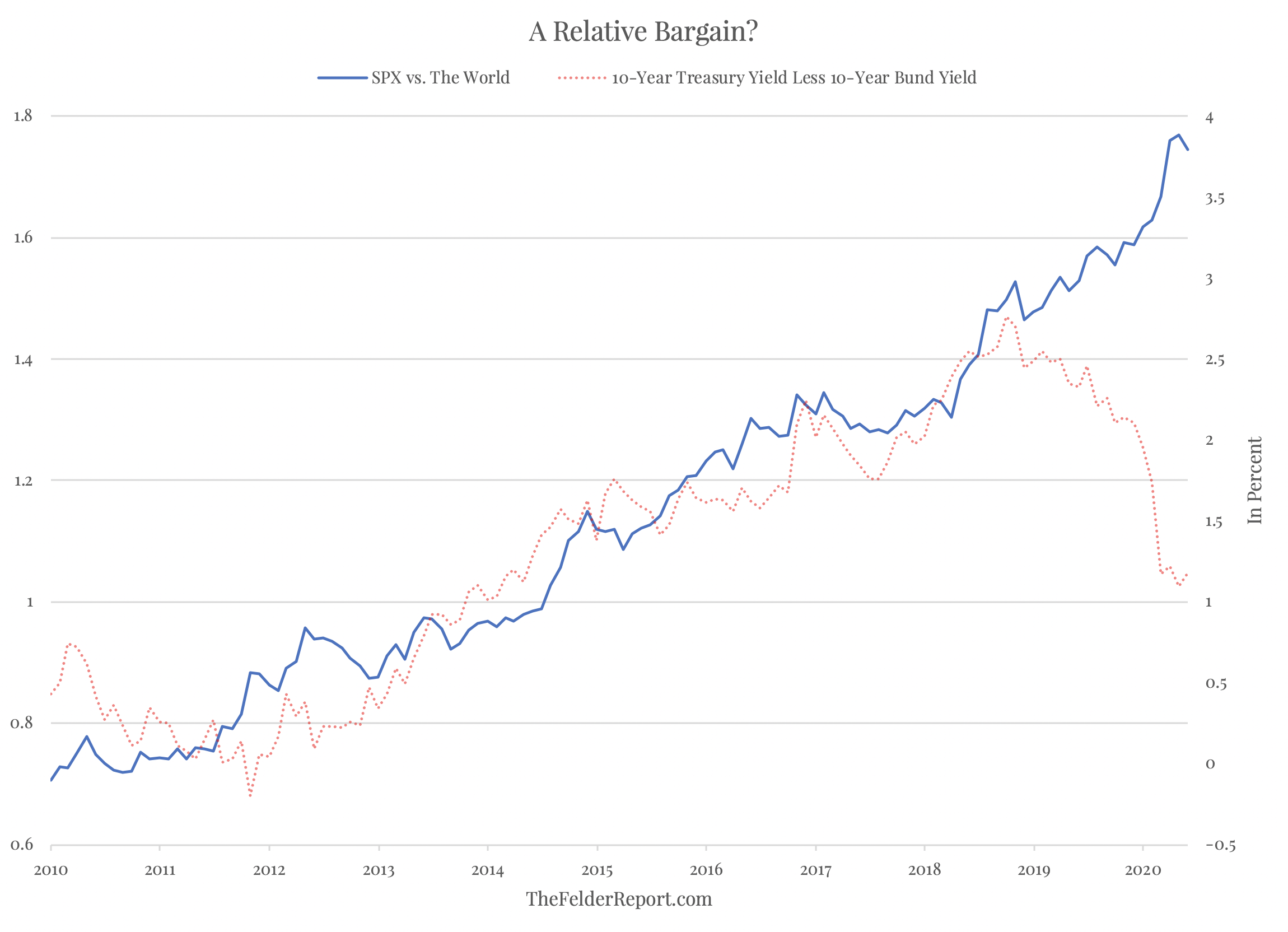

It’s important to note, though, that this relationship is merely representative of a larger dynamic. To demonstrate this I would simply point out that the correlation between the yield spread noted above and the relative performance of U.S. stocks versus the rest of the world over the ten years prior to 2020 has been a very high 94%.

But as you can see in the chart below a dramatic divergence has opened up recently. While spreads between U.S. and German yields have narrowed dramatically over the past year, U.S. stocks have dramatically increased their outperformance of their overseas counterparts at the same time.

The question investors should thus be asking themselves is this:

‘Is this divergence sustainable or are U.S. stocks due to give back a good deal of their significant outperformance now that U.S. assets are no longer a relative bargain?’

Further, ‘If they are to give back a big chunk of that outperformance will it come from underperforming on the upside or underperforming to the downside?’ Considering U.S. stocks now trade at record high valuations, my guess would be the latter.