President Donald Trump loves to talk about how he is in the process of and will continue to, “Make America Great Again.” However, there are many signs that, at least when it comes to the stock market, this may already be as great as it gets.

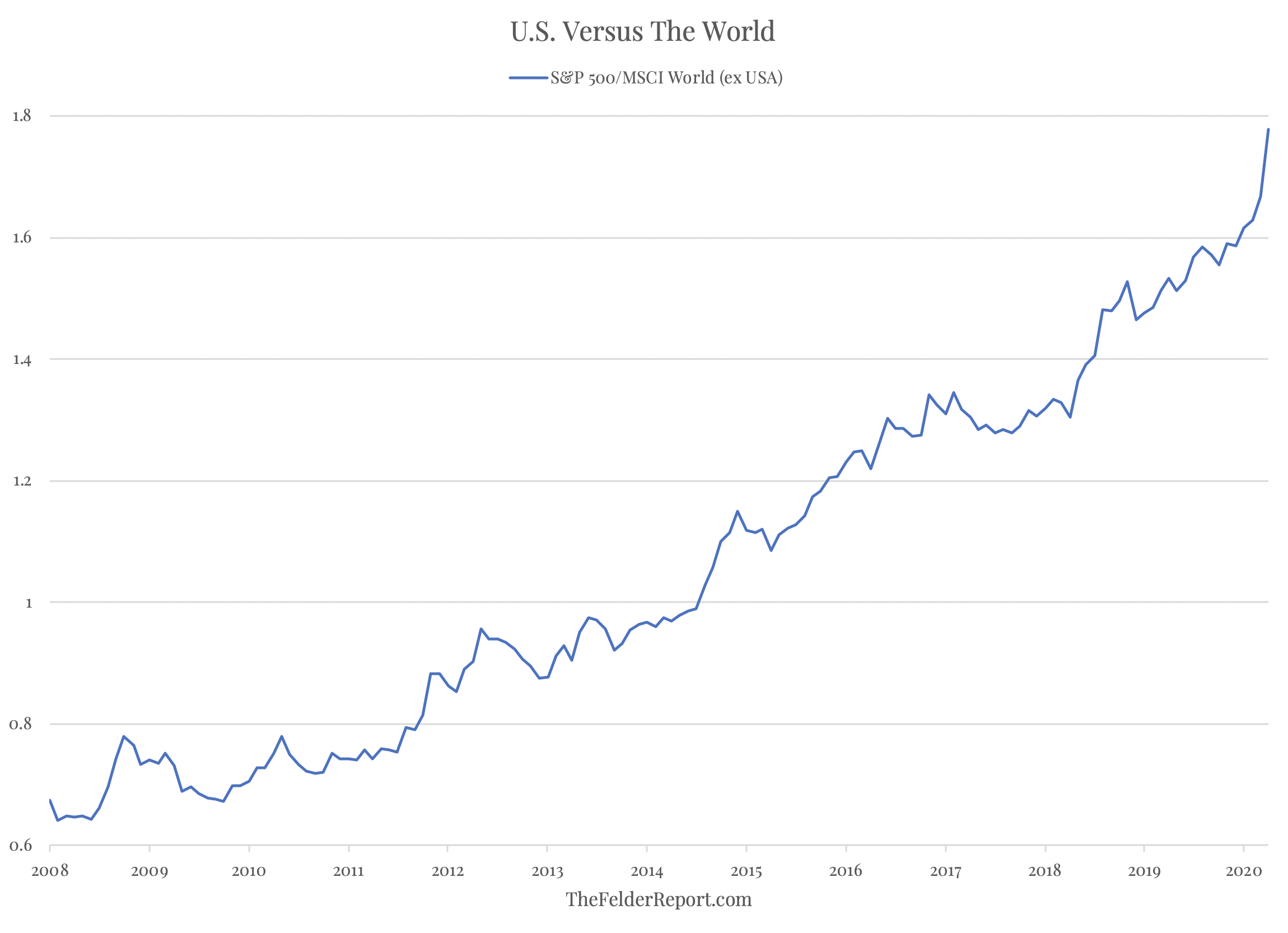

Over the past decade or so, U.S. stocks have dramatically outperformed their counterparts around the world. Over the past few months, this relative performance gain has gone totally parabolic. The question equity investors should be asking right now is: Is this sustainable?

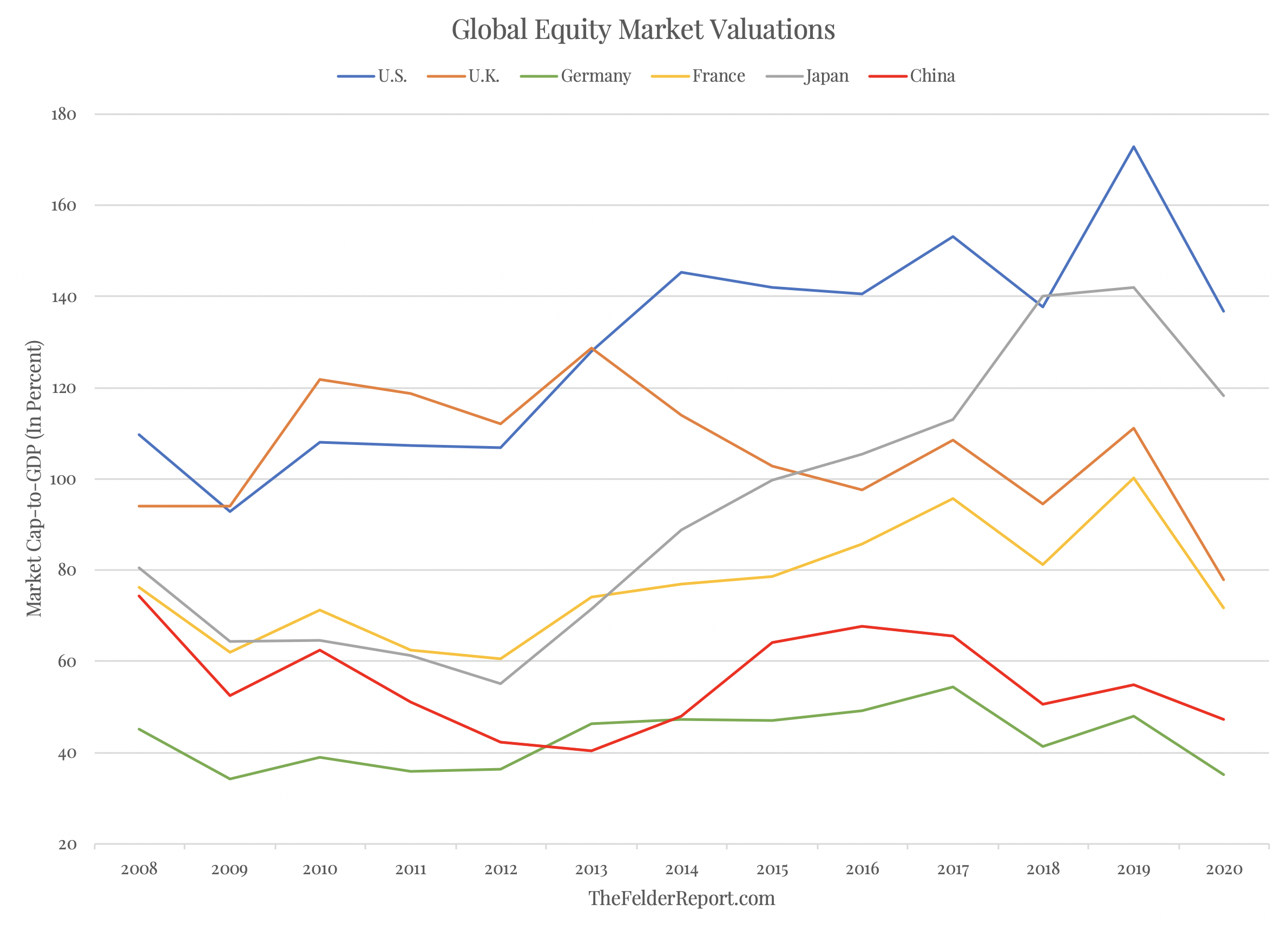

In my view, this phenomenon comes down to a pair of dynamics. First, U.S. equity valuations over the past decade have risen to record heights while most other major markets have actually seen their own valuations decline.

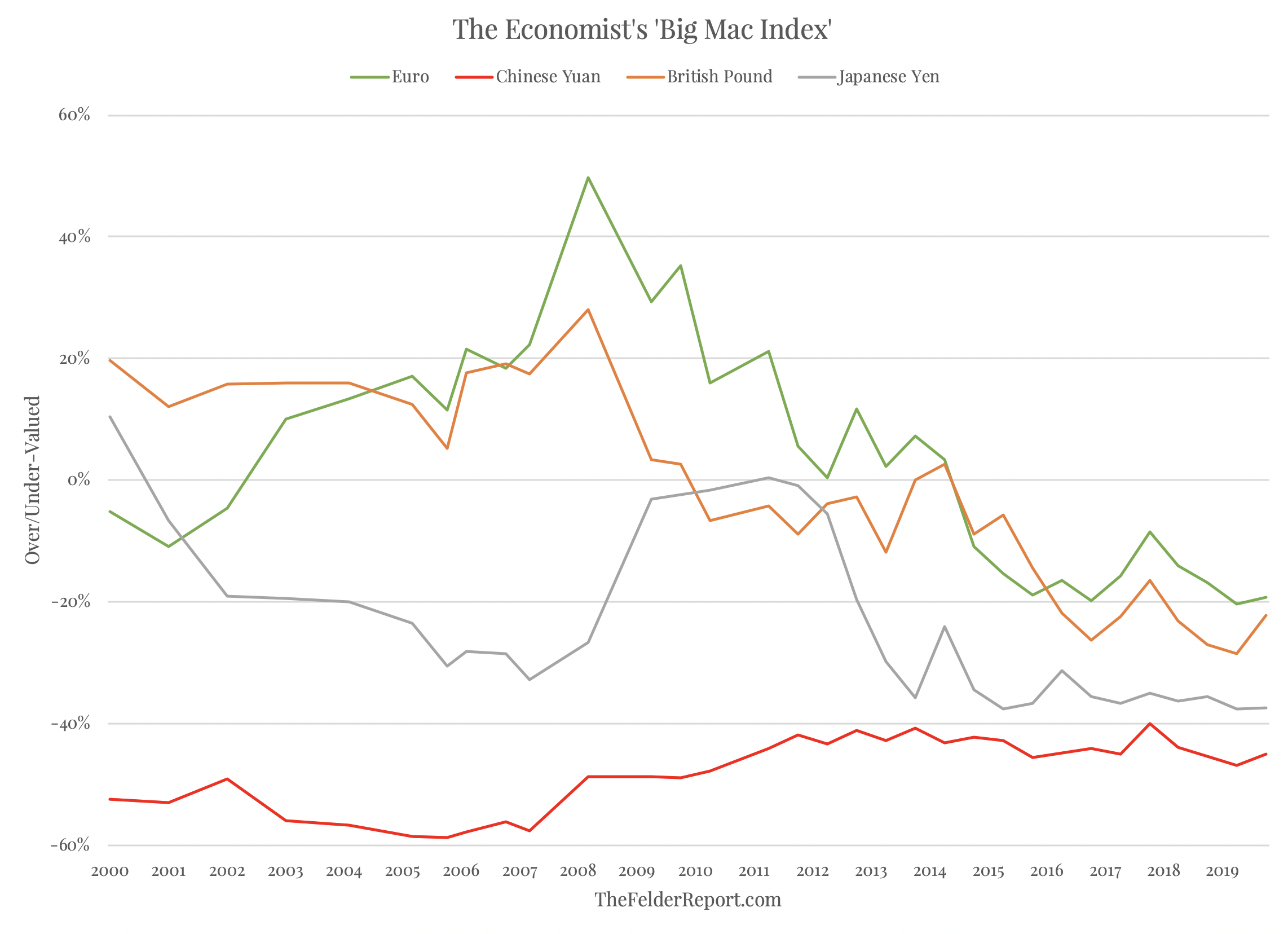

Second, the dollar has also soared higher over the past decade or so leaving it significantly overvalued in relation to most other major currencies around the globe.

Thus the dramatic outperformance of the U.S. stock market is mainly a function of both equity and currency valuations rising to extremes over the past decade relative to most other markets around the world. If, as Warren Buffett likes to say, “the price you pay determines your rate of return,” then investors in U.S. equities should not expect this relative outperformance to be sustainable.

In fact, given the relative undervaluation of overseas equity markets paired with the undervaluation of their currencies, there may have never been a more dangerous time to suffer from home country bias. Conversely, there may have never been a better time to diversify overseas.