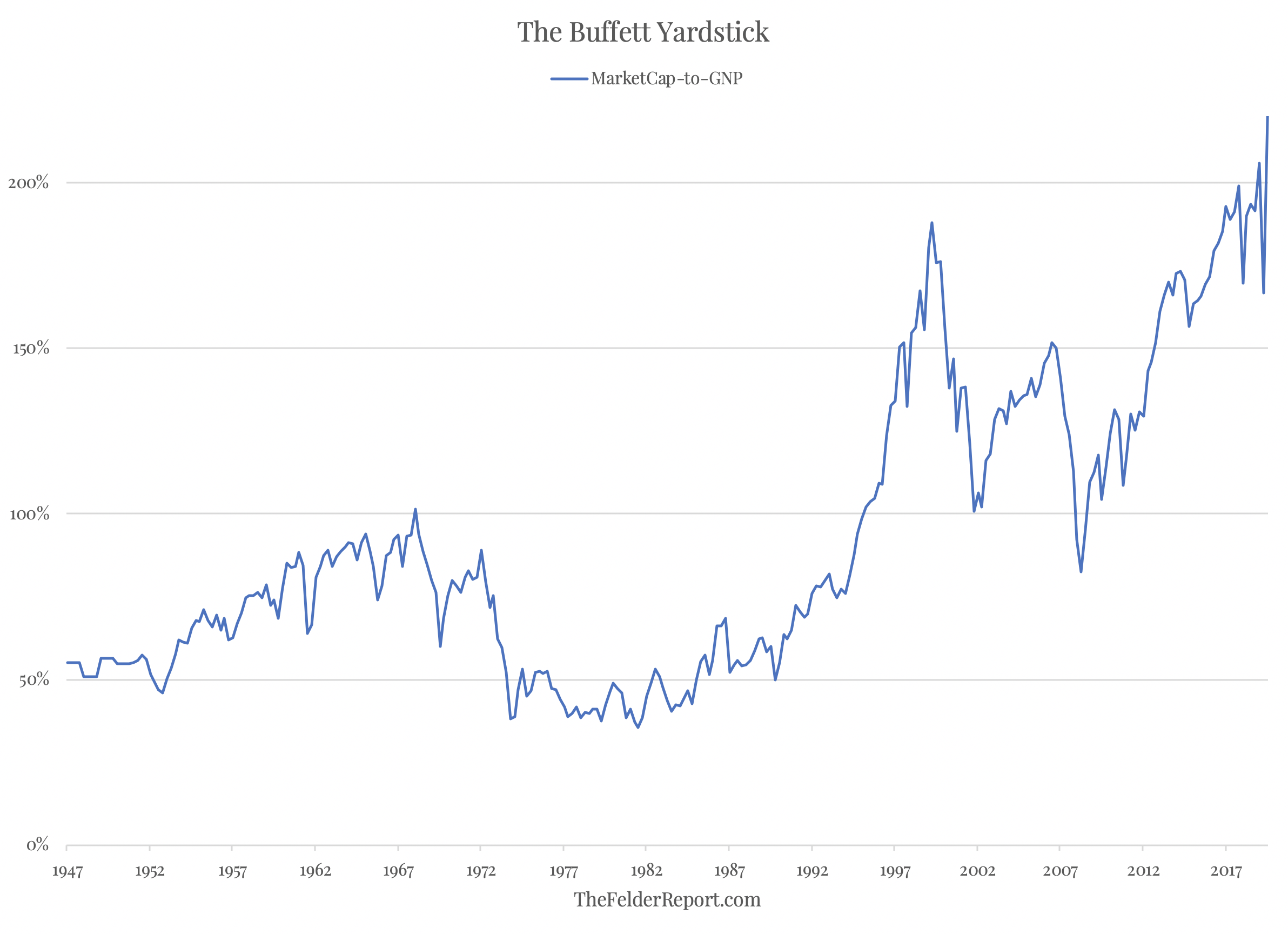

Stocks rallied another 4.5% in May, taking their total gain from the March lows to 39%. When we put this result into the context of an estimated 52.8% annualized decline in GDP during the current quarter (via the Atlanta Fed), equity valuations have just risen to new record highs.

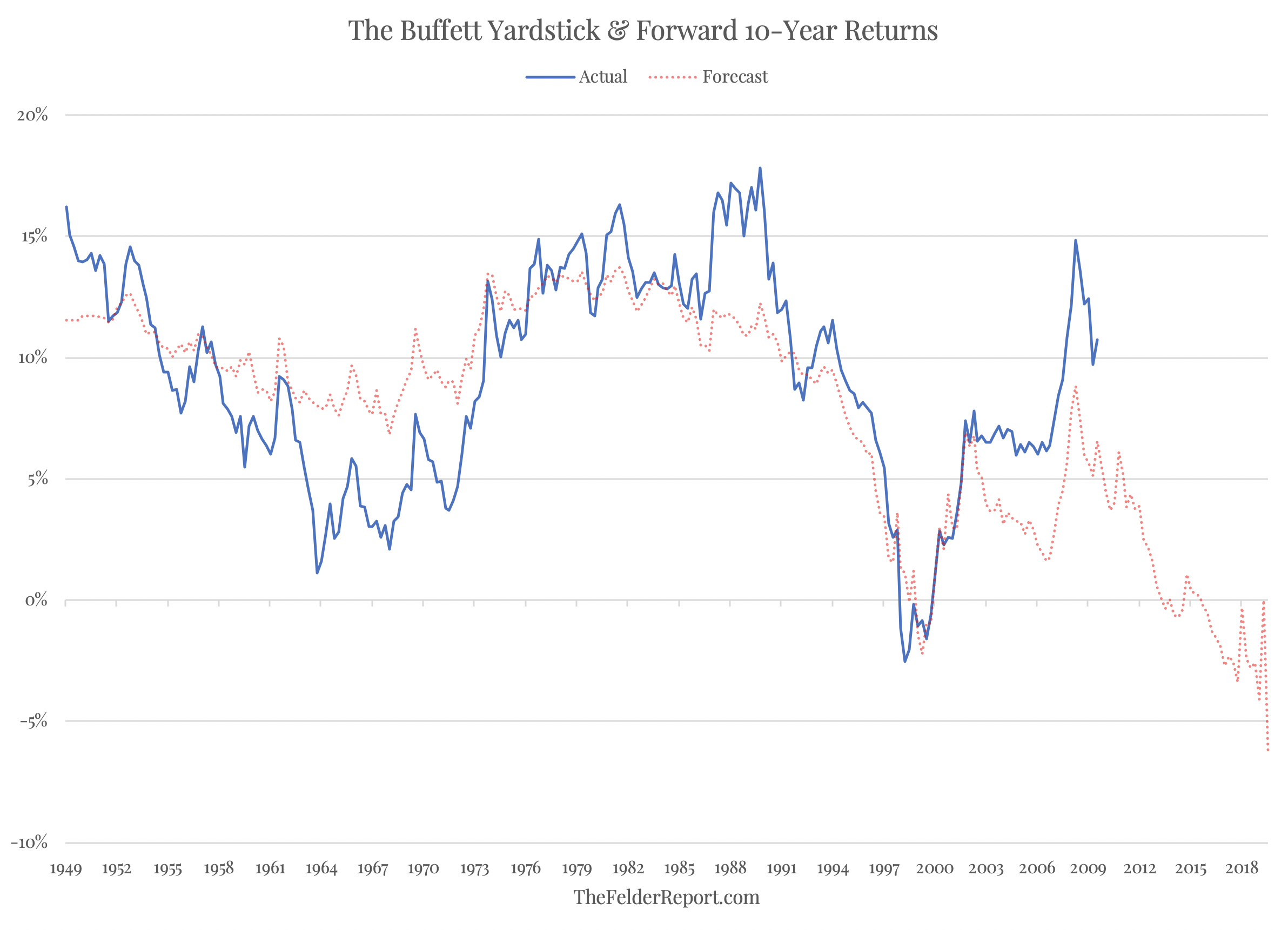

The new reading in the Buffett Yardstick yields a 10-year forecast for equities of -6% per year, including dividends (based on the 80% negative correlation between the two).

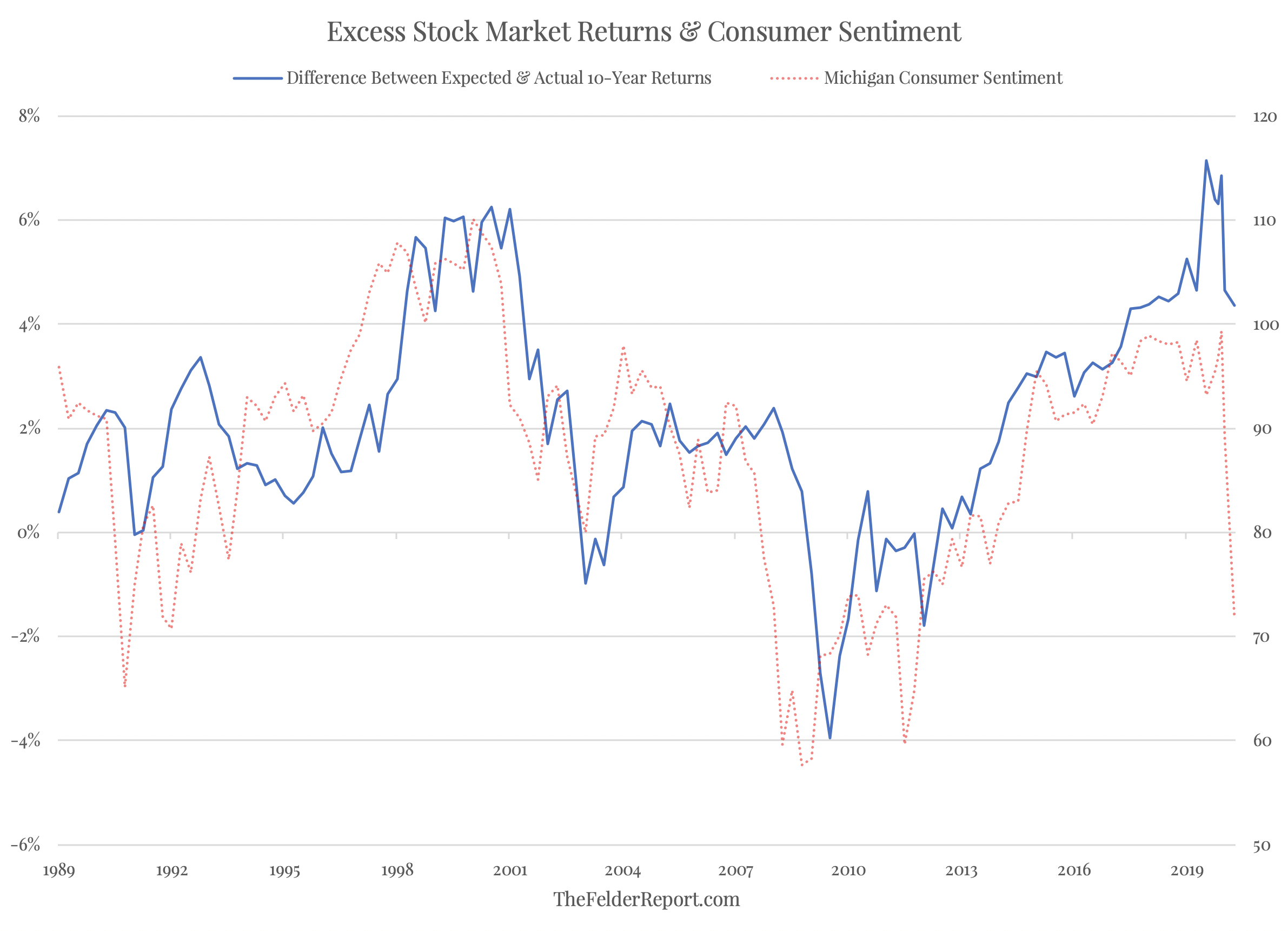

As you probably noticed from the chart above, however, returns over the past decade have exceeded this measure’s forecast by several percent per year so it’s certainly possible for the market to avoid such a nasty fate. The difference between forecast and actual returns can be explained by sentiment (hat tip, Mark Louis via John Hussman). When investors (and consumers) are overly confident, stocks outperform their fundamentals and vice versa.

Now that sentiment has already begun to rapidly deteriorate, it would seem reasonable to expect the excess returns of the past decade to be given back and possibly in short order. This would mean the S&P 500 Index would have to fall approximately to the 1,750 area, more than 40% below its current price.